Why you need to have large cap mutual funds in your portfolio?

Market context

Equity markets have rallied in the last 2 months or so. In the December FOMC meeting the US Federal Reserve indicated that there will be multiple rate cuts in 2024, which has lowered US Treasury Bond yields and provided tailwinds to the rally in equities. Nifty and Sensex are trading at their all-time highs. While Nifty 50 TRI gave north of 20% return in CY 2023, the broader market performed even better with Nifty Midcap 150 TRI and Nifty Small Cap 250 TRI giving 44% and 48% returns respectively.

Are valuations a cause of concern?

When markets rally, valuations also go up and naturally investors may get concerned. Nifty was trading at PE multiple of 23.3 (source: NSE, as on 31st December 2023). Nifty Midcap 150 PE was 26.4 and Nifty Small Cap 50 PE was 27.4 (source: NSE, as on 31st December 2023). Current midcap and small cap valuations are still significantly below historical highs; there is considerable upside potentials in all market segments. India was the fastest growing G-20 economy in 2023 and is likely to be again the fastest growing G-20 economy in 2024 (as per IMF forecasts). Global market experts expect India to see larger share of global investors’ emerging market (EM) investment flows, which will drive stock prices much higher, particularly in the midcap and small cap segments where volumes are thinner. Asset allocation is an important part of investment strategy both in bull and bear markets. Even within a particular asset class e.g. equity, you need to spread your risks across different market cap segments. Financial planners recommend that large cap funds should form the core of equity investment portfolio.

What are large cap funds?

Large cap funds are equity funds with more than 80% allocation of scheme’s corpus to large cap stocks (top 100 stocks by market capitalization).

Why invest in large cap funds?

- Large cap funds invest in companies which are household names. They are market leaders in their respective industry sectors and able positioned to survive through recessions. Large cap funds usually have lower risk profiles compared to midcap and small cap funds.

- Large cap companies have well established and stable business models. They are usually market share leaders in their respective industry sectors. As such these companies are usually better positioned to survive economic downturns.

- Large cap companies in India are usually highly capital intensive businesses. The capital intensive nature of their business models are significant entry barriers for their competitors. These companies enjoy significant competitive advantage and can sustain for long period of time.

- As mentioned earlier, large cap stocks have a high percentage of FII and DII ownership. As result these are very well researched. The earnings growth visibility and risk factors are discounted to a large extent in prices of large cap stocks. The risk of sharp price correction or long term underperformance due to factors unknown to the fund manager is relatively less in large cap funds.

- These stocks also have high percentage of free-floating shares (i.e. shares held by the public). Large cap stocks are the most actively traded stocks in the exchanges. As a result, these stocks are highly liquid.

- Since midcaps and small caps have relatively less free floating shares, their trading volumes are thinner. As a result, the prices of these stocks can run up much higher – high demand and less supply. Large caps, on the other hand, do not have this problem because there is always good supply of shares of large cap stocks due to high public ownership (institutional and retail).

- One of the biggest advantages of liquidity in large cap funds is that the fund manager can meet redemption pressures without incurring high impact costs. Impact cost is the cost that a buyer or seller of stocks incurs while executing a transaction due to the prevailing liquidity condition on the counter. A major disadvantage of stocks with low liquidity is that the fund manager may have to sell a stock at much lower price to meet redemption needs.

Wealth creation potential of large cap

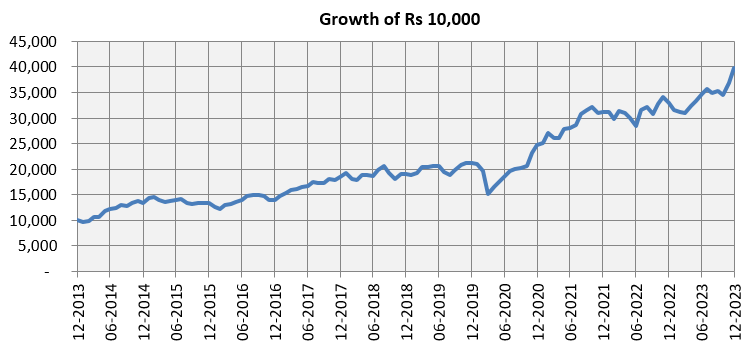

The chart below shows the growth of Rs 10,000 investment in Nifty 100 TRI, the benchmark index of all large cap stocks over the last 10 years. Your investment would have multiplied nearly 4 times in last 10 years at a CAGR of nearly 15%.

Source: NSE, Advisorkhoj Research, as on 31st December 2023). Disclaimer: Past performance may or may not be sustained in the future

Actively managed large cap funds can create alphas

There is a perception among some investors that active large cap funds cannot beat the index. This perception is created due a phenomenon, which an investment expert described as the “tyranny of averages”. If you look at category average returns and compare it with benchmark index returns, you may get the incorrect perception about alpha creation potential of active large cap funds. In our view, there is potential for alphas in large cap funds. If you look at last 3 year large cap returns in Advisorkhoj, then you will see that the top quartile funds were able to beat benchmark index returns. It boils down to consistency, process driven approach and risk management which enable a fund to beat the benchmark over sufficiently long investment horizon. You should look at the long term performance track record of a fund manager, the performance track record fund house across the different fund categories and the research team of the fund house, to take informed investment decisions.

Who should invest in large cap funds?

- Investors who are looking for capital appreciation over long investment tenures.

- Investors who prefer relatively less volatility in their portfolio.

- Investors should have at least 5 years investment tenure in these funds.

- Investors should have moderately high to high risk appetites for these funds.

- Large cap funds can be good investment options for young and / or inexperienced investors.

- Investors should consult with their financial advisors if large cap funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY