PGIM Large Cap Fund: An equity MF scheme that can bring stability in current market scenario

Current market context

The market has recovered from the jolt of the Lok Sabha election results and is currently trading at record highs. Buy low and sell high is the mantra of investing. When the market is at all time high, it is natural that investors may feel nervous. Though the Government has a comfortable majority in the Parliament, there may be concerns about future policy direction, especially with assembly elections for a few states coming up in the next few months. Among global risk factors, the possible extent of US economic slowdown at the tail end of the current interest rate cycle can affect global risk sentiments.

Why large caps in the current scenario?

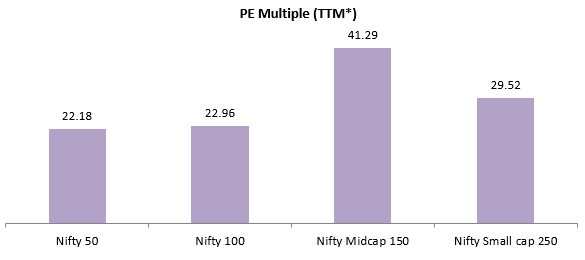

FY 2023-24 was great for midcap and small cap stocks. The Nifty Midcap 150 TRI and Nifty Small Cap 250 TRI gave 57.5% and 64.17% returns respectively. In the first two months of this financial year (FY 2024-25) midcaps and small caps continued to outperform large caps. The outperformance of midcaps and small caps attracted huge retail investments. For the first time in history, the assets under management (AUM) of midcap funds exceeded that of large cap funds (source: AMFI, as on 31st May 2024), something that was unthinkable even a few years back. AUM of small cap funds is more than AUMs of most diversified equity funds categories. Huge retail investment flows into midcap and small cap stocks, which may have relatively low percentage of free floating shares, raises concerns about valuations (see the chart below).

Source: National Stock Exchange, as on 12th June 2024.

In current market situation, investors should focus on asset allocation and not get over-extended in any one asset category. Large caps can bring stability to your investment portfolio and potentially generate inflation beating tax efficient returns over long investment horizon. In this article, we will discuss about one such large cap fund, PGIM India Large Cap Fund which has the potential of providing stability to your portfolio if the market turns volatile for whatever reason.

About PGIM India Large Cap Fund

PGIM India Large Cap Fund was launched in 2003 and has given 17.41% CAGR returns (as on 31st May 2024) since inception. If you invested Rs 1 lakh in the scheme at time of its inception, your investment would have grown to nearly Rs 31 lakhs (source: Advisorkhoj Research).

Fund with one of highest large cap allocations

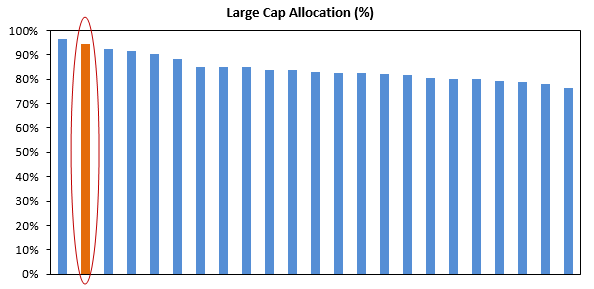

The top 100 companies by market capitalization are classified as large cap companies. These are the largest companies in India, tend to be market share leaders in their respective industries and have a large percentage of public ownership. SEBI mandates large cap mutual funds to invest minimum 80% of their assets in these companies / stocks. The fund managers have the flexibility to deploy the balance 20% in other market cap segments, cash, etc. as per their strategy. PGIM India Large Cap Fund has one of the highest large cap allocations (more than 90%) among its peers (see the chart below, circled in red).

Source: Advisorkhoj Research, as on 31st May 2024. Please note that we have excluded funds that have less Rs 500 crores AUM.

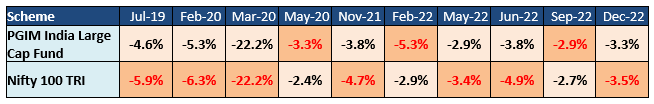

Protected downside in months when market was down

We looked at 10 months over the last 5 years, in which the benchmark market index had the biggest percentage drop (see the table). You can see that PGIM India Large Cap Fund was able to limit the downside risk in 7 out of those 10 months.

Source: Advisorkhoj Research, as on 31st May 2024.

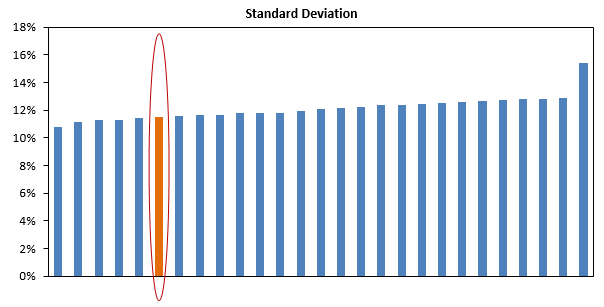

Lower volatility compared to peers

A major consideration for investors in large cap funds can be stability, in other words, lower volatility. Standard Deviation is a statistical measure of a fund’s volatility. We compared the standard deviations in monthly returns over last 3 years of the peer funds of PGIM India Large Cap Fund (see the chart below). If we rank funds in ascending order of standard deviations, then PGIM India Large Cap Fund (circled in red) is in the top quartile in terms of lower volatility.

Source: Advisorkhoj Research, as on 31st May 2024. Please note that we have excluded funds that have not completed three years

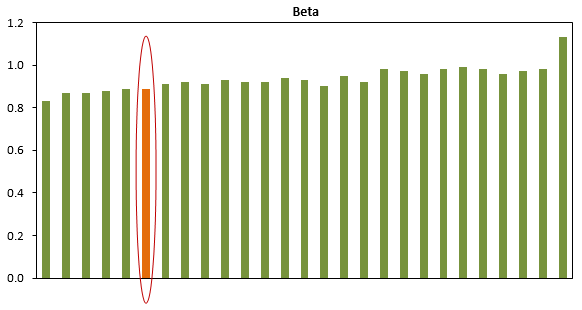

Lower beta (risk) compared to peers

Beta is another statistical measure of risk – movement of fund NAV versus the market index. While high beta can give higher returns in bull markets, it can also result in bigger drawdowns in bear markets. We compared the beta of PGIM India Large Cap with its peers (see the chart below). If we rank funds in ascending order of beta, then PGIM India Large Cap Fund (circled in red) is in the top quartile in terms of lower beta, in other words, lower risk relative to peers.

Source: Advisorkhoj Research, as on 31st May 2024. Please note that we have excluded funds that have not completed three years

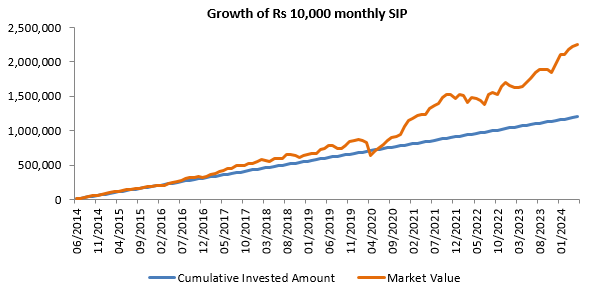

Wealth creation through SIP

The chart below shows the growth of Rs 10,000 monthly SIP in PGIM India Large Cap Fund, as on 31st May 2024. You can see that with a cumulative investment of Rs 12 lakhs over the last 10 years, you could have accumulated a corpus of more than Rs 22 lakhs by 31st May 2024.

Source: Advisorkhoj SIP Returns Calculator, as on 31st May 2024.

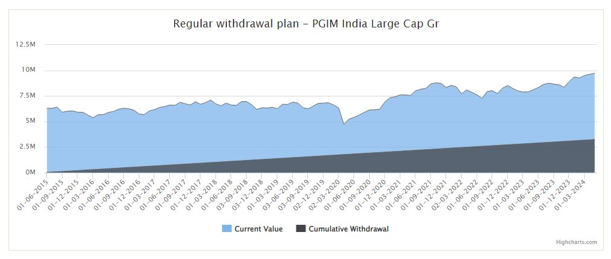

Regular cash-flows through SWP

Let us assume you invested Rs 50 lakhs in PGIM India Large Cap Fund on 1st June 2014. You began withdrawing Rs 30,000 every month through SWP 1st June 2015 onwards – you waited a year to begin your SWP to avoid exit load and short term capital gains taxation. Let us see how much you would have withdrawn till 3rd June 2024 and what would be the current value of your investments, after the withdrawals (see the chart below). Till 3rd June 2024, you would have withdrawn Rs 32.7 lakhs from your initial investment. Despite this withdrawal, the value of your balance units would be over Rs 98 lakhs (almost double that of the initial investment). This shows that for moderate rates of withdrawals, SWP has the potential to generate both regular cash-flows for your needs, as well as capital appreciation (see the chart below).

Source: Advisorkhoj SWP Returns Calculator, as on 3rd June 2024.

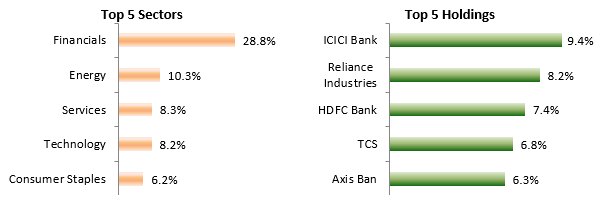

Current portfolio positioning

Source: Advisorkhoj Research, as on 31st May 2024.

Who should invest in PGIM India Large Cap Fund?

- Investors who are looking for capital appreciation with a long-term investment horizon.

- Those who are looking to build their core portfolio with large-cap stocks.

- Those who have an investment horizon of more than 3 years.

- The fund is suitable for first time or new equity investors

- You can invest in this fund either in lump sum or SIP depending on your financial situation or investment needs

- Investors should consult their financial advisors or mutual fund distributors if PGIM India Large Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY