How ELSS mutual funds help investors in goal planning while saving taxes

Tax payers usually treat tax planning as tax saving exercise. But tax planning should be a very important financial planning exercise tax payers must endeavour to link their tax saving investments with long term financial goals.

Section 80C of Income Tax Act 1961 allows tax payers to claim deductions from their taxable income by investing in specified schemes like National Savings Certificates (NSC), Public Provident Fund (PPF), premiums paid on life insurance, tax saver bank fixed deposits and Equity linked saving schemes (ELSS mutual funds) etc. Tax payers can claim tax deduction equal to the investment amount from their taxable income up to a maximum limit of Rs 1.5 lakhs in a financial year (FY). Thus, one can save up to Rs 46,800 in taxes (for the highest tax slab) by investing in 80C tax savings schemes.

Let us now compare some of the Section 80C investment options with ELSS Mutual Funds.

Comparison of ELSS Mutual Funds with Government 80C small savings schemes

If you refer the chart below you can see that the interest paid by Government / Post Office Small Savings Schemes is in the range of 7.7 to 7.9%, except for Senior Citizens Savings Scheme (SCSS) in which only the senior citizens can invest and Sukanya Samruddhi Yojana (SSY) in which parents can save for the girl child. Tax payers should note that the interest rates of these schemes are not fixed and are linked with relevant benchmark Government bond yields. Government bond yield shave been falling for the last 2 years and thus interest rates of these schemes are also following a declining trajectory.

Source: India post website

However, Government / Post Office Small Savings Schemes ensure capital safety, while ELSS mutual funds are subject to market risks. The reason being, ELSS mutual funds are diversified equity mutual funds, which invests in stocks across sectors and various market capitalization which defines the stocks as large, mid and small cap. However, equities, as an asset class, have the potential to give superior returns in the long term compared to all other asset classes.

For example - Over the last 10 years, the Nifty 100 TRI, which is the benchmark index of large cap stocks, has given 12% CAGR returns; whereas PPF gave 8.24% annualized returns in the same period.

Comparison of ELSS Mutual Funds with PPF

Now to understand why equity is the best asset class for wealth creation, let us compare the corpuses accumulated by tax payers over a long period of time by investing in PPF and ELSS mutual funds.

Public Provident Fund (PPF)

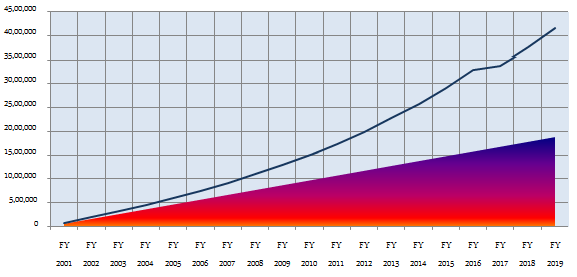

- Let us assume that the investor invested Rs 1 lakh per annum in PPF and ELSS respectively on 1st day of the year from year 2001 onwards; the last deposit was made on January 1, 2019. The chart below shows the growth of PPF account balance from 2001 to 2019 (March 31). The term of PPF is 15 years and it can be renewed for blocks of 5 years. In this example, we are showing the example of PPF deposits made over the entire term of 15 years and then renewed.

Source: Advisorkhoj Research - Historical PPF Rates

You can see that the tax payer would have been able to accumulate a corpus of nearly Rs 45 lakhs with a cumulative investment of Rs 18.7 lakhs by investing in PPF. The annualized return (IRR) of PPF is 8.6% (Interest earned in PPF is entirely tax exempt).

ELSS Mutual Funds

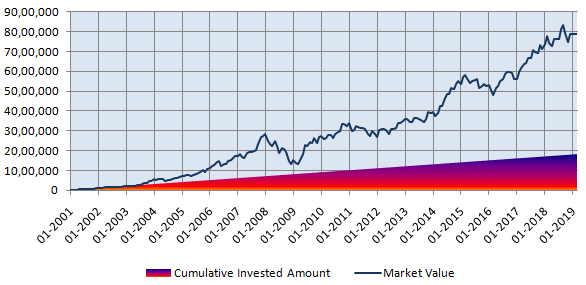

- Let us now examine the wealth creation potential of ELSS mutual funds. We have used Nifty 50 TRI as a proxy for ELSS mutual funds. If you are investing in a good ELSS mutual fund scheme, you should expect that the fund manager can beat the market and give superior returns. For the sake of comparison, let us assume you invested Rs 8,333 in NIFTY 50 TRI on the 1st of every month from April 2001 to March 2019 via monthly systematic investment plan (SIP).You could have claimed Rs 1 Lakh annual deduction (Rs 8,333 x 12 months) for saving taxes under Section 80C.

Source: Advisorkhoj Research

With a cumulative SIP investment of Rs 18 lakhs the tax payer could have accumulated a corpus of nearly Rs 85 lakhs – this is almost double the amount he / she would have accumulated in PPF even though the amount of investment and the period is same. The annualized SIP return of Nifty 50 TRI is over 14%. This example is a testimony of how equities have the potential to create wealth over the long term compared to other traditional 80C investment options.

Tax Benefits of ELSS Mutual Funds

Under Section 80C of Income Tax Act 1961, an ELSS mutual fund is one of the most tax friendly investment options. Unlike fixed income 80C investment options (excepting PPF), there is no taxation in ELSS during the investment period. Since ELSS mutual funds are equity oriented schemes with a minimum investment lock-in period of 3 years, capital gains are treated as long term and thus,Rs 1 lakh in a financial year is tax exempt. Capital gains in excess of Rs 1 lakh in any financial year is taxed at only 10%.

Also, ELSS schemes being equity funds, dividends paid by the scheme is tax free in the hands of the investors, but the AMC pays dividend distribution tax (DDT) at the rate of 10% on the dividends paid out.

Did you know, you can rollover your ELSS investments? Read this – Rollover of ELSS mutual funds can provide magical dual benefits of tax savings and wealth creation

Comparison of liquidity of ELSS funds with other 80C tax saving investment options

ELSS mutual funds offer higher liquidity compared to other investment options in Section 80C. Investments options like NSC, tax saving bank FDs, post office tax saving time deposits and ULIP etc. have a lock in period of 5 years. PPFinvestment tenure is of 15 years with limited liquidity in the interim. Traditional life insurance policies also have long maturity tenures and surrendered within a certain period from the policy start date then surrender charges are deducted from the final payment value. As ELSS mutual funds have a lock-in period of 3 years, it makes them the most flexible Section 80C investment choice from a liquidity perspective.

ELSS mutual funds for financial goals

Tax savers should note that 80C investments should not be made only for the purpose of savings taxes, rather these can be linked to their long term financial goals. Long term goals should be the most important ones for any investors and they should include the ELSS funds for this purpose. The wealth creation potential of ELSS funds demonstrates its suitability for meeting the long term financial goals like building a house, retirement planning, children’s higher education and marriage or simply for wealth creation purposes etc. ELSS schemes being equity fund scan be volatile in the short term but if the investors have a long investment horizon, he or she will be able to overcome the effects of short term market volatility and create substantial wealth for reaching their respective financial goals in the long term.

It is suggested that the investor should link their long term financial goals with ELSS investments and track them over the goal period. Even though lock-in period is 3 years only, the investors should not redeem ELSS investments until they meet the goal with which the investment was tagged.

We suggest that you can read this article on retirement planning through ELSS in detail – How ELSS Mutual Funds can help in tax saving and retirement planning

Read one more, how ELSS can help in wealth creation – ELSS mutual funds are best tax savings investment for wealth creation

Summary

In this article, we discussed the various advantages of Equity Linked Savings Schemes (ELSS mutual funds) compared to other 80C investment options. Equity Linked Savings Schemes offer superior wealth creation potential, liquidity and tax benefits compared to other Section 80C investment schemes and also an ideal investment choice for meeting your long term financial goals. You should discuss with your financial advisor how you can invest in ELSS mutual funds not only to save taxes but to meet your long term financial goals as well.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY