PGIM India Retirement Fund: A fund designed to support your retirement planning goals

Retirement can be one of the most fulfilling stages of life when planned properly and in advance. The earlier you start saving for retirement, the easier it is to achieve your financial goals. Waiting too long can make it increasingly difficult to secure the future you envision. Retirement planning is complex, and one of the most challenging aspects is imagining how your future will align with your current lifestyle. As a young person, you may have a particular vision of what retirement will look like, but as you grow older, that vision may evolve when you reassess your goals.

Retirement Planning Challenges

According to PGIM India MF's Retirement Readiness Survey 2023, 38% of respondents expressed concerns about a "lack of an alternate source of income" when it comes to managing finances, a significant increase from just 8% in 2020. Societal shifts, such as the move from joint to nuclear families, are also contributing to growing insecurity about retirement preparedness. Around 70% of respondents in 2023 (down from 89% in 2020) reported feeling financially secure living in joint families. Having an alternative income source greatly enhances the sense of readiness for retirement. Of the 36% of respondents with a secondary income stream, 42% earn extra income through investments in financial assets. Additionally, 39% are actively considering building a secondary source of income (Source: PGIM India MF's Retirement Readiness Survey 2023).

In this article, we will explore the importance of retirement planning and how the PGIM India Retirement Fund can assist you in this process.

Our interview on retirement planning with PGIM India MF CEO, Mr Ajit Menon

Why is retirement planning essential?

- Life expectancy: With advancement in medical science, life expectancy has risen. In order to be financially independent, even in your twilight years, it is important that you plan for your retirement while you still have a regular stream of income

- Rising cost of living: Inflation is a real thing and it will continue to be so. What costs Rs 10,000/- today will cost Rs 32,000/- in 20 years at a flat 6% inflation rate. Therefore, retirement plans have to factor in this inflation while planning for the future cost of living. By this definition, if your current monthly expenses are Rs 50,000/- and you are to retire after 10 years then you could need anywhere between Rs 85,000/- to Rs 1 lakh due to inflation assumed between 5-7%. For this, you should have an annual income of at least 12 lakhs per annum at the time of retirement. If you were to fund your monthly expenses from interest from your retirement corpus then assuming a 6% investment yield, you would need to build up a corpus of at least Rs 2 crores to maintain your current lifestyle during your retirement.

- Changing lifestyle and macro-economic situation: Retirement planning is a process that spans most of our adult lives. As one’s income grows, their lifestyle changes and so do the costs associated with it. Societal shifts and evolving aspirations, influenced by broader macroeconomic changes, also impact our lifestyle. It's crucial to factor in lifestyle when planning for retirement. Your retirement corpus should be large enough to maintain your standard of living without compromise. Given the changing lifestyle and economic conditions, Indians now believe they need 10-12 times their annual income to build a sufficient retirement fund, according to PGIM India MF's Retirement Readiness Survey 2023. This is an increase from the 8-9 times considered necessary in the 2020 survey.

- Getting the bigger picture right: Once you have a clear picture of how much you need to save and the potential growth of your retirement corpus by your planned retirement age, you can better prioritize your needs versus wants and make more informed financial decisions. Remember, retirement planning is the only financial goal for which you cannot get a loan. For other financial goals like buying a house, child’s higher education etc, you can get a loan. Therefore, you must prioritize retirement planning throughout your life to achieve financial security.

- Healthcare costs: Healthcare costs are rising. According to statistics, healthcare inflation in India is around 14% and over 71% of Indians pay for a majority of their healthcare expenses out of their pocket (source: Plum, Health Report of Corporate India 2023). Planning for an adequate retirement corpus is important to lead a healthy, worry free, independent life after retirement.

- Compounding returns: Investing with a plan in mind will help you reach your target due to the power of compounding over the long term. Remember, the earlier you start on your investment journey, the more likely it is for you to reach your retirement goals.

Why is a dedicated fund required for your retirement goals?

There are many ways to save for your retirement. A dedicated retirement fund, however, offers distinct advantages tailored to support your retirement planning goals. These are:-

- Expert management by the Fund managers

- Disciplined investment

- Strategic asset allocation

Why PGIM India Retirement Fund?

- 5-year Lock in period: PGIM India retirement Fund has a lock in period of 5 years or your retirement age (whichever is earlier),this helps you stay disciplined in your investment

- Active fund management: PGIM India Retirement Fund is an equity fund which has the potential to deliver inflation adjusted returns in the long term. The fund is managed by a team of expert fund managers.

- Dynamic allocation: The Fund managers make strategic decisions with respect to fund allocation in a mix of securities comprising of equity, equity related instruments, REITs and InvITs and fixed income securities.

- Minimizing downside risks: Active fund management aims to provide a level of cushioning against market downturns while still participating in potential market upswings.

PGIM India Retirement Fund

PGIM is a global leader in providing retirement security to investors through their products. The PGIM India Retirement Fund was launched in April 2024. The investment objective of the scheme is to provide capital appreciation and income to investors in line with their retirement goals by investing in a mix of securities comprising of equity, equity related instruments, REITs and InvITs and fixed income securities.

The fund managers of the scheme are, Mr. Vinay Paharia (Equity Portion) (Over 20 years of experience in Indian financial markets, primarily in equity research & Fund Management); Mr. Puneet Pal (REITs & InvITs, Debt portion) (Over 22 years of experience in Debt Market); Mr. Anandha Padmanabhan Anjeneyan (Equity Portion) (Over 15 years of experience in Equity Market; and Mr. Vivek Sharma (Equity Portion) (Over 14 years of experience in Equity market, research and fund management).

Stages of Retirement planning

There are two crucial parts in retirement planning: - the accumulation phase and then the distribution phase. The first phase is creating the corpus, this is where it is necessary to stay disciplined and consistent in your investment and not break your investments under pressure from market volatility or personal financial needs. PGIM India Retirement Fund has a 5 year lock-in period which will help you remain disciplined.

You can build a retirement corpus by investing relatively small amounts from your regular savings through SIP. You can also invest in PGIM India Retirement Fund in lumpsum whenever you have sufficient investible surpluses. Investing in the right asset class is important in the accumulation phase because of varying wealth creation potential of different asset classes. PGIM India Retirement Fund primarily invests in equity / equity related securities. Equity, as an asset class, has the potential to generate superior inflation adjusted returns over long investment horizon.

The second phase of retirement planning is the distribution phase, this is where you create a stream of cash-flows from the corpus you have created over the years to finance your expenses during retirement. Investors have traditionally depended on Fixed Deposit or Post Office Small Savings Schemes interest and annuity plans for their retirement cash-flows. However, mutual fund systematic withdrawal plan (SWP) can be a tax efficient way of generating a stream of cash-flows from your investment. A SWP helps you withdraw funds from your corpus in a regular intervals and lets the remaining amount still earn returns.

Investment Strategy of PGIM India Retirement Fund

- Multicap Strategy – Minimum 25% each in large cap, midcap and small cap stocks

- Lock In Period – The fund has a 5 year lock-in period or retirement age of 60 (whichever is earlier). The lock-in period will prevent premature withdrawals and allow your investments sufficient time to grow.

- Top-down and bottom-up investment strategy - The portfolio is built utilizing a combination of the top-down and bottom-up portfolio construction process, focusing on the fundamentals of each stock, including quality of management and prevailing valuations.

- GARP style - The fund manager(s) would select companies with stable or high growth with due consideration to valuation.

- The fund manager(s) would consider a range of quantitative and qualitative factors such as company’s business prospects, historical and present financial condition, capital allocation efficiency, operating cash flows, leverage position, valuation metrics, competitive edge, brand equity, strength of management and good corporate governance practices among others.

Strong performance

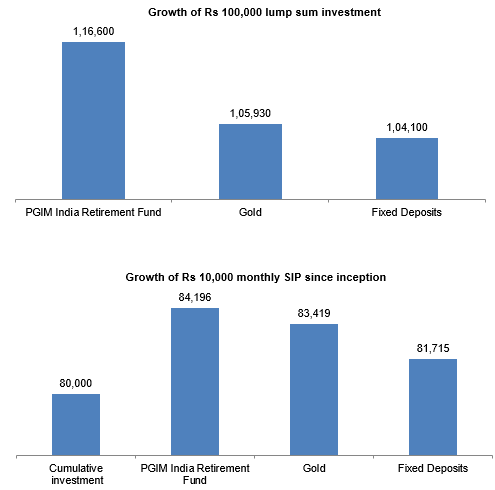

The PGIM India Retirement Fund has given a return of 26.57% since inception; despite high volatility (data as on 30th November 2024). The chart below shows the growth of 1 lakh in the fund versus other asset classes since the inception of the scheme. Clearly, investing in PGIM Retirement fund has given better returns compared to traditional investment options like gold and fixed deposits, in the short time since its inception.

Source: Advisorkhoj research as on 30th November 2024

Why should you invest in the PGIM India Retirement Fund?

- It helps you invest for one of the most important life-stage financial goals—retirement.

- It provides tax efficiency through its equity allocation.

- Its dynamic asset allocation model aims to participate in market gains while protecting against potential losses.

- The 5-year lock-in period encourages disciplined, long-term savings.

Who should invest in PGIM India Retirement Fund?

- Investors who are looking for capital appreciation over a long investment horizon.

- Investors looking to save for retirement.

- Investors with a risk appetite for equity allocation.

- Investors with a minimum 5-year investment tenure.

- You can invest in this scheme in lump sum or SIP, depending on your investment needs.

Remember, planning for retirement is not just a financial choice; it's a lifestyle decision. By taking action today and considering the PGIM India Retirement Fund, you can enjoy the financial freedom you deserve during your silver years. Start planning for retirement today and reap the rewards in the years to come.

Consult your financial advisor to understand if PGIM India Retirement Fund is suited to their retirement needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY