PGIM India Balanced Advantage Fund: A suitable fund in volatile market conditions

Current Market Context

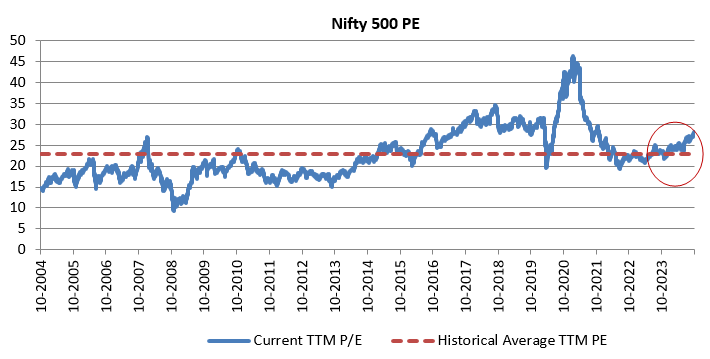

Equity market has turned very volatile in the last few weeks. The Nifty has fallen from its all time high of 26,277 to below 24,500 levels (as on 22nd October 2024). The Sensex has slid by more than 5,000 points to 80,021 (as on 22nd October 2024). Several factors, global and local are causing volatility in the market. High US Treasury Bond yields, strong US Dollar and impact of the upcoming Presidential elections on the US dollar are impacting global risk sentiments. China’s outperformance relative to India and weak Q2 earnings growth is also a contributing factor to the volatile market conditions. Concerns about valuations in certain pockets of the market (see the chart below) also led to profit booking.

Source: National Stock Exchange, as on 30th September 2024

In these market conditions, balanced advantage funds which manage asset allocation dynamically based on relative valuations can provide stability to your portfolio and also have the potential to generate reasonable returns over sufficiently long investment horizon.

How Balanced Advantage Funds work?

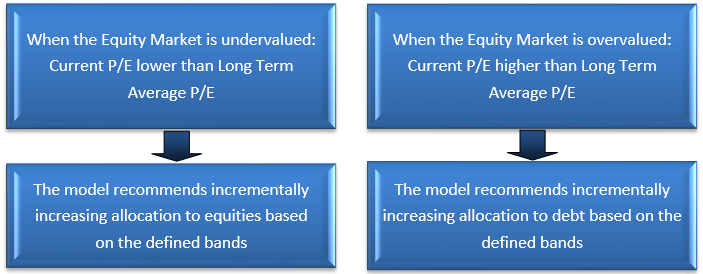

By lowering net equity allocations when the equity market valuation seems high or the outlook is not attractive, dynamic asset allocation aims to reduce downside risk if the market corrects. Similarly, BAF will increase its net equity allocations and decrease its debt allocation as equity valuations fall (become cheap) or if the outlook is upbeat. By increasing equity allocations in such times, the dynamic asset allocation model may generate higher risk adjusted returns for the investor.

Balanced advantage funds usually cap their debt allocation to 35% so that the scheme can enjoy equity taxation. If the net equity exposure needs to fall below 65% as per the dynamic asset allocation model, these funds use hedging to reduce the net equity allocation, but keep the gross equity exposure above 65% to ensure equity taxation.

About PGIM India Balanced Advantage Fund

PGIM India Balanced Advantage Fund was launched in February 2021 and has Rs 1,112 crores of assets under management with a total expense ratio of 2.14% for the regular plan (details as on 30th September 2024). The fund has given around 12.44% CAGR returns since inception (as on 30th September 2024). A.Anandha Padmanabhan, Vinay Paharia, Utsav Mehta, Puneet Paland Chetan Gindodia are the fund managers of the scheme. The fund managers have combined experience of over 80 years.

Dynamic Asset Allocation model of the PGIM India Balanced Advantage Fund

Asset allocation for PGIM India Balanced Advantage Fund is guided by a Dynamic Asset Allocation model. The fund dynamically changes its asset allocation based on the deviation of the current P/E ratio of Nifty 500 from the long term average P/E of the index (as shown in the graphic below). 15 year rolling P/E of Nifty 500 Index is considered for the long-term average P/E, whereas the current PE is the last 20 days moving average.

PGIM India Balanced Advantage Fund’s dynamic asset allocation model is scientific and transparent. Using this model, PGIM India Balanced Advantage Fund follows the “Buy Low, Sell High” mantra, allocating across equity and debt based on equity market valuation. The fund maintains minimum 65% exposure to equity and equity related instruments (this ensures equity taxation for the fund), with directional equity exposure of at least 30% at all points of time.

Limited downside risks in market corrections

The chart below shows the returns of PGIM India Balanced Advantage Fund versus Nifty 500 TRI in all the months in which the market (represented by the broad market index Nifty 500) was down since the launch of the fund. You can see that the fund was able to limit downside risks for investors most times.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th September 2024

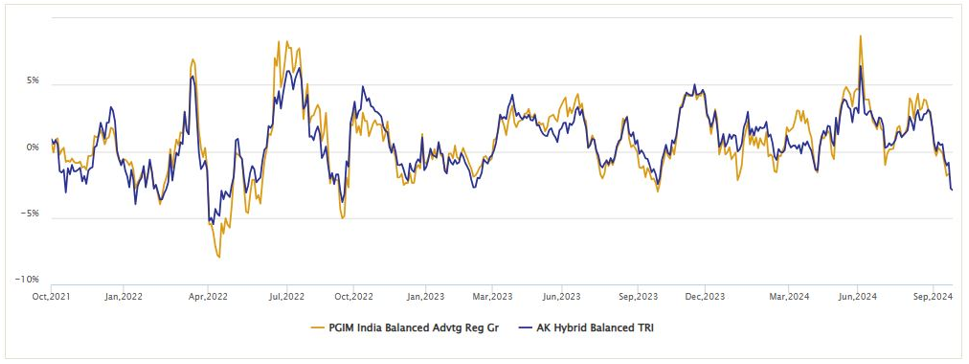

Outperformed custom balanced index (50% equity + 50% debt) across different market conditions

The chart below shows the monthly rolling returns of PGIM India Balanced Advantage Fund versus our custom balanced index since the inception of the fund over the last 3 years. The asset allocation of our custom balanced index is 50% equity (represented by Nifty 50 TRI) and 50% fixed income (represented by Nifty 10 Year Benchmark G-Sec Index) rebalanced monthly. You can see that the PGIM India Balanced Advantage Fund outperformed our custom index most of the time in up markets.

Source: Advisorkhoj Rolling Returns, as on 30th September 2024

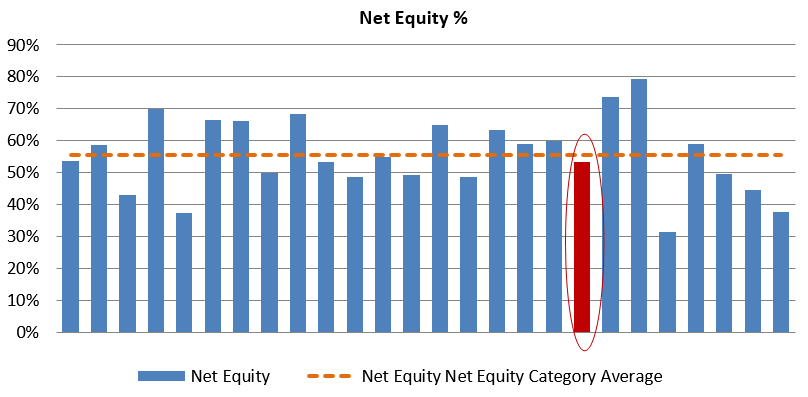

Asset allocation –PGIM India Balanced Advantage Fund versus peers

The chart below shows the market cap allocations of all the Balanced Advantage Funds that have minimum 3 year track record and have minimum Rs 500 crores AUM. The net equity exposure of PGIM India Balanced Advantage was 53% (as on 30th September 2024). PGIM India Balanced Advantage Fund marked in red had slightly lower net equity compared to the category average net equity allocations.

Source: Advisorkhoj Research, as on 30th September 2024

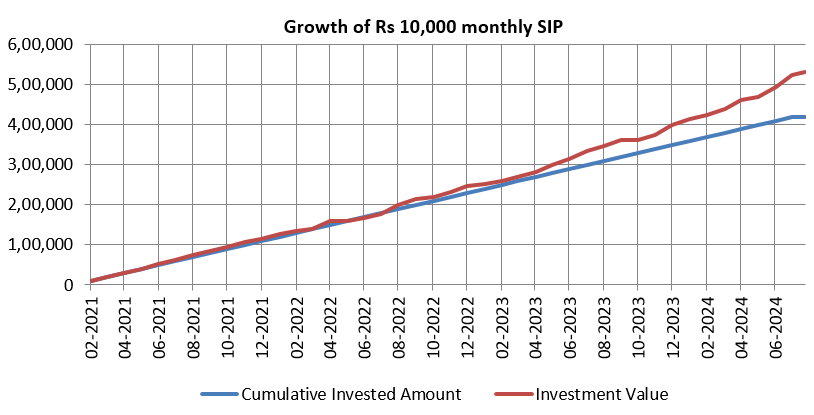

Fundperformance since inception –SIP

The chart below shows the growth of Rs 10,000 monthly SIP since the inception of PGIM India Balanced Advantage Fund. With a cumulative investment of Rs 4.4 lakhs, you could have accumulated a corpus of Rs 5.71 lakhs (as on 30th September 2024). The annualized SIP return (XIRR) since inception was 14.34%

Source: Advisorkhoj Research, as on 30th September 2024

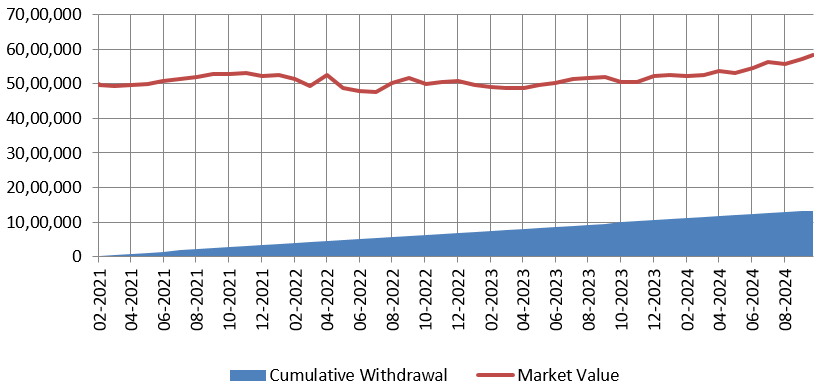

Suitable for SWP

The chart below shows the result of Rs 30,000 monthly SWP from a lump sum investment of Rs 50 Lakhs since the inception of the PGIM India Balanced Advantage Fund. You can see that despite withdrawing Rs 13.2 lakhs on a cumulative basis, the market value of the balance units (as on 30th September 2024) increased from Rs 50 lakhs to more than Rs 58 lakhs.

Source: Advisorkhoj Research, as on 30th September 2024

Who should invest in PGIM India Balanced Advantage Fund?

- Investors who want capital appreciation and income over long investment tenures

- Investors who do not want high volatility in their portfolios

- Investors with minimum 3 to 5 years investment horizon

- New investors or investors who do not have experience of volatile markets can invest in this scheme

- You should consult with your financial advisor or mutual fund distributor if PGIM India Balanced Advantage Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY