PGIM India Midcap Opportunities Fund: Track record of wealth creation

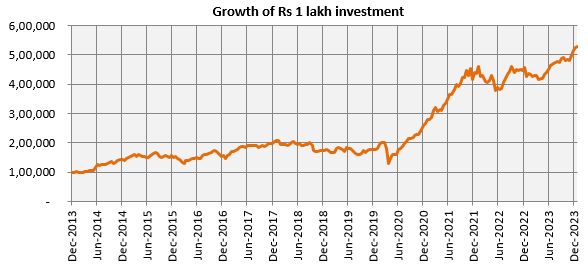

PGIM India Midcap Opportunities fund recently entered the Rs 10,000 crores AUM club. Out of 29 midcap schemes only 8 schemes can boast of this achievement. As a result of its long-term performance track record, the popularity of PGIM India Midcap opportunities fund has increased among investors. The scheme recently completed 10 years. As shown in exhibit 1, if you had invested Rs 1 lakh in the scheme at the time of its inception (in 2013), the value of your investment would have grown to Rs 5.28 lakhs as on 31st December 2023 (see the chart below). The CAGR returns since inception is 17.95% (as on 31st December 2023).

Exhibit 1: Growth of Rs.1 lakh investment in PGIM India Midcap Opportunities Fund

Source: Advisorkhoj Research, as on 31.12.2023. Returns mentioned are for regular, growth option

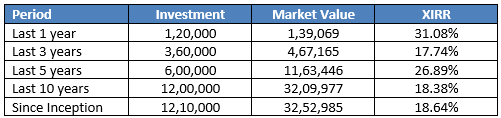

Wealth creation through SIP

SIP is a very popular mode of investing in midcap funds. Since midcaps in general can be said to be more volatile than large caps, investors can take advantage of the volatility by investing through SIP. For each of the SIP tenures, the following table in exhibit 2 shows the returns of Rs.10,000 SIP in PGIM India Midcap Opportunities Fund You can see that the scheme was able to create wealth for investors.

Exhibit 2: SIP returns for various tenures since the inception of the scheme

Source: Advisorkhoj Research, as on 31.12.2023

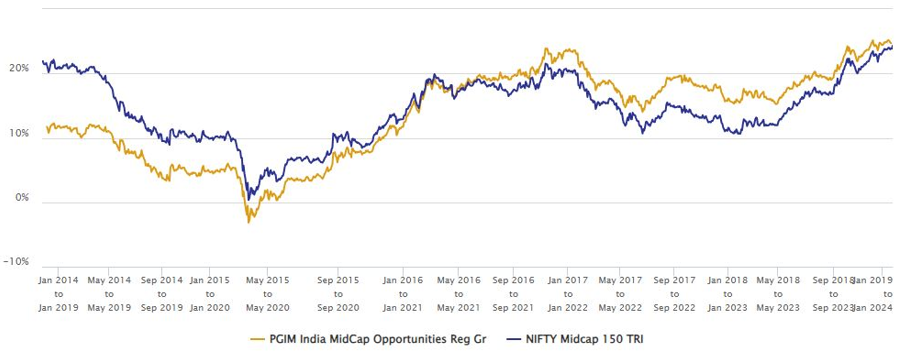

Rolling returns - Outperformed the benchmark over long investment tenures

The chart below shows the 5 year rolling returns of in PGIM India Midcap Opportunities Fund (rolled daily) versus its benchmark index Nifty Midcap 150 TRI since the inception of the scheme. Rolling returns is the most unbiased measures measure to evaluate fund's performance. Point to point return is biased by the market conditions prevailing in the period into consideration. Rolling returns, on the other hand, measures the fund's performance across all market conditions without the time period bias. We are showing 5 year trailing returns in this chart because in our opinion, you should have minimum 5 year investment horizon while investing in midcap funds. You can see that after an initial period of underperformance till about 2016 – 17, PGIM India Midcap Opportunities Fund was able to consistently outperform the benchmark index over 5 year investment tenures across different market conditions (both bull and bear markets). The ability to create alpha consistently over long term is the hallmark of fund management. A scheme may outperform / underperform in certain years, but a good fund manager should be able to beat the market benchmark index over long investment tenures across investment cycles.

Exhibit 3: 5 year daily rolling returns performance comparison

Source: Advisorkhoj Research, as on 31st December 2023

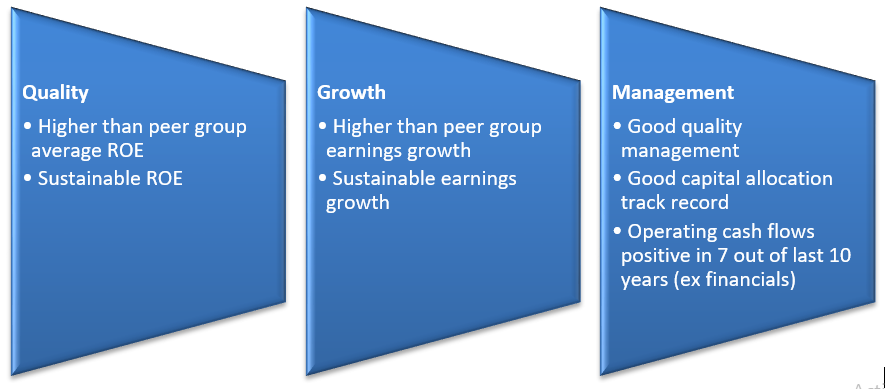

Stock selection strategy of PGIM India Midcap Opportunities Fund

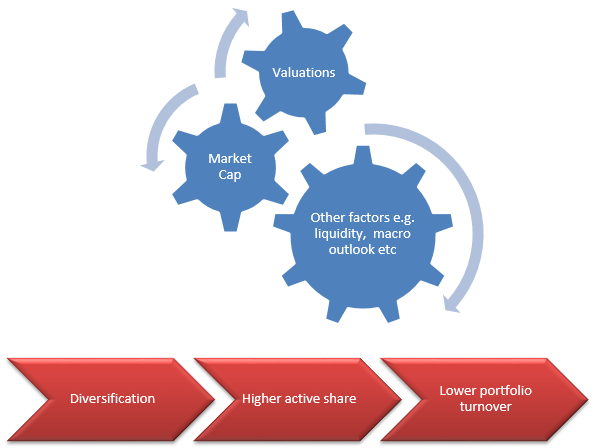

Portfolio construction principles

Superior portfolio metrics versus the benchmark

- High active share (68% of portfolio). High active share and low overlap with the index are essential for alpha creation

- Higher return on equity (16.8%) versus benchmark index (13.3%) i.e. higher quality portfolio

- Lower leverage i.e. debt equity ratio (51.5%) versus benchmark index (81.1%) i.e. higher quality portfolio

- Lower beta (0.94) versus benchmark index (1.00) i.e. relatively lower risk

Source: PGIM India MF, as on 31st December 2023

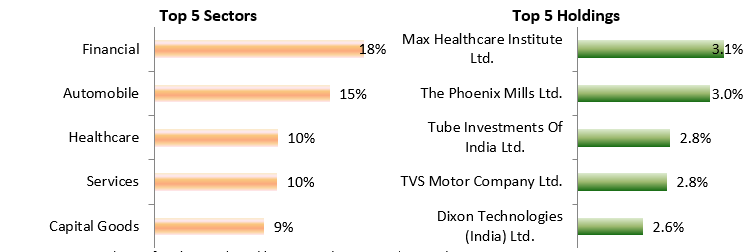

Current portfolio positioning

Source: PGIM India MF factsheet, Advisorkhoj Research, as on 31st December 2023

Why invest in midcap funds?

101st to 250th stocks by market capitalization are classified as midcap stocks. According to SEBI’s mandate, midcap funds must invest minimum 65% of their assets in the midcap stocks. Midcap funds, despite their high volatilities, have been very popular with retail investors. Following are the reasons, why investors should have midcap funds in their portfolio:-

- There are many sectors where midcaps have larger presence compared to large caps e.g. software product development companies, water and water transportation, discretionary retail, hospitality, real estate, home building, chemicals, staffing etc. Investors can get exposure to unique investor opportunities through midcap stocks.

- There is a perception among some investors that midcaps are smaller companies in size. Midcap companies are no longer that small. The smallest midcap company by market capitalization has a market cap of over Rs 20,000 crores (source: AMFI, 31st December 2023).

- Midcaps have the potential of giving higher returns than large caps over long investment tenures. In the last 10 years, Nifty Midcap 150 TRI has given 22% CAGR returns, while Nifty 100 TRI (index of large cap stocks) has given 14.8% CAGR return (source: Advisorkhoj, as on 31st December 2023).

- At the same time, midcaps are considerably less volatile than small caps i.e. lower downside risks compared to small caps.

Why invest in PGIM India Midcap Opportunities Fund?

- PGIM India Midcap Opportunities Fund looks to identify quality midcap stocks which can benefit from a favourable economic environment, based on extensive research and thorough selection process

- The scheme has a rigorous approach to stock selection. Stocks are selected on the basis of, amongst others, the historical and current financial condition of the company, potential value creation/unlocking of value and its impact on earnings growth, capital structure, business prospects, policy environment, strength of management, responsiveness to business conditions, product profile, brand equity, market share, competitive edge, research, technological know–how and corporate governance.

- The scheme portfolio is high quality and relatively low risk (beta)

- The scheme has long term track record of wealth creation.

Who should invest in PGIM India Midcap Opportunities Fund?

- Investors looking for capital appreciation and wealth creation.

- Investors should have at least 5 year investment horizon in this scheme.

- Investors with very high risk appetite.

- Investors can invest in this scheme either through lump sum or SIP depending on your investment needs.

Investors should consult their financial advisors or mutual fund distributors if in PGIM India Midcap Opportunities Fund is suitable for their long term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY