PGIM India Large and Midcap Fund: Off to a good start

PGIM India Large and Midcap Fund has recently completed 1 year since its launch in February 2024. The fund invests primarily in large and mid-sized companies. As per SEBI’s mandate large and midcap funds must invest minimum 35% each in large cap (top 100 companies by market cap) and midcap sized (101st to 250th companies by market cap). The fund has made a good start beating its benchmark index in the last 1 year. In this article, we will review PGIM India Large and Midcap Fund.

Current market context

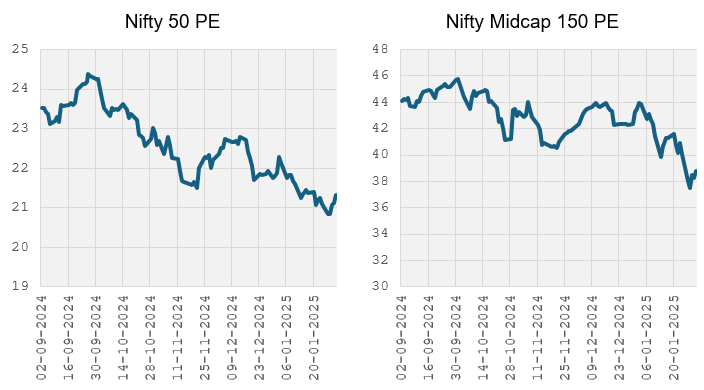

The market has been volatile for the past 4 months. INR depreciation, weaker than expected corporate earnings and concerns about trade policies of new US Administration have led to heavy Foreign Institutional Investor (FII) sell-off. Nifty 50 has corrected by more than 12% from its 52-week high. The deep correction has eased valuations and bringing them to more reasonable levels, especially in large cap segment (see the chart below). Midcap valuations have also eased, though there are still pockets of concerns. Among the three market cap segments, small caps have been the most volatile last 1 month (down 11.6%). In contrast, large and midcaps, have been less volatile.

Source: NSE, as on 31st January 2025

Why invest in large and midcap funds now?

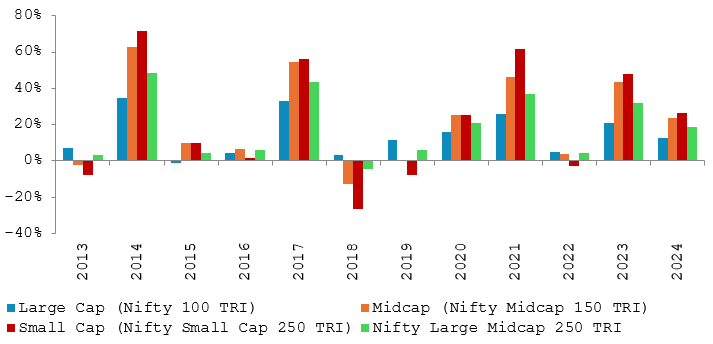

- Winners rotate market cap segments (see the chart below). It is difficult for investors to anticipate which market cap segment will outperform. Large and midcap funds automate market capitalization-based asset allocation decision for the investor.

Source: NSE, as on 31st December 2024

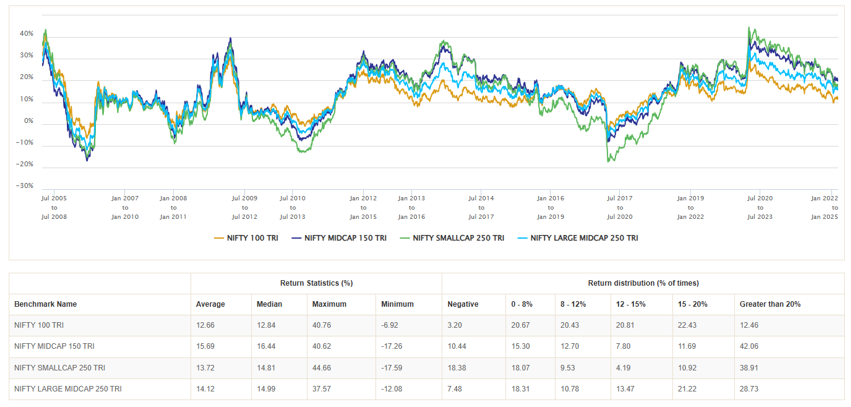

- Large and midcaps have decent participation in market upsides and at the same time, has also relatively provided downside protection (see the chart below) across investment cycles. In volatile markets, large and midcap funds will provide a stable investment experience and also create potential alphas in the investors’ portfolios, over sufficiently long-term investment horizons.

Source: NSE, as on 31st January 2025

- Large and midcaps provide exposure to sectors where large caps will have no presence e.g. textiles, media, and entertainment etc. You can get richer diversification through large and midcap funds. Sectors with significant midcap presence can benefit from India’s consumption driven economic growth, rising per capita income, changing global supply chain landscape (e.g., China + 1), Government’s policies e.g., import substitution (Make in India), digitization, infrastructure spending, shift from unorganized to organized sectors etc. Large and midcap funds can provide investors exposure to a broader range of investment opportunities.

- In the current valuation scenario, large and midcap funds can exploit potential attractive investment opportunities across market cap segments, while sticking to their market cap mandate. This can result in long term wealth creation opportunities.

PGIM India Large and Midcap Fund – Outperformed the benchmark

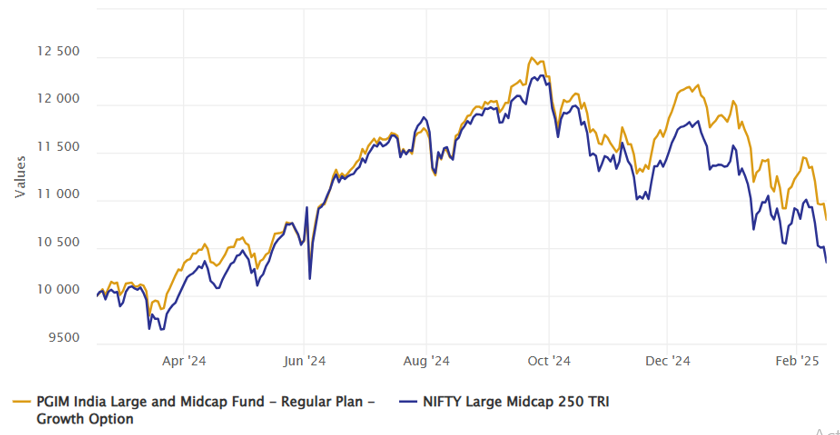

The chart below shows the growth of Rs 10,000 investment in PGIM India Large and Midcap Fund versus the benchmark index, since the inception of the fund. You can see that the fund has outperformed the benchmark since its inception.

Source: NSE, as on 14th February 2025

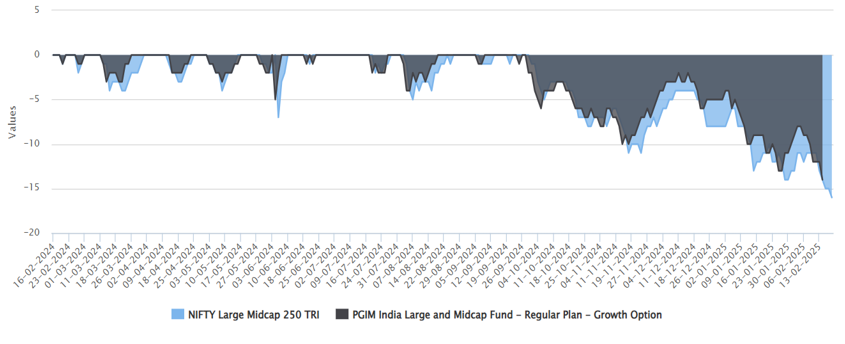

PGIM India Large and Midcap Fund – Limited downside risks

The chart below shows the drawdowns on the fund relative to the benchmark index since the inception of the fund. You can see that the fund was able to limit downside risks for investors.

Source: NSE, as on 14th February 2025

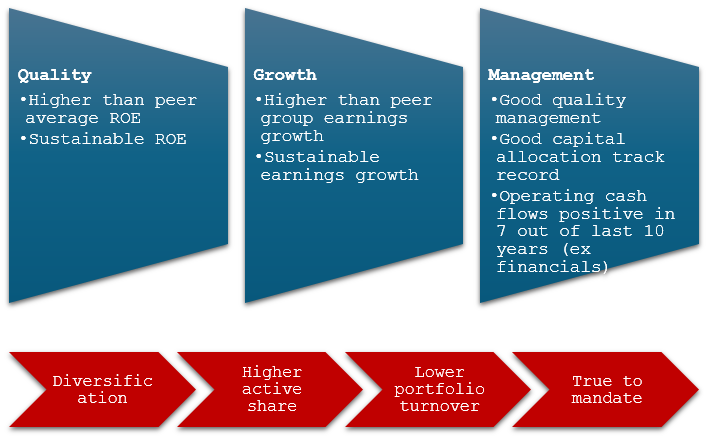

PGIM India Large and Midcap Fund – Stock Selection Strategy

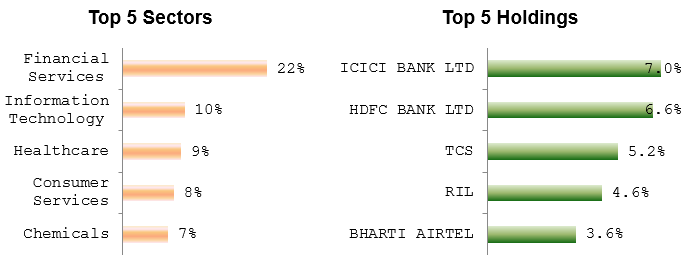

Current portfolio positioning

The portfolio has currently a large cap bias with more than 50% of portfolio holdings in large cap. Midcaps are around 39% and small caps less than 5%. The market cap allocations seem prudent in current market conditions. Additionally, the fund has about 5% in cash / cash-equivalents which can be deployed in attractive investment opportunities, as and when they arise.

Source: PGIM India MF, as on 31st January 2025

Who should invest in PGIM India Large and Midcap Fund?

- Investors looking for capital appreciation and wealth creation.

- Investors should have at least 5-year investment horizon in this scheme.

- This fund can be suitable for new or first-time investors

- Investors with very high-risk appetites.

- You can invest in this scheme either through lump sum or SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if PGIM India Large and Midcap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY