PGIM India Healthcare Fund: Invest in long term growth prospects

PGIM India Mutual Fund has launched a new fund offer (NFO), PGIM India Healthcare Fund. This is a thematic fund which will invest in pharmaceuticals and healthcare / healthcare related stocks. Healthcare is a popular investment theme and has strong growth prospects as India’s economy continues to grow. The NFO has opened for subscription on 19th November 2024 and will close on 3rd December 2024. In this article we will review, PGIM India Healthcare Fund.

Why could healthcare be a structural theme in India over the next decade?

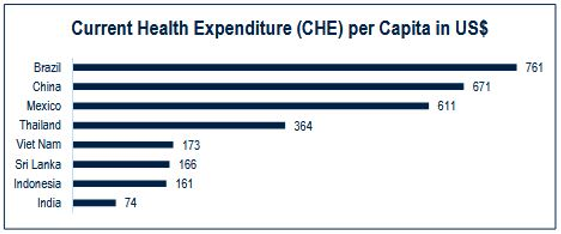

- Current healthcare expenditure in India, on a per capita basis, is significantly lower even when compared to other emerging markets.

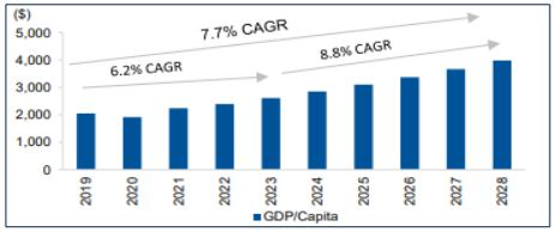

- This will change with rising household income and improved affordability. Per capita income in India is currently at an inflexion point. As income increases, household expenditure on health care is likely to increase.

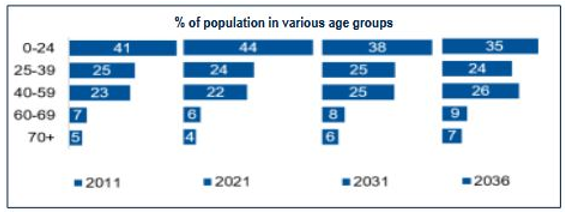

- As India’s population gets older, medical, or healthcare related spending is likely to increase.

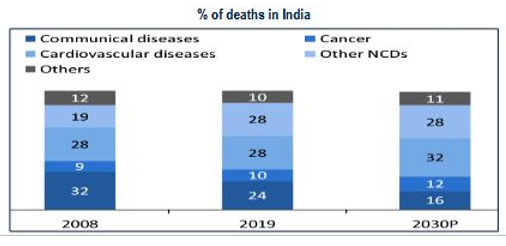

- Prevalence of lifestyle diseases is also projected to increase over the coming years

Source: AMSEC, MOSPI/ Press Information Bureau, U.S. Bureau of Labour Statistics, National Bureau of Statistics of China, Bank Indonesia, Red seer analysis, WHO. NCD- Non communicable disease (lifestyle diseases such as diabetes), WHO Global Health Expenditure Database accessed in October 2024 (2021 Data) *Data as of 31-Mar-23

How has healthcare performed as an investment theme over the years?

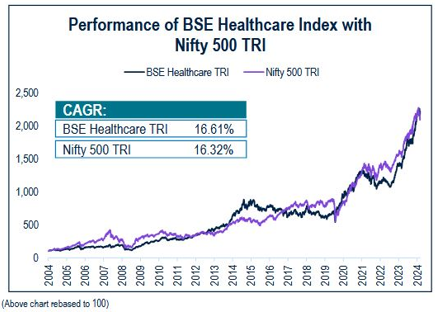

- BSE Healthcare Index has outperformed the broader market (represented by Nifty 500 TRI) over the last 20 years or so.

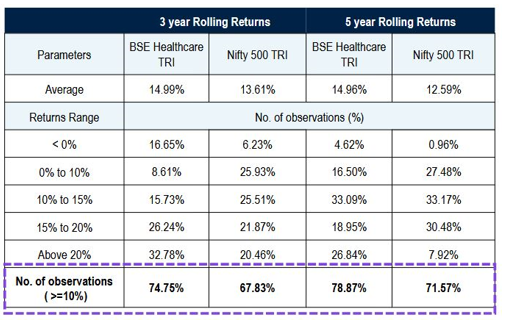

- BSE Healthcare Index has delivered more consistent performance than Nifty 500 TRI over the past 20 years. Over 5-year investment periods, the healthcare index has provided double-digit returns in nearly 79% of instances, compared to 72% for the Nifty 500 TRI.

Source: MFI ICRA, PGIM India Internal Data. Data as on 31st August 2004 to 31st October 2024. It should not be construed to be indicative of scheme performance in any manner. Past performance may or may not be sustained in the future.

Why opt for active management in the healthcare sector?

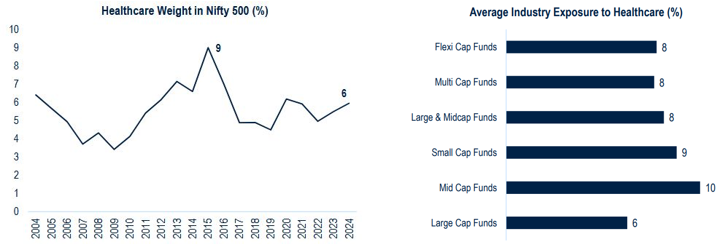

- The exposure of broader category funds to healthcare is limited. Historically, exposure of healthcare in the Nifty 500 TRI has been below 10% (see the chart below). A thematic healthcare fund will provide you focused exposure to healthcare.

Source: MFI ICRA, PGIM India Internal Data. Data as of 30-Sep-24

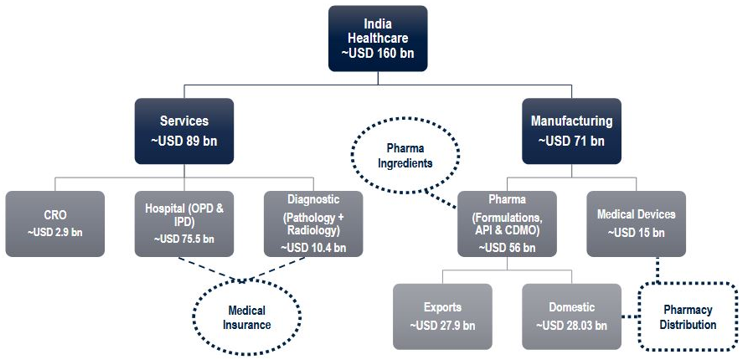

- BSE Healthcare Index is skewed towards large cap pharmaceuticals (pharma constitutes 77% of the BSE Healthcare Index), while there are numerous growth opportunities present across different sub-segments within the healthcare sector.

Source: CRISIL MI&A, Frost & Sullivan, Department of Pharmaceuticals, Dun and Bradstreet estimates, IQVIA. API- Active Pharmaceutical Ingredient, CDMOs- Contract development and manufacturing organizations, OPD-Outpatient, IPD- Inpatient, CRO- Contract research organizations. Taken 84.43 as the USD INR conversion rate. Data as of FY 2024. The above-mentioned numbers are approximate estimates

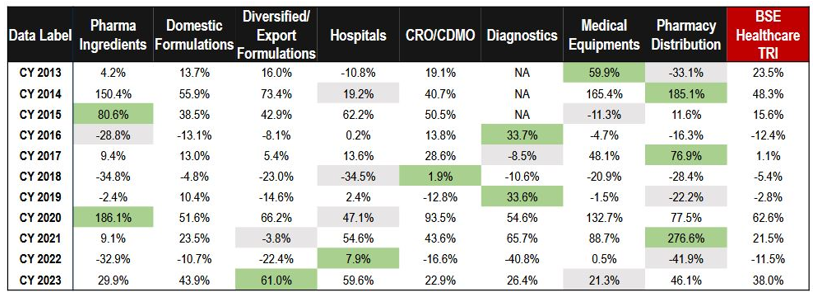

- Winners rotate within the healthcare sector. Different segments experience different business cycles, leading to varying performance trends. Bottom-up stock selection can result in alpha creation.

Source: Factset, PGIM India Internal Analysis. For understanding purposes only. The sub-segments are the internal bifurcation of PGIM India AMC. The stock(s) mentioned in this slide do not constitute any recommendation and PGIM India Mutual Fund may or may not have any future position in this stock(s) Past performance may or may not be sustained in the future and is not a guarantee of any future returns. Index performance does not signify scheme performance. CDMOs- Contract development and manufacturing organizations, CRO- Contract research organizations.

Stock selection process of PGIM India Healthcare Fund

Investment philosophy of PGIM India Healthcare Fund

Why invest in PGIM India Healthcare Fund?

- The fund may help diversify your portfolio

- The fund will endeavour to have a high active share, which could offer the potential for generating alpha in your portfolio

- The fund will endeavour to invest in high conviction stocks.

- The fund will be true to mandate

Who should invest in PGIM India Healthcare Fund?

- Suitable for investors looking for tactical satellite allocations to their overall equity portfolio.

- Investors with a long-term investment horizon.

- Investors who have a high risk appetite.

- Investors with a minimum investment horizon of 3 to 5 years.

Investors should consult with their financial advisors or mutual fund distributors if PGIM India Healthcare Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY