Why should you allocate a portion of your investment portfolio to Nifty ETFs

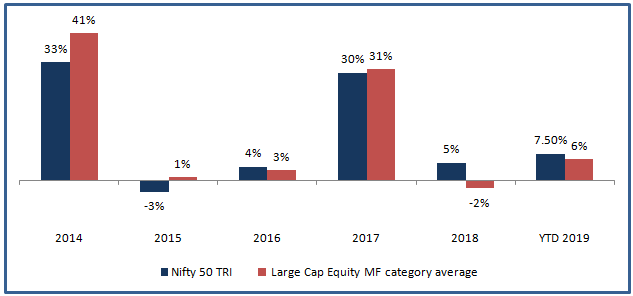

Investing in ETFs and index funds are not as popular among retail investors in India as it is in the developed markets like the United States, but it is increasingly gaining popularity among investors. In the last 1 year, Nifty 50 was one of the best performing investments across all asset classes giving total returns of 11.6%. In contrast average return of actively managed large cap equity mutual funds was 4.4% only; multi-cap and mid/small cap fared even worse. We have received a lot of comments from investors on our portal showing interest in ETFs and index funds. In this blog post, we will discuss about ETFs in general and Nifty ETFs in particular. Hopefully, this post will clarify some doubts which investors may have and explain why investors should allocate a portion of their investment portfolio to Nifty ETFs.

What are ETFs?

- ETF is an instrument which invests in the basket of securities that, reflects the composition of a market index like Nifty, Sensex, Nifty – 100, BSE - 100, Nifty - CPSE etc.

- ETFs aim to replicate an index as closely as possible (reduce tracking errors) and give market returns. Unlike actively managed funds, ETFs do not aim to beat the market.

- Cost or expense ratios of ETFs are much lower than actively managed funds. Expense ratios have a direct impact of the absolute returns of investors.

- Investors can buy or sell units of ETFs, just like they can buy or sell units of mutual fund schemes. However, like publicly traded shares, ETFs can be bought (except during the NFO subscription period) or sold only in stock exchanges. Investors need to have a demat account and trading account to invest in ETFs.

Read: Are ETFs the right investment option for you

Pros of investing in ETFs versus actively managed MFs

- The biggest advantage of ETFs is that their expense ratios are lower than those of actively managed mutual funds. Expense ratios of Nifty ETFs are usually around 10 bps, while that of actively managed funds are usually in the range of 200 to 250 bps. This implies that actively managed funds have to beat the market by around 2% or higher in order to just match ETF returns. It is not impossible for fund managers to generate 200 bps of alpha, but in a maturing (growing more efficient) stock market, alpha generation is likely to be more challenging.

- Stricter SEBI mutual fund mandates, has put restrictions on market cap allocations for different fund categories. Large cap funds now have to mandatorily invest at least 80% of their AUM in the 100 largest companies by market capitalization. In the past, large cap funds could have had higher allocations to mid and small caps to boost alphas. The new SEBI regulations which have been enforced over the last 1 year or so, while reducing risk and bringing uniformity, has made alpha creation more challenging for fund managers of actively managed schemes.

- Nifty is a market capitalization weighted index. This means that stocks with higher market capitalization are given more weight in the index. A stock which is performing well will grow its market cap faster than other stocks, and consequently will have a higher weight in the index. Since ETFs simply aim to replicate the index, they increase their exposure to these high performing stocks. Actively managed funds, on the other hand, have diversification objectives and concentrations in single stocks are capped in accordance with the mandate of individual schemes. The single most attribution factor of Nifty ETFs beating actively managed funds in the last 1 year was that, Nifty performance was largely driven by performance of a few heavyweight stocks. Nifty ETFs simply had to increase the allocations to these high performing stocks in line with the index composition, but actively managed funds were restricted in terms of how much exposure they could have to single stocks.

![Pros of investing in ETFs versus actively managed MFs Pros of investing in ETFs versus actively managed MFs]()

Cons of investing in ETFs versus actively managed MFs

- ETFs simply aim to replicate the index, while actively managed funds aim to beat the index. While the Indian stock market has certainly become more efficient in the last 15 years or so, we in Advisorkhoj believe that there is considerable scope of alpha creation in all market cap segments, even in large cap. Actively managed funds in the past,despite higher expense ratios, have beaten the market, by a wide margin and though relative returns (versus market) may come down in the future, actively managed funds have the potential to beat ETFs in India in the long term. Fund manager performance however, is crucial in the case of actively managed funds.

- Since ETFs can be sold only in stock exchanges, you need to have a demat account to buy / sell ETFs. You do not necessarily need to have demat account for buying / selling mutual funds. To get a demat account you have to submit KYC documents and fulfil paperwork required by the stockbroker / depositary participant.

- In the case of actively managed mutual funds, you can redeem your units with the asset management company. But in the case of ETFs, they can only be sold on stock exchanges, in other words, you need to find a buyer when selling an ETF. Therefore, liquidity may be an issue with ETFs, when you do not find enough buyers in the stock exchange. Liquidity differs from one ETF to another, depending on the demand for the instrument in the market.

Why invest in Nifty ETFs?

Nifty – 50 (popularly known as simply Nifty) is the index of the 50 largest stocks by market capitalization in India. With 50 stocks, across 13 industry sectors, Nifty – 50 is a well diversified equity portfolio. It is the dominant market index of our stock market, representing around 67% of the free float market capitalization of National Stock Exchange (the largest stock exchange in volume terms) as on 29th March 2019. The total traded value of Nifty index constituents for the last six months ending March 2019 is approximately 53.4% of the traded value of all stocks on the NSE.

Suggested reading: Diversification: How to take advantage of it

While SEBI’s definition of large cap stocks, cover the 100 largest companies by market cap, Nifty dominates the large cap segment. Nifty – 100 index, comprising of the 100 largest stocks by market cap (SEBI’s definition of large cap), represents 77% of the total market cap, of which Nifty alone represents 67% of the total market cap. Nifty ETFs invest in a basket of stocks in appropriate weights that reflect the composition of the index as closely as possible.

Nifty is a large cap index. The large cap segment of the market is less risky than the mid and small cap segment. Nifty ETFs have lower risk profiles compared to other equity asset categories. Low cost is obviously a huge advantage enjoyed by Nifty ETFs compared to actively managed funds. Nifty ETFs will bring stability to your investment portfolio and give good returns in the long term. In the last 20 years, Nifty 50 TRI has given 13.75% CAGR returns. Liquidity is a concern for ETFs, but several Nifty ETFs enjoy higher liquidity than many other ETFs.

Large cap stocks should form the core of your equity portfolio. Different investment experts and financial planners have different views on large cap versus mid/small cap allocations in portfolios but at a high level, 60 – 80% allocation to large cap and 20 – 40% allocation to mid/small cap are generally recommended to investors. If you have higher risk appetites, then your midcap allocation can be towards the higher end of the recommended range and vice versa. Nifty ETFs are excellent low cost investment options in the large cap segment and as such, should form a part of your investment portfolio.

Conclusion

Though the ETF market in India is not as matured as in the developed markets, there is a compelling case for including ETFs in your investment portfolio because low costs can boost your returns in the long term compared to actively managed funds of similar risk profile. Nifty ETFs are among the most popular ETFs in India and several Nifty ETFs have fairly good liquidity. Investors should consult with their financial advisors, if ETFs are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY