Why you should invest in constant duration funds in this interest rate environment?

What are constant duration funds?

There is relatively less awareness of this debt mutual fund category. Constant duration funds invest in Government bonds and maintain a constant duration of their portfolio of bonds. A debt fund with constant duration of 10 years will maintain the 10 year duration irrespective of interest rate cycles. Before we delve further into this category of funds, let us understand the concept of duration and its importance in debt funds.

What is duration?

The Macaulay duration is the weighted average term to maturity of the cash flows from a fixed income security. In simplistic terms, Macaulay Duration is the weighted average number of years an investor must maintain a position in a fixed income instrument until the present value of the fixed income instrument’s cash flows equals the amount paid for the instrument.

Duration and maturity are related – longer the maturity, longer is the duration. It is important for you to know that duration is directly related to the interest rate sensitivity of a bond. Higher the duration, higher is the bond’s sensitivity to interest changes. Bond prices have inverse relationship with interest rates. Bond prices fall when interest rates go up and vice versa. Debt funds with longer durations have more interest rate risk, compared to funds with shorter duration.

Constant duration funds versus accrual based debt funds

Accrual based debt funds hold the bonds in their portfolio till maturity. They accrue the coupons paid by the bonds. A constant duration fund, on the other hand will periodically rebalance its portfolio to keep the duration constant. Accrual based funds usually invest in shorter duration debt and money market instruments, while a constant duration fund invests in longer duration bonds.

Constant duration funds versus Dynamic bond funds

A dynamic bond fund will actively manage its duration depending on the interest rate outlook. If the dynamic bond fund manager expects interest rates to rise, he / she will try to shorten the fund duration to reduce the impact of falling price. If the fund manager expects rates to fall, he / she will try to lengthen the duration to take advantage of higher yields of longer duration bonds.

A constant duration fund will keep its duration the same irrespective of interest rate changes. This makes a constant duration funds highly sensitive to interest rates. While these funds may be highly volatile when interest rates are rising, they can be attractive investment options when the interest rates have peaked and are expected to fall. Another advantage of constant duration funds is credit quality. As per SEBI’s mandate, constant duration funds must invest 80% of their assets in G-Secs.

Is this a good time to invest in constant duration funds?

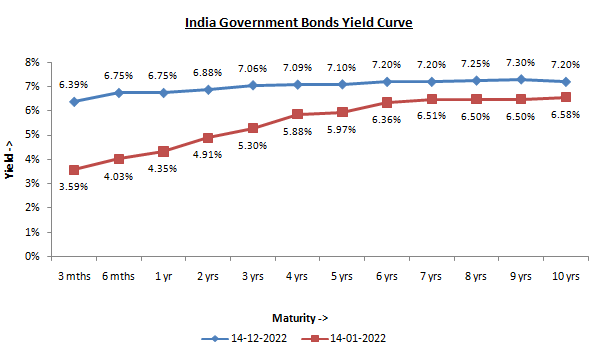

The current shape of the yield curve makes a compelling case for constant duration funds. The chart below shows the yields of Government securities of different maturities as on 14th December 2022 versus 14th January 2022. You can see in the chart below that yields have risen considerably this year. The yield of the 10 year Government Bond is around 7.20%. You can also observe that the slope of the yield curve has flattened considerably compared to what it was at the beginning of this year. Yield curve flattening indicates that the market expects inflation to fall and a reversal in interest rate trajectory in the future.

Source: worldgovernmentbonds.com, Advisorkhoj Research. Disclaimer: Bond yields are market linked and change in the future.

Bond markets have interpreted the recent comments made by US Federal Reserve Chairman Jerome Powell to be dovish. While the market expects rate hikes to continue, but it expects the readjustment in size of rate hikes i.e. the market expects smaller rate hikes in the future. The US bondmarket is expecting a 50 bps rate hike in December after 4 consecutive 75 bps rate hike. The RBI has already reduced the quantum of rate hikes. After 3 consecutive repo rate hikes of 50 bps, the RBI hiked repo rate by 35 bps in December. The headline inflation figures also supports RBI’s monetary policy stance, with the October CPI inflation easing to 3 month low.

How constant duration funds may benefit in the current environment?

The flattening yield curve, easing inflation and central bank policy stance indicates that we may be approaching the end of this interest rate cycle. This is good opportunity to get attractive yields by investing in constant duration funds. Constant duration funds invest in bonds which have high yields. In a falling interest rate regime, you will benefit not only from higher yields (higher coupons paid by the bonds) but also capital gains since bond prices and Net Asset Value (NAVs) will rise as interest rate falls. However, you should understand that constant duration funds may be volatile in the short term. You should always have long investment tenures for these funds.

Why invest in constant duration funds now?

We will summarize the benefits of the investing in constant duration funds in the current interest rate environment:-

- We may be approaching the end of this interest rate cycle.

- You will get higher yields by investing in constant duration funds. These funds invest in long duration bonds. Yields of long duration Government Bonds (e.g. the 10 year G-Sec) are much more attractive now compared interest rates of traditional fixed income investments like Bank FDs and Post Office Small Savings Schemes.

- Potential of capital appreciation in falling interest rates regime.

- High credit quality since these funds invest primarily in Government bonds.

- Benefits of long term capital gains taxation for investment tenures of over 3 years. Long term capital gains in debt funds are taxed at 20% after allowing for indexation benefits.

Who should invest in constant duration funds?

- Investors seeking income and capital appreciation in falling interest regime.

- You should have appetite for short term volatility because these funds may be volatile in the short term.

- You should have long investment tenures – minimum 2 to 3 year investment tenures are recommended for these funds. Investors with 3 year plus investment tenures will benefit from long term capital gains taxation.

Investors should consult with their financial advisors if constant duration funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY