All you wanted to know about Index Funds

Passive funds have become popular in India over the past few years. Exchange Traded Funds (ETFs) is now the largest mutual fund category in terms of Assets under Management (AUM). As per AMFI data, AUM of passive funds stood at more than Rs 5 lakh crores, as on 29th April 2022. A large part of the AUM in passive funds comes from institutional investors e.g. EPFO, but retail interest in passive funds has also been growing. In the last one year (ending 29th April 2022) retail and HNI AUM in passive funds grew by more than 50%.

What are passive funds?

Passive funds track different market indices e.g. Nifty 50, Sensex etc. Unlike actively managed mutual fund schemes, passive funds do not aim to beat the index. The total expense ratio (TER) of passive funds is much lower than actively managed funds. Exchange Traded Funds (ETFs) and Index Funds are two types of passive funds. There are also passive fund of funds, which invest in ETFs and index funds. We will discuss about index funds in this blog post.

What are index funds?

Index funds are passive mutual fund schemes which invest in a basket of stocks tracking a particular market benchmark index e.g. Nifty 50, Sensex, Bank Nifty etc. The percentage weight of stocks in an index funds is the same as the percentage of the stocks in the market benchmark index. Index funds are quite similar to ETFs in many respects. However, there are important differences between the two which will discuss later in this blog post.

Benefits of Index Funds

- The TERs of index funds are much lower than actively managed mutual funds. This can be a significant advantage for investors in the long term. For the same level of performance of the underlying portfolio, lower costs means high returns for investors.

- Actively managed funds need to be overweight / underweight on some stocks / sectors to beat the market benchmark index. This gives rise to unsystematic risk i.e. stock or sector specific risk in actively managed funds.

- There is no unsystematic risk in index funds because they invest in the entire basket of stocks in the index they are tracking, in the same proportion as the market index. Index funds are only exposed to market risks.

- Index funds which track market cap weighted indices (most market indices are market cap weighted) give higher weights to strong performers and lower weights to poor performers in their basket of securities because that is how market cap weighted indices work. This results in superior investment returns.

You may like to read: How passive investing makes a lot of sense for long term SIP investor

Why are index funds becoming popular?

As a financial market becomes more efficient, it leads to faster price discovery and it becomes more difficult for fund managers in some market segments, to generate alphas (beat the market) in the long term by investing in under-valued stocks. If the fund manager of an active fund finds it unable to beat the market in certain periods, then lower costs of index funds work to its advantage in the long term.

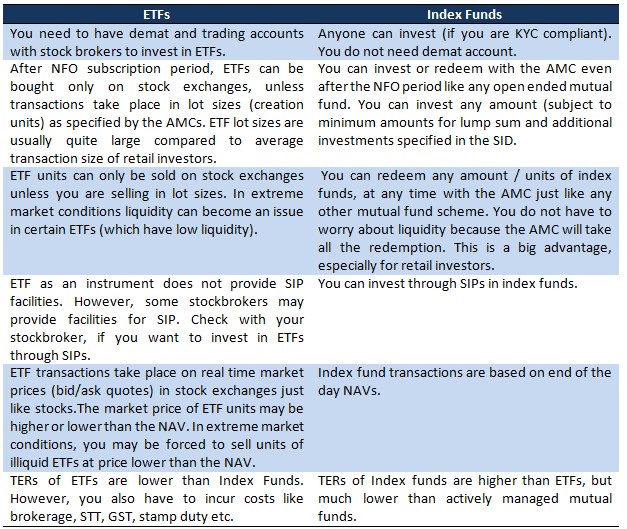

Difference between Index funds and ETFs

Variety of investment needs through index funds

The stock exchanges have designed and developed a large number of indices for different market cap segments (e.g. large cap, midcap, small cap etc), different industry sectors (e.g. banking, IT, FMCG etc) and investment strategies (quality, value, dividend opportunities, ESG etc). Index funds tracking these different indices can provide solutions for different investment needs and risk appetites.

Are sector investments better played through sector index funds?

Actively managed sector funds have been around for many years. We have seen investor interest in these funds from time to time. There is a school of thought, which says that certain sector investments are better played through index funds because both active sector and index funds invest in limited universe of stocks as far as certain industry sectors are concerned; the lower TER of sector index funds can be an advantage in such cases. Our view in Advisorkhoj is that there is no clear cut answer in this regard; some sector funds have delivered high alphas to investors. If an active sector fund has delivered good returns to you, then it is prudent to stick to it. However, if you have an underperforming active sector fund in your portfolio, then you may consider switching to sector index funds.

How to select index funds?

- Benchmark Index: This is the first consideration, when you are investing in index funds. Index funds track various market indices. Sensex and Nifty, the two most popular indices are large cap indices. Nifty 500 is a broad market index, while Bank Nifty, Nifty IT, Nifty FMCG etc are sector indices. Different indices will have different risk profiles. You should select an index according to your risk appetite. You should consult with your financial advisor if you need help.

- Tracking errors: Tracking error is the deviation of the fund’s returns from the benchmark index return. There are a number of factors that can give rise to tracking errors, of which TER is the largest source of error. Higher the TER, higher will be the tracking error. The percentage of fund assets held in cash or cash equivalents can also give rise to tracking errors. Finally, delay in executing buying or selling of securities can also give rise to tracking errors. You should select passive schemes with low tracking errors. AMCs disclose the tracking errors of their index funds in the monthly fund factsheet.

- Total Expense Ratio: Total expense ratio (TER) of a mutual fund scheme is the cost of managing and operating the scheme on a per unit basis. It is calculated by dividing the total expenses of the fund with the assets under management (AUM). TER is very important in index funds investments because it directly impacts the returns of the scheme. For the same benchmark index, an index fund with lower TER is likely to deliver higher returns compared to a scheme with higher TER. You should always select index funds with low TERs. You can find TERs of index funds on the AMC websites and the monthly fund factsheets.

Conclusion

We have noticed that there is a lot of interest in passive funds among retail investors in recent years, especially since the outbreak of COVID-19 pandemic. One of the most frequently asked questions with regards to passive funds is whether you should invest in ETFs or index funds.

In this blog post, we have tried to explain the main differences between the two. If you have a Demat / trading account and are experienced in buying / selling stocks in the exchange, you can invest in ETFs to take advantage of lower TERs. You may also like to read: How to select ETFs using Nippon India MF VICTER framework

However, if you do not have a Demat account and are not comfortable with buying / selling in the market, then index funds are ideal for you. Though index fund TERs are little higher than ETF TERs, they are much lower than actively managed mutual funds. With index funds, you get all the other advantages of ETFs i.e. no unsystematic risks, no human biases, applying analytical investment strategies etc. When you are investing in index funds, you should select funds with low tracking errors and TERs. Most importantly, you should select funds according to your risk appetite.

Consult with your financial advisor about which index funds can be suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY