From the desk of Vinay Paharia (CIO) PGIM India Mutual Fund - Investment Process: PGIM India Mutual Fund

In this article, let me take our readers through the process that we follow for managing our funds and also a back-tested study to understand how high growth and good quality companies have performed in the past in India over the longer term and look at the characteristics of these set of companies to construct our portfolios.

We at PGIM India believe that to achieve consistent investment success, it depends on designing a robust investment process and following it diligently, through both good and bad times.

The investment process that we follow at PGIM MF for our equity-oriented portfolios, is divided into two parts: 1) Stock Selection and 2) Portfolio Construction.

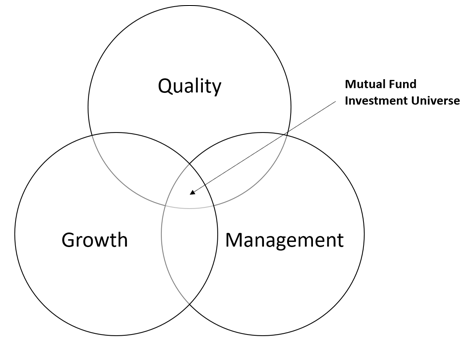

- Stock Selection: We select stocks by starting with a universe of listed stocks, which have more than Rs.1000cr in market capitalisation. There are approximately 1200 companies which currently satisfy this criteria (as of Nov-23, source: Bloomberg). We then identify companies which satisfy the twin criteria of a) higher than average Return on Equity (RoE) and b) higher than average growth in earnings. Post this we do a thorough due diligence on management quality and if found satisfactory, we select the stock for inclusion in our Mutual Fund Investment Universe.

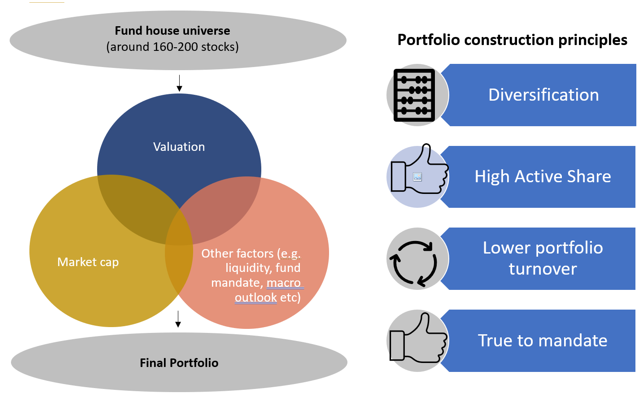

- Portfolio construction: Once a stock is selected for inclusion in Mutual Fund Investment Universe, it is allocated to different portfolios based on parameters like a) Valuation: we measure the fair values of stocks for the next 5 years and compare the current market price with the 5-year hence fair value to compute the potential upside. Ceteris Paribus, the higher the potential upside, higher is the allocation to a particular stock. b) Market Capitalisation: All other things remaining the same, the higher the market capitalisation of a stock, higher is the allocation. Thus, if a Large Cap company offers the same upside as the Small Cap company, then the allocation will be higher to the Large Cap company. c) Other Factors: We consider a host of other factors like fund house view on the particular sector, liquidity in a particular stock, our macro views, etc.

These are designed keeping in mind four key considerations – a) ensuring portfolios are well diversified to ensure a healthy balance between risk and return which may result in a reduction in volatility in alpha, b) maintain high Active Share portfolios, c) endeavour to reduce portfolio turnover such that we have a lower portfolio turnover, and d) ensure that portfolios are true to mandate.

Back testing of our Investment Process in Indian Markets

We think our investment process is fairly robust from a long term perspective, as it has been back-tested.

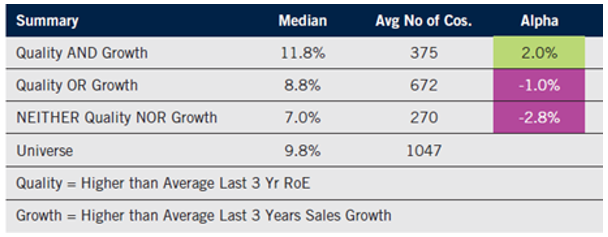

As a starting point, we analysed 1500+ companies (which were part of NSE 500 Index over last 20 years) and looked at fundamental parameters like 3-Year Sales Growth (proxy for Growth) and 3-Year Average Return on Equity (proxy for Quality) to see whether any pattern emerges for succeeding as an investor. We derived a very simple outcome: markets over the long term, rewards companies which exhibit both of these characteristics: 1) Higher than average historical 3-Yr Sales Growth and 2) Higher than average historical Return on Equity.

In the last 21 years, on a rolling 3 year basis, there we only two times that this strategy has underperformed Nifty 500 Index - once in March 2015-2018 period and second in March 2020-23 period.

(Source: Bloomberg. PGIM India analysis as on 31st March, 2023. Universe – All companies in NSE 500 index from 2002 to 2022. Median denotes that the value is lying at the midpoint of a frequency distribution of observed values, such that there is an equal probability of falling above or below it)

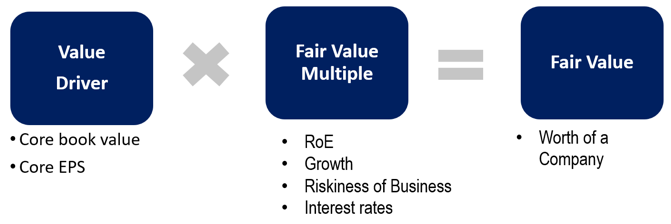

As a Fund House, our endeavor is to target high and diversified Active Share which may help to reduce volatility in alpha. Our inhouse Fair Value approach (as shown below) serves as a unique proprietary tool, which help in making investment decisions, which we feel may deliver risk adjusted returns over a long period of time.

In terms of our holding period we feel patience is a virtue and long holding periods are often required to nurture businesses. Although our approach is to construct a high quality and diversified portfolio, there would be instances where our thesis may not work and we could sell stocks if the investment rationale is significantly weakened or impaired, absolute valuation re-rating resulting in low potential upside or if we have a better alternative with superior risk reward payoff. If a stock is sold purely for Valuation reasons, we do not remove it from the Mutual Fund Investment Universe. Conversely, if we sell due to deterioration in Business or Management Quality, we remove the stock from the Mutual Fund Investment Universe.

Market Outlook:

Current positioning of markets may seem uncertain for short term investors, but presents a good opportunity for long term investors, in our view.

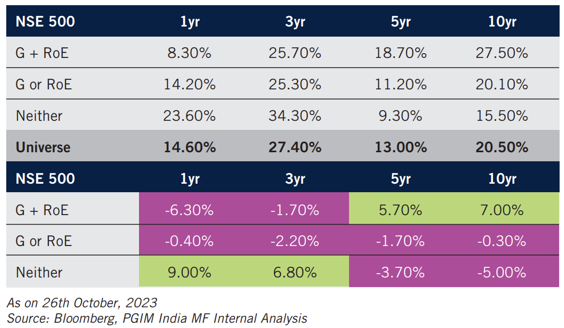

We analysed all the NSE 500 companies, based on last 5-year sales growth and RoE. Based on this study, Good Quality-High Growth companies have significantly underperformed their counterparts which have lower Growth and weaker quality, over the last 1 year and three years. However, over a 5 year and 10 year period, Good Quality-High Growth companies have significantly outperformed their weaker counterparts.

The primary reason behind the underperformance of good quality-high growth companies appears to be dramatic rise in interest rates. Over the last 3 years, we have seen an unprecedented rise in interest rates. The US Fed Funds rate has climbed to around 5.25% from 0% around 3 years back and India's repo rate has climbed from 4% about 2 years back to 6.5% currently. Such companies are generally long duration assets and their valuation gets disproportionately hit by rise in interest rates.

We think the unprecedented rise in interest rates is behind us and incrementally, after a long plateau, we may start to see some fall in rates from the second half of 2024. Markets may stop the compression in valuation of such Good Quality-High Growth companies in anticipation of no further rise in rates. Hence, buying into high growth and good quality companies may be the preferred approach for participating in the Indian Equity Markets.

The information contained herein is provided by PGIM India Asset Management Private Limited (the AMC) on the basis of publicly available information, internally developed data and other third party sources believed to be reliable. However, the AMC cannot guarantee the accuracy of such information, assure its completeness, or warrant such information will not be changed. The information contained herein is current as of the date of issuance* (or such earlier date as referenced herein) and is subject to change without notice. The AMC has no obligation to update any or all of such information; nor does the AMC make any express or implied warranties or representations as to its completeness or accuracy. There can be no assurance that any forecast made herein will be actually realized. These materials do not take into account individual investor's objectives, needs or circumstances or the suitability of any securities, financial instruments or investment strategies described herein for particular investor. Hence, each investor is advised to consult his or her own professional investment / tax advisor / consultant for advice in this regard. The information contained herein is provided on the basis of and subject to the explanations, caveats and warnings set out elsewhere herein. The views of the Fund Manager should not be construed as an advice and investors must make their own investment decisions regarding investment/ disinvestment in securities market and/or suitability of the fund based on their specific investment objectives and financial positions and using such independent advisors as they believe necessary.

© 2023 Prudential Financial, Inc. (PFI) and its related entities. PGIM, the PGIM logo, and the Rock symbol are service marks of Prudential Financial, Inc., and its related entities, registered in many jurisdictions worldwide.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Document Date: December 19, 2023

Document Number: 155 – 2023-24

PGIM is the global investment management business of Prudential Financial, Inc. (PFI) USA, with USD 1.5 trillion1 in assets under management. We offer a broad range of investment capabilities through our multi-manager model along with experienced investment teams that assist you in achieving your financial goals. With a glorious legacy of 145 years, PGIM is built on the strength, stability and deep expertise in managing money. We offer you a long-term perspective, having weathered multiple market cycles, and see opportunity in periods of disruption.

Investor Centre

Follow PGIM India MF

More About PGIM India MF

POST A QUERY