Multi-Asset Allocation Funds: Suitable investment option in the current economic environment

What is asset allocation?

Asset allocation is spreading your investments over different asset classes, e.g. equity, fixed income, gold, real estate etc. The primary purpose of asset allocation is to balance risk and returns. If you are over-invested in one particular asset class, you may take too much risk or get sub-optimal portfolio returns. Through asset allocation, you take optimal risks to get the reasonable returns needed for your financial goals.

What is multi-asset allocation?

In standard parlance, asset allocation refers to the mix of equity and debt (fixed income) in your portfolio. However, there are several other important asset classes, e.g. Gold, Silver, Real Estate, International Securities etc. Multi-asset allocation is spreading your investments across several asset classes, not limited to just equity and debt.

What are multi-asset allocation funds?

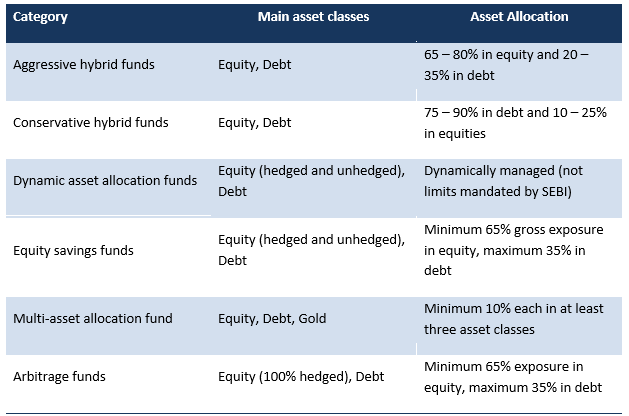

Multi-Asset Allocation funds are hybrid mutual fund schemes that invest in 3 or more asset classes. According to SEBI, multi-asset allocation funds must invest at least 10% each in at least 3 asset classes. Apart from the two most popular asset classes, equity and fixed income or debt, multi-asset allocation funds must invest in other asset classes like gold, real estate investment trusts (REITs), infrastructure investment trusts (InvITs) etc. The fund manager decides the proportional allocation to each asset class based on the market conditions to balance risks and returns.

Role of different asset classes in your asset allocation

- Equity: The primary objective of equity as an asset class in capital appreciation over long investment tenures, i.e. wealth creation. Historical data shows that equity can give superior returns over long investment horizons. The chart below shows the growth of Rs 10,000 investment in Nifty 50 TRI over the last 10 years, ending 31st May 2023.

Source: National Stock Exchange, Advisorkhoj Research, as of 31.05.2023. Disclaimer: Past performance may or may be sustained in the future.

- Fixed Income: The primary investment objective for fixed income or debt is income. Fixed-income returns have a low correlation with equity returns and can stabilise your portfolio in market downturns. The chart below shows the growth of Rs 10,000 investment in the Nifty 10-year Benchmark G-Sec Index over the last 10 years, ending 31st May 2023.

Source: National Stock Exchange, Advisorkhoj Research, as of 31.05.2023. Disclaimer: Past performance may or may be sustained in the future.

- Gold: Gold is culturally significant in India; it is considered an auspicious metal in many Indian households. As an asset class, gold is seen as a store of economic value. Historical data shows that gold can be a hedge against inflation in the long term. The chart below shows the growth of Rs 10,000 investment in Gold (INR) over the last 10 years, ending 30th April 2023.

Source: National Stock Exchange, Advisorkhoj Research, as of 31.05.2023. Disclaimer: Past performance may or may be sustained in the future.

- REITs: Real Estate Investment Trusts or REITs are investment vehicles that invest in real estate properties. REITs buy, manage and sell real estate properties. REITs get rental income from properties they lease, which is distributed as dividends to shareholders/investors. Over long investment horizons, investors can also get capital appreciation as the properties owned by the REITs appreciates. REITs usually invest in high-value real estate like offices, industrial complexes, shopping malls, supermarkets, hospitals, high-value residential complexes etc. REITs combine the benefits of debt and equity for investors. You can use regular income from the rental income of the REIT properties as dividends. Over long investment horizons, you can also get capital appreciation.

- InvITs: Infrastructure Investment Trusts or InvITs are similar to REITs in structure. They are investment vehicles that invest in revenue-generating infrastructure projects, e.g. commercial assets across Roads, Power, Railways, Warehouses, Airports, Data centres, Telecom towers, etc. As an InvIT investor, you can invest in a finished project that generates revenues or under-construction projects. The main investment objective of InvITs is long-term income, and they can be suitable investment options for retirees. Though REITs and InvITs were initially positioned for HNI investors, SEBI has reduced the minimum investment amount to allow retail investors to participate in REITs and InvITs.

Why multi-asset allocation achieves better risk diversification?

Since Multi Asset Allocation funds invest in 3 or more asset classes, they stabilise your portfolio returns across investment cycles. There is a low correlation between returns of different asset classes in different market conditions; equity and gold are usually counter-cyclical to each other, i.e. gold outperforms when equity underperforms and vice versa (see the chart below). Note the years when gold gave very high returns when equity underperformed and vice versa. Adding gold to your investment portfolio provides much better risk diversification than a portfolio comprising just equity and fixed income.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st May 2023. Equity as an asset class is represented by Nifty 50 TRI, debt as an asset class is represented by Nifty 10-year benchmark G-Sec and gold returns refer to appreciation in the domestic (INR) price of gold. Disclaimer: Past performance may or may not be sustained in the future.

Multi-Asset Allocation Funds compared to other hybrid fund categories

Source: SEBI circular on Categorization and Rationalization of mutual fund schemes (Oct 06, 2017)

Taxation of Multi Asset Allocation funds

The taxation of Multi Asset Allocation Funds will depend on the average equity exposure of the scheme. The fund managers of these schemes change their asset allocation depending on market conditions and their outlook. Though the fund manager may endeavour to give you tax-efficient returns, you should not assume that you will get equity taxation. Equity taxation will apply if the equity allocation is more than 65%. Long-term capital gains (investment holding period of 12 months or more) of up to Rs 1 lakh will be tax-exempt and taxed at 10% thereafter.

If the equity exposure is more than 35% but less than 65%, the investor will get indexation benefits in capital gains taxation. Long-term capital gains (investment holding period of 3 years or more) will be taxed at 20% after allowing for indexation benefits. If the equity exposure is less than 35%, capital gains will be added to your income and taxed as per your income tax rate. You should consult with your financial advisor or mutual fund distributor to understand the tax consequences of your scheme and make informed investment decisions.

Is this a good time to invest in Multi Asset Allocation Funds?

- The developments over the past 2 – 3 months indicate that we are nearing the possible end of this rising interest rate cycle in light of cooling inflation.

- The RBI is expected to hold the repo rate flat for the balance part of this year and start cutting interest rates from next year.

- After a couple of months of volatility, equity is recovering broadly, with the leading indices, Nifty and Sensex, near their all-time highs.

- Gold has been the best-performing asset class in the last year. Usually, equity and gold are counter-cyclical, but despite the strong recovery made by equities, the gold rally has continued primarily due to the weakening USD.

- With signs of economic slowdown in the US and a possible reversal in the trajectory of US interest rates, gold can be a beneficial asset class in your portfolio over the medium to long term.

- Multi Asset Allocation Funds can provide you tax-efficient exposure to gold while optimising asset allocation to equities and debt for your long-term investment objectives.

- You should have a minimum of 3-year investment tenures for multi-asset allocation funds. You can always invest for more extended periods depending on your investment needs.

Investors should consult with their financial advisors to determine if Multi Asset Allocation Funds will suit their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY