PGIM India ELSS Tax Saver Fund: Tax saving and wealth creation

As this financial year draws to a close, it will be useful to remind taxpayers in the old tax regime, to complete the tax savings (80C) before the deadline of 31st March 2025. Though Public Provident Fund or Voluntary Provident Fund have the traditional tax saving investment options under Section 80C, Equity Linked Savings Scheme have also become very popular with investors, since they have higher wealth creation potential over long investment tenures compared to traditional tax saving investment options like PPF. In this article, we will review PGIM India ELSS Tax Saver Fund, which has a strong performance track record.

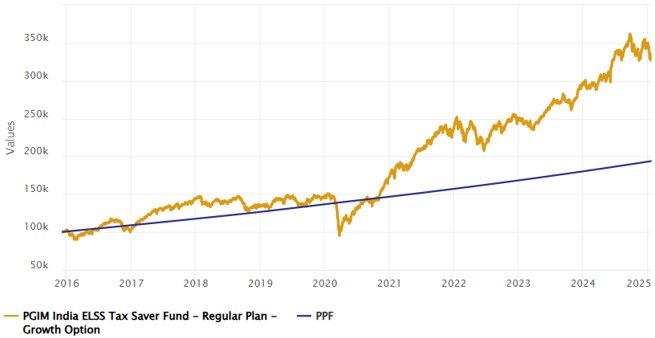

PGIM India ELSS Tax Saver Fund versus PPF

The chart below shows the growth of Rs 1 lakh investment in PGIM India ELSS Tax Saver Fund versus Public Provident Fund since the inception of the scheme. You can see that despite higher volatility, the fund was able to provide significantly higher wealth creation compared to PPF.

Source: Advisorkhoj Research, as on 22nd January 2025

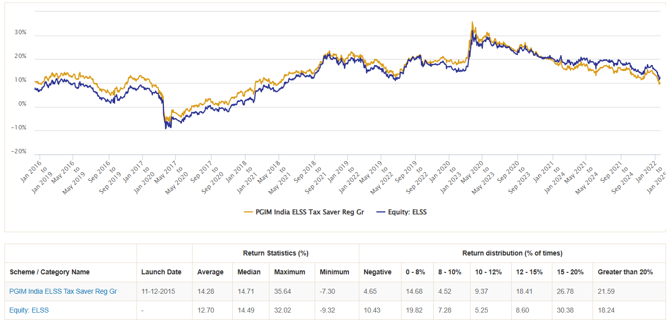

Outperformed peers across different market conditions

PGIM India ELSS Tax Saver Fund outperformed the ELSS category across different market conditions over 3-year investment tenures (see the 3-year rolling return chart of the scheme versus the category average since the scheme's inception). PGIM India ELSS Tax Saver Fund has lesser instances of negative returns compared to peers, as well more instances of 12%+ CAGR returns compared to peers.

Source: Advisorkhoj Rolling Returns, 22nd January 2025

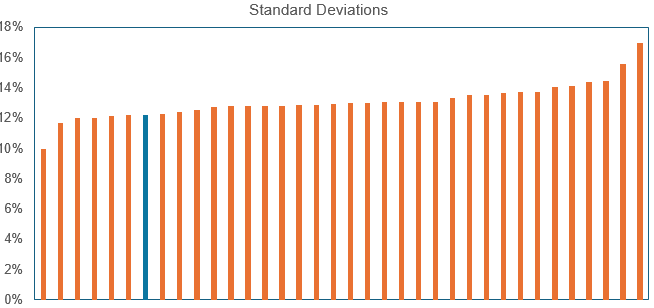

Lower volatility compared to peers

Standard deviation is a statistical measure of volatility. We looked at the standard deviations of all ELSS funds which have completed 3 years. PGIM India ELSS Tax Saver Fund has lower volatility compared to peers,

Source: Advisorkhoj Research, as on 31st December 2025

Lower systematic risks compared to peers

Beta is a measure of systematic risks. We looked at the beta of all ELSS funds which have completed 3 years. PGIM India ELSS Tax Saver Fund has lower betas compared to peers.

Source: Advisorkhoj Research, as on 31st December 2025

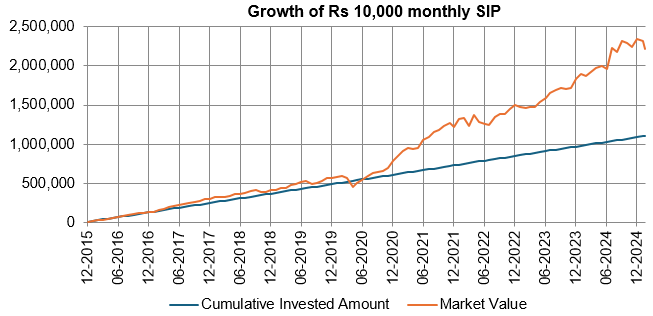

Wealth creation through SIP

SIP is highly suitable for your tax savings investments since it keeps you disciplined and avoid last minute rush. The chart below shows the growth of Rs 10,000 monthly SIP in PGIM India ELSS Tax Saver Fund since the inception of the scheme. With a cumulative investment of Rs 11 lakhs, you could have accumulated a corpus of more than Rs 22 lakhs through SIP. This shows the wealth creation of SIP over long investment horizons.

Source: Advisorkhoj Research, as on 22nd January 2025

Market capture ratios

Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market's upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market's downside was arrested by the fund. Up Market Capture Ratio and Down-Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of PGIM India ELSS Tax Saver Fund over the last 5 years.

The Up Market Capture Ratio of PGIM India ELSS Tax Saver Fund over last 5 years was 91% which implies that if the benchmark index went up by 1% in a month, then the scheme's NAV went up by 0.91%. The Down Market Capture Ratio of the fund was 86% which implies that if the benchmark index went down by 1% in a month, then the scheme's Net Asset Value (NAV) went down by 0.86%. The market capture ratios of PGIM India ELSS Tax Saver Fund are a clear indicator of the potential of the fund to give superior risk adjusted returns of the fund.

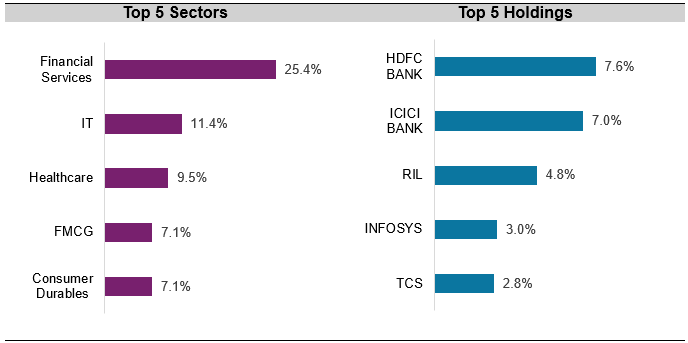

Current portfolio positioning

The fund invests through a bottom-up stock–by–stock selection across market cap spectrum, with consideration given to price–to–earnings, price–to–book, and price–to–sales ratios, as well as growth, margins, asset returns, and cash flows, amongst others. The fund manager focuses, amongst others, on the historical and current financial condition of the company, potential value creation/unlocking of value and its impact on earnings growth, capital structure, business prospects, policy environment, strength of management, responsiveness to business conditions, product profile, brand equity, market share, competitive edge, research, technological know–how and transparency in corporate governance.

Source: PGIM India MF, as on 31st December 2024

Who should invest in PGIM India ELSS Tax Saver Fund?

- Investors looking to save taxes under Section 80C.

- Investors who want capital appreciation or wealth creation over long investment tenures

- The scheme has a lock-in period of 3 years. You cannot redeem units of the scheme before the completion of 3 years from the investment date.

- Investors with high-risk appetites

Investors should consult their financial advisors or mutual fund distributors if PGIM India ELSS Tax Saver Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY