Can you get higher returns by spreading your Mutual Fund SIP across multiple dates

One of my friends, a banker and a long time mutual fund investor, always spreads his mutual fund SIPs over 3 – 4 dates in a month. I, on the other hand, have simply selected one date, at the start of the month for my mutual fund SIPs. Another friend, also an investor, who knows both of us, asked me a few months back, whether our banker friend was getting any significant advantage in terms of returns by spreading his mutual fund SIPs over multiple dates. I told this friend that, for me selecting just one date was simply a matter of convenience and I that I have not given this much thought beyond that. I was very happy with my mutual fund SIP returns but I thought,can I get more by doing what my banker friend was doing? To discuss this further, I arranged for all three of us to get together in a coffee shop and chat on this topic.

Argument in favor of spreading monthly SIP over multiple dates

My knowledgeable banker friend said that, mutual fund SIPs takes advantage of market volatility through Rupee Cost Averaging – you buy units at different price points, to average out the cost of purchase and thereby, enhance your returns. He opined that just like how the market is volatile over a year or several years, it is also volatile during a month or week. My friend argued that, spreading your mutual fund SIP over multiple dates in a month should enable you to take advantage of intra-month or intra-week volatilities. His argument was quite logical. I knew that my friend has been doing this for many years now and since he felt quite convinced about the effectiveness of his strategy, I am assuming he must have got good returns.

Counter argument against spreading monthly SIP over multiple dates

Renowned economist and Nobel Laureate Amartya Sen, in his book the Argumentative Indian, said that debates and discussions were an important part of the intellectual and cultural traditions of Indiasince ancient times. A debate does not get interesting and insightful, unless someone presents an alternative viewpoint. It was difficult to refute my banker friend’s “volatility” logic, but I presented an alternate perspective which was purely based on practical considerations.

Spreading your monthly mutual fund SIPs over multiple dates will require you to have sufficient funds in your bank account on the different dates across the month. Further, many of us have mutual fund SIPs in multiple mutual fund schemes across different Asset Management Companies (AMCs). Different AMCs have different SIP dates. Suppose you want to spread your SIP over 3 or 4 dates and you have invested in schemes across 4 or 5 AMCs. This means that debits may take place from your bank account on many days spread across the month, maybe as many as 10 or more different dates. We may have other expenses like home loan EMIs, credit card payments, phone bills etc, for which we have set up standing ECS instructions with our banks. You have to ensure that you always have sufficient funds in your bank account on the different SIP dates. This means you have to monitor your expenses and bank account regularly if you have SIP auto-debit (ECS) instructions on multiple dates in a month.

Check SIP returns of mutual fund schemes of any category from here

If there is insufficient balance in your bank account on any mutual fund SIP date, the transaction will not go through. If the SIP transaction fails to go through for 3 consecutive months then the AMC will cancel the SIP and you will have to go through the hassle of setting up your mutual fund SIP all over again. Therefore, from a practical standpoint, having just one SIP date, preferably at the beginning of the month, especially for salaried investors, makes investment experience smooth and hassle-free.

Is there any financial advantage to be gained by spreading your mutual fund SIPs over multiple dates?

As discussed earlier, having just one date for your monthly mutual fund SIP is much more convenient and hassle free. However, if there is a significant financial advantage to be gained by spreading your SIP over multiple dates, the extra effort required for managing your expenses throughout the month, may be worth putting in. I could have compared my SIP returns with my banker friend’s returns to see if he was gaining any significant advantage, but we have invested in different schemes with different risk / return characteristics and therefore, it would not be fair to compare.

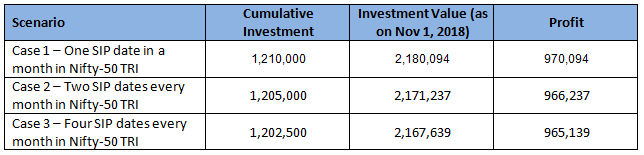

For the benefit of all our readers, we have analyzed returns of mutual fund SIPs with single monthly installment versus spreading SIPs over multiple dates in a month, using one of the most popular market benchmarks in India, the Nifty-50. We have looked at three cases, all involving monthly investment of Rs 10,000 in Nifty-50 TRI (Total Returns Index).

- In the first case, Rs 10,000 is invested monthly in Nifty-50 on the first day of the month through SIP. If the first day is a weekend / holiday, the transaction will take place on the next business day. Please check here – NIFTY 50 TRI Benchmark Monthly SIP

- In the second case, Rs 5000 is invested monthly in Nifty-50 on the first day of the month. Another 5,000 is invested monthly on the 15th. Total monthly investment like in the first case is Rs 10,000. Please check here - NIFTY 50 TRI Benchmark Fortnightly SIP

- In the third case, Rs 2500 is invested monthly in Nifty-50 on the first day of the month. Another Rs 2500 is invested on the 8th day, Rs 2500 on the 15th day and Rs 2500 on the 22nd day. The total monthly investment, like in first and second case is Rs 10,000.

- Let us assume, we began our SIPs on November 1 2008, around 10 years back. Let us see, how much we would have accumulated by November 1, 2018.

Source: Advisorkhoj Benchmark SIP calculator

The table above shows that, for all the effort you put in spreading your SIP across multiple dates in a month, there is no advantage gained. Why go through all the hassles? In our view, it is recommended, especially for salaried people, to select one SIP date at the beginning of the month, just after you receive your monthly salary. You can remain disciplined in your mutual fund SIP investment over long periods of time and be able to create wealth through power of compounding.

Is there an advantage in spreading out mutual fund SIP across the month for midcaps?

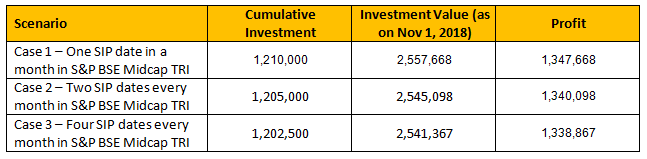

I shared the results of my analysis with my banker friend. He understood the results, but commented that Nifty-50 is a large cap index. Since midcaps stocks are more volatile than large capstocks, there may be an advantage of spreading out SIP for midcap funds. His comment prompted me to extend our analysis to midcap funds also.

The scenarios are exactly the same, i.e. one, two and four installments every month through the SIP. The only difference is that the underlying asset is S&P BSE Midcap Index (TRI), instead of Nifty-50 TRI. Let us see if we get dramatically different results in terms of relative performance.

Source: Advisorkhoj Benchmark SIP calculator

Again like in the previous analysis, there is no advantage to be gained by spreading your mutual fund SIPs across different dates in a month.

You can still check how SIPs of different frequencies worked in S&P BSE MIDCAP TRI

Conclusion

Our theoretical take on this topic is that, Rupee Cost Averaging in mutual fund SIPs work effectively over market cycles or business cycles – bear markets and bull markets. The market will not go from being a bull market to a bear market and back to a bull market within a month. Therefore, spreading mutual fund SIPs over multiple dates in a month may not be effective. Deep corrections or bear markets last several months up to a year or even longer. Monthly mutual fund SIP is extremely effective in taking advantage of bear markets or deep corrections.

You may like to read: how power of compounding work in mutual fund SIPs

The most important success factor in creating long term wealth is that you should remain disciplined for long periods of time. Mutual fund SIPs are wonderful investment options to invest towards your long term financial goals from your regular monthly savings. The convenience which mutual funds SIP offers is that it puts your financial planning on auto-pilot mode. Investors should make investing through mutual fund SIP a part of their habit.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY