PGIM India Large and Midcap Fund: Off to a promising start

Why invest in large and midcap funds?

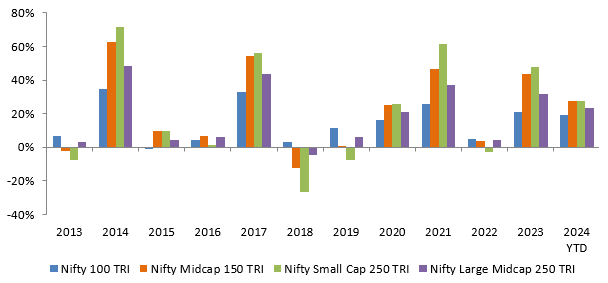

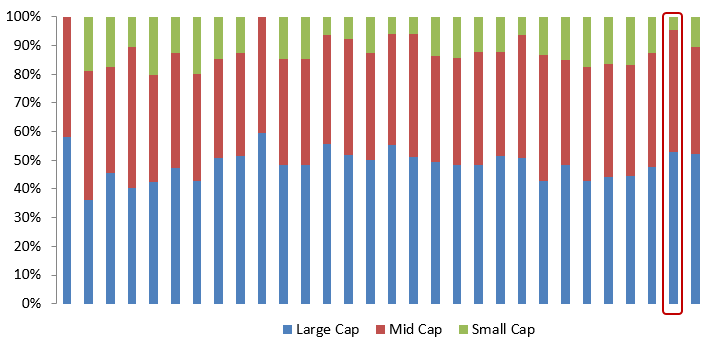

- Winners do rotate across market cap segments (see the chart below). It is difficult for investors to anticipate which market cap segment will outperform and when. Large and midcap funds offer a market cap based asset allocation solution for the investor.

Source: Advisorkhoj Research, Data for period: 01/01/2013 to 31/07/2024. Disclaimer: Past performance may or may not be sustained in the future.

- Historically, Large and midcaps have had decent participation in market upcyclesand also provided relative downside protection across market cycles (see the chart below). The chart below shows the 3 year rolling returns of large and midcap index versus the large cap and midcap indices since the inception of the index (1st April 2005).

Source: Advisorkhoj Research, Data for period: 01/04/2005 to 31/07/2024.

- Large cap indices like Nifty 100 has a heavier tilt towards certain sectors like BFSI, IT, Oil and Gas, FMCG. Large and midcaps provide relatively more balanced exposure across different industry sectors, both established and new age.

- Large and midcaps provide exposure to sectors where large caps have no presence e.g. textiles, media and entertainment etc. Investors can get diversification benefits across various sectors through large and midcap funds.

- Both large caps and midcaps can play an important role in the India Growth Story. Indian large cap companies have considerable growth potential as our economy grows. Even the largest companies in India are relatively smaller than the largest companies on a global scale, indicating room for expansion and growth, as Indian economy expands.

- Beyond large caps, sectors with significant midcap presence can benefit from India’s consumption-driven economic growth, rising per capita income, changing global supply chain landscape (e.g. China+1), Government’s policies e.g. import substitution (Make in India), digitization, infrastructure spending, shift from unorganized to organized sectors etc. Large and midcap funds can provide investors exposure to a broader range of investment opportunities in the above mentioned themes.

- There is a scope for large and midcap fund managers to create alpha by taking positions (overweight / underweight) in a particular market cap segment or sector as per the fund manager’s views.

Current market context

Equity market is near record highs, continuing its strong run from 2023. The rally in equities has been broad based with small and midcaps outperforming large cap stocks. Global markets, especially the US market, have supported the momentum in Indian equities. Though the Nifty 50 valuations (trailing twelve months PE multiple) are around the long-term average, valuations may be stretched in certain pockets of the market. The market has been range bound after making all time high. We are seeing profit booking at higher levels and support coming in at lower level of the range. In terms of global risk factors, there are concerns about possible recession in the United States. This may lead to increased volatility in the market.

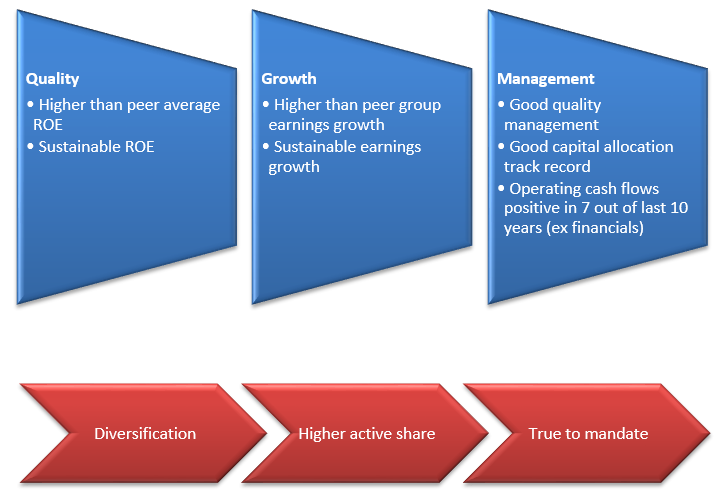

PGIM India Large and Midcap Fund – Stock Selection Principles

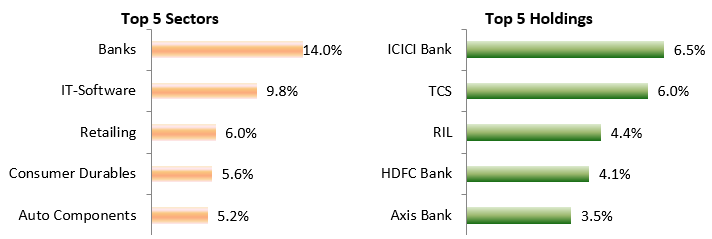

Higher large cap and lower small cap allocations compared to peers

PGIM India Large and Midcap (marked in red) has higher large cap (50% versus 46% category average) and lower small cap - 4.3% versus 13% category average (ex-PGIM) allocations relative to the category average. This can provide relative stability to investors in volatile markets. Furthermore, the midcap allocations of the fund (40%) are higher than the category average (ex-PGIM) allocation of 38%. This can lead to long term alpha creation.

Source: Advisorkhoj Research, as on 31st July 2024

Current portfolio construction

Source: PGIM India Fund Factsheet, Advisorkhoj Research, as on 31st July 2024

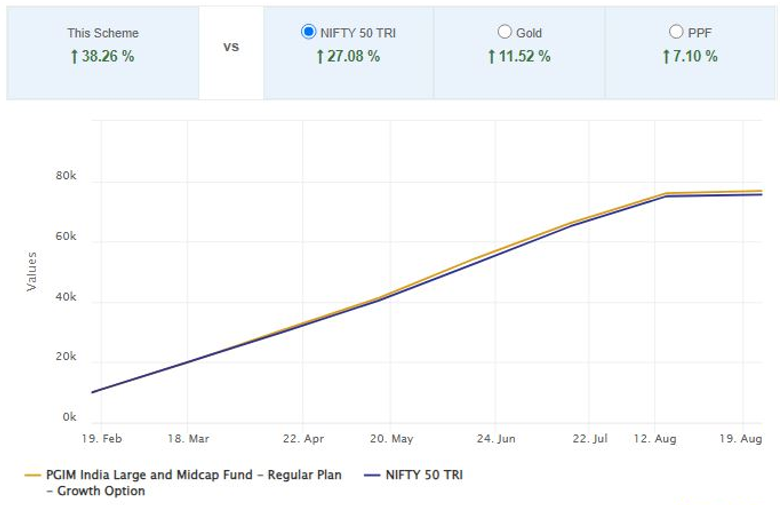

SIP Performance – Outperformed Nifty and other asset classes

Source: Advisorkhoj Research, as on 20th August 2024

Why invest in PGIM India Large and Midcap Fund?

- Historically, large & Midcap has provided above average risk-adjusted returns as compared to large caps

- Large & Midcaps category provides fair exposure to both established sectors as well as balanced exposure to promising or new age sectors

- Fund manager can be overweight/underweight large, and midcaps based on his views. There is scope for alpha creation through active management. Currently the fund manager has 50% allocation to large cap and 40% to midcaps

- PGIM India Large and Midcap Fund is true to label (large and midcap) with more than 90% of the scheme’s assets invested in these two market cap segments (large caps and midcaps).

- The fund focuses on high quality (higher ROE compared to peer average and sustainable ROE), high growth (higher earnings growth compared to peer average and sustainable EPS growth) and strong management (good capital management, capital allocation track record, positive operating cash-flows in 7 out of 10 years)

- The fund avoids low ROE and growth potential stocks, businesses that are subject to disruptions, highly leveraged companies (companies with high debt to equity ratios) and weak corporate governance track records. PGIM’s internal study on Indian markets also proves that High growth & High quality stocks outperform low quality and low growth stocks.

- PGIM India Large and Midcap Fundmaintains high active share (difference between percentages of the fund’s stock holdings and the benchmark’s stock holdings). This may result in potential alpha creation for the investor over long investment horizon.

Who should invest in PGIM India Large and Midcap Fund?

- Investors looking for capital appreciation and wealth creation.

- Investors should have at least 5 year investment horizon in this scheme.

- This fund can be suitable for new or first time investors

- Investors with very high risk appetite.

- Investors can invest in this scheme either through lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisors if PGIM India Large and Midcap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY