Use these 6 tips to select the right tax saver option

Tax payers can claim deduction of up to Rs 150,000 from their taxable income by investing in certain eligible schemes specified under Section 80C of Income tax Act. There are several investment options under Section 80C for different needs and risk appetites. Unfortunately many investors look at tax planning, purely from the perspective of tax savings without considering other objectives of investments. This often leads to making sub-optimal decisions. In this blog post, we discuss six factors that you must consider when choosing the right tax saver option for you.

What are these six factors?

While tax saving (which all 80C schemes are eligible for) is the primary consideration, you must consider the following factors:-

- Investment Objective – Capital preservation or wealth creation

- Investment tenure – How long you want to stay invested? This should be linked to your financial goals

- Potential returns – Returns of 80C schemes can be non-market linked or market linked

- Risk appetite – Low to high. Your risk appetite will depend on your stage of life and financial situation. You should consult with your financial advisor, if you need help in understanding your risk appetite

- Liquidity – How quickly can you turn your investments into cash if required? All 80C investments require you to remain invested for a minimum period in order to claim tax benefits, but different schemes have different liquidity profiles

- Taxation of maturity or redemption proceeds – How will the maturity or redemption proceeds of you 80C investments be taxed?

What are different types of 80C schemes?

There are broadly two types of schemes eligible under Section 80C:-

- Non-market linked schemes: Employee Provident Fund (EPF), Voluntary Provident Fund (VPF), Public Provident Fund (PPF), National Savings Certificates (NSC), 5 year tax saver bank FDs and traditional life insurance plans (e.g. endowment plans, money back plans) are the non market linked schemes u/s 80C. Most of the non-market linked schemes assure a fixed rate of interest over a certain period of time. The interest rates of the small savings schemes are subject to quarterly revision by the Government. Traditional life insurance plans also have fixed income type features such as, payment of sum assured on maturity or money back from time to time, and guaranteed additions depending on the policy term. Non-market linked schemes provide high degree of capital safety and fixed income returns.

- Market linked schemes: Mutual fund Equity Linked Savings Schemes (ELSS) and Unit Linked Insurance Plans (ULIPs) are the market linked schemes u/s 80C. These schemes invest in financial market securities e.g. stocks. Their returns are linked to market returns and they are subject to market risks. There is no guarantee of capital safety in these investments.

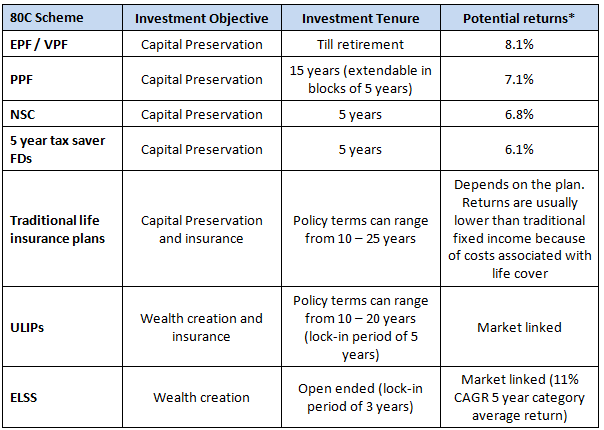

Evaluation of 80C schemes based on the 6 factors for choosing tax saver option

Let us first evaluate the different 80C schemes based on the first three factors viz. investment objective, investment tenure and potential returns. You can see that while ELSS is subject to market risks, it has the highest wealth creation potential among all 80C investment schemes.

*As on 28th October 2022. Source: Ministry of Finance, India Post, Major public and private sector banks, Advisorkhoj returns. Disclaimers: Government small savings interest rates are subject to quarterly revisions. Mutual fund past performance may or may not sustained in the future. The above table is only for investor education purposes and not for tax planning recommendations. You should invest according to your risk appetite and consult with your financial advisor if you need any help

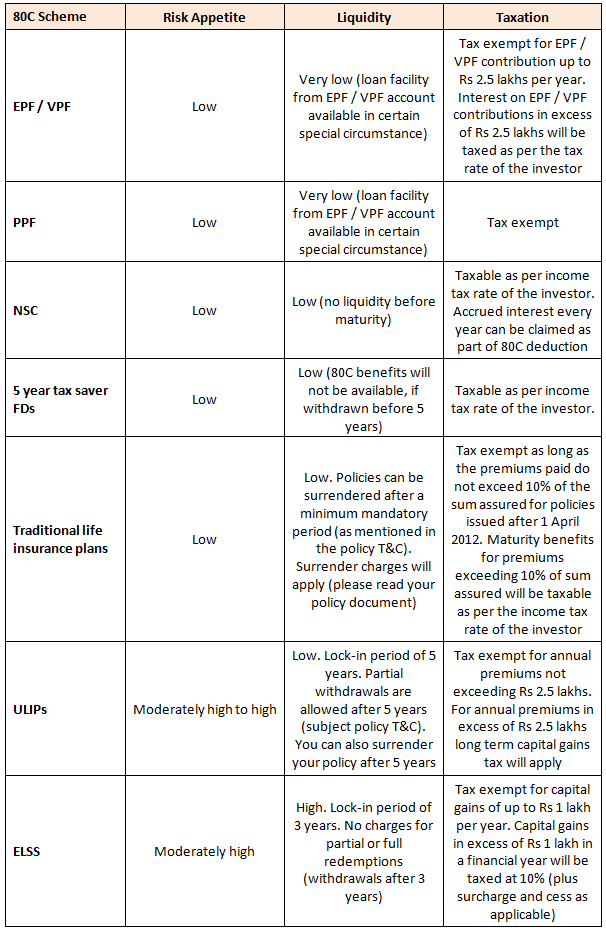

Let us now evaluate the different 80C schemes based on the other three factors viz. risk appetite, liquidity and taxation. You can see that for investors with moderately high to high risk appetites, ELSS offers not only higher potential wealth creation but also provides superior liquidity and tax benefits compared to many other 80C schemes.

Think about the future when planning investments

You should also think about how your financial situation may evolve in the future. For example, if you buy a 20 year life insurance policy purely for the purpose of tax savings, you will have to pay the same annual premium for the next 20 years unless you surrender your policy and pay surrender charges as applicable. Suppose a few years later, you take a home loan to buy a house and start paying home loan EMIs. The principal component of your home loan EMI is eligible for deduction u/s 80C. Also, as your salary increases your EPF contribution will also increase. In both the cases, you can make less investments in other 80C schemes because the maximum deduction permissible in Rs 1.5 lakhs. You should opt for investments that give you flexibility, depending on your changing financial situation and needs. For example, in ELSS you can invest different amounts every year depending on your tax planning needs.

Suggested reading: how ELSS mutual funds help investors in goal planning while saving taxes

In this blog post, we discussed some tips which can help you choose the right tax saver option. You should consult with your financial advisor if you need help in making investment decisions.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY