PGIM India ELSS Tax Saver Fund: Tax savings and wealth creation

As we approach the last quarter of this financial year, you should ensure that you complete your tax planning well in time, instead of scrambling at the last minute. Section 80C of Income Tax Act allows investors to claim deductions from their gross taxable income by investing in certain tax savings schemes eligible u/s 80C. The amount you invest in 80C scheme is eligible for claiming deductions against your gross taxable income for the purpose of calculating your income tax obligations for the year. The maximum deduction in one financial year that you can claim u/s 80C is Rs 150,000. For investors in the highest tax bracket, you can save up to Rs 46,800 in taxes u/s 80C.

How to plan your tax savings?

These tax savings schemes can broadly be categorized as, Government small savings schemes (e.g. EPF, VPF, PPF, NSC etc), tax saver Bank Fixed Deposits, life insurance plans (traditional and unit linked plans) and tax saving mutual funds. For most salaried investors, Employee Provident Fund (EPF) contributions are a mandatory requirement; you can claim your contributions to EPF as deduction against your taxable u/s 80C. However your EPF contributions may not be enough to claim the full benefit u/s 80C. If you are paying home loan EMIs, you can claim the payments made towards principal repayment as 80C deductions. If you need to save and invest more to claim the full deduction u/s 80C, you need to make tax planning investments. You should consider the following factors in your tax planning investments:-

- Returns and risk

- Liquidity

- Taxation

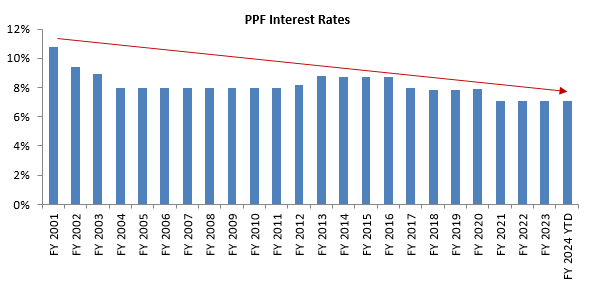

Government small savings interest rates have been declining over the long term

Government small savings like PPF have been popular 80C investment options for many investors, but small savings scheme interest rates have been declining secularly over the long term.

Source: Advisorkhoj.com

Why invest in ELSS for tax savings?

Equity Linked Savings Scheme (ELSS) is a mutual fund equity scheme which qualifies for tax savings u/s 80C. ELSS has a lock-in period of 3 years. An ELSS is essentially a diversified equity fund, which invests across industry sectors and market cap segments. You can invest in ELSS, either in lump sum or through Systematic Investment Plan (SIP). Even though ELSS are subject to market risks unlike Government small savings schemes, there are several reasons for investors to consider ELSS for their tax planning needs.

- Historical data shows that equity, as an asset class, has the potential of giving superior returns in the long term. In the last 20 years (ending 30th November 2023) Nifty 50 TRI has given 16.5% CAGR returns.

- The three year lock-in period of ELSS enables fund managers to invest in high conviction stocks for a long period of time because of relatively less redemption pressure.

- ELSS is the most liquid investment option u/s 80C. ELSS has lock-in period of three years, whereas minimum lock-in period of other 80C investment options is 5 years.

- ELSS is one of the most tax efficient investment options u/s 80C. Capital gains of up to Rs 1 lakh is tax exempt and taxed at 10% thereafter

Over the years, ELSS has emerged as one of the most popular choices for investors as 80C investments. As on November 30th 2023, ELSS had Rs 1.88 lakh crores of assets under management (source: AMFI).

PGIM India ELSS Tax Saver Fund

PGIM India ELSS Tax Saver Fund was launched in December 2015. The fund has given 13.88% returns since inception (as on 30th November 2023 for Regular Plan, source: Advisorkhoj Research). Vinay Paharia (Equity Portion), Anandha Padmanabhan Anjeneyan (Equity Portion) and Bhupesh Kalyani (Debt Portion) are managing this fund from April 01, 2023.

Performance

The chart below shows the growth of Rs 10,000 invested in PGIM India ELSS Tax Saver Fund since the inception of your scheme. The value of your investment would have grown to Rs 28,190 as on 30th November 2023 and CAGR of 13.88%.

Source: Advisorkhoj.com, as on 30th November 2023

Volatility of returns reduces over long investment tenures

Many investors prefer risk-free investments over equities since equities are volatile. However, historical data shows that probability of loss decreases over long investment tenures. The chart below shows the 5 year rolling returns of PGIM India ELSS Tax Saver Fund versus the ELSS category average since the inception of the scheme. You can see that the fund never gave negative returns over 5 year investment tenures across all market conditions. You can see in the chart that the minimum return of the fund over 5 year tenure was around 10%; this is significantly higher than interest rates of 80C Government Small Savings Schemes.

Source: Advisorkhoj.com, as on 30th November 2023

Track record of outperformance versus peers

The chart below shows the annual returns of PGIM India ELSS Tax Saver Fund versus category average and the quartile rankings. In 8 years since launch, the fund was in the top 2 quartiles, 5 times.

Source: Advisorkhoj.com, as on 30th November 2023

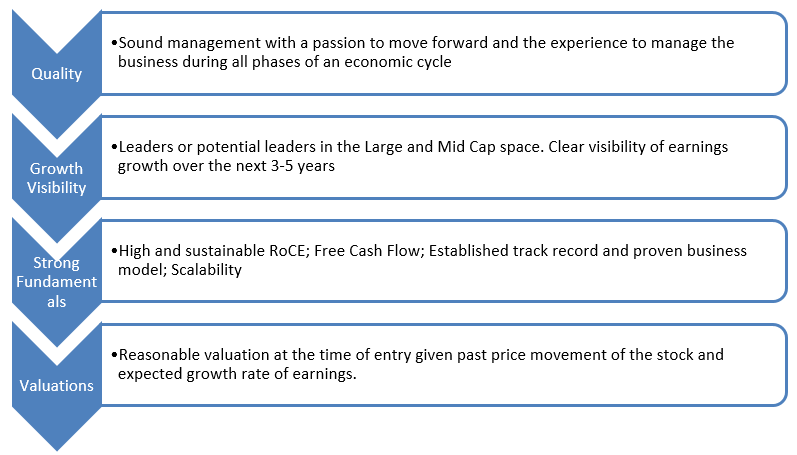

Investment Strategy

Current Portfolio Positioning

Source: Advisorkhoj.com, PGIM MF Factsheet as on 30th November 2023

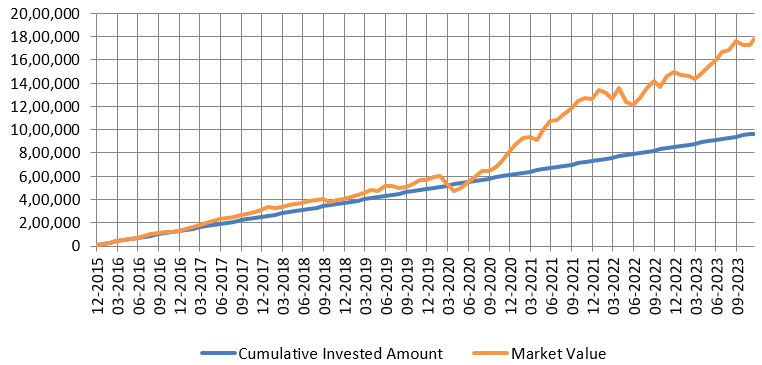

SIP – Effective and convenient way of investing in PGIM India ELSS Tax Saver Fund

The chart below shows the growth of Rs 10,000 monthly SIP in PGIM India ELSS Tax Saver Fund. Investing in ELSS through SIP not only keeps you disciplined in your tax planning, it can also help you accumulate wealth in the long term. You can see that with a cumulative investment of Rs 9.60 lakhs, you could have accumulated Rs 17.80 lakhs (as on 30th November 2023).

Source: Advisorkhoj.com, as on 30th November 2023

Why you should invest in PGIM India ELSS Tax Saver Fund?

- By investing up to Rs 1.5 lakhs in PGIM India ELSS Tax Saver Fund and save tax up to Rs 46,800 u/s 80C.

- The Scheme has a diversified equity portfolio across market capitalizations and is suitable for wealth creation.

- It has flexibility to increase or decrease exposure to Large, Mid or Small Cap stocks as per market cycles and the Fund Manager’s view.

- The scheme’s mandated three-year lock-in ensures that you do not react to market swings and continue to remain invested.

Who should invest in PGIM India ELSS Tax Saver Fund?

- Investors looking for tax savings under section 80C and capital appreciation over long investment horizons.

- Investors with high-risk appetite.

- Investors with minimum 3 years investment tenures.

- You can invest either in lump sum or SIP depending on your financial needs.

Investors should consult their financial advisor or mutual fund distributors if PGIM India ELSS Tax Saver Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY