Sundaram ELSS Tax Saver Fund Regular Growth

Fund House: Sundaram Mutual Fund| Category: Equity: ELSS |

| Launch Date: 01-01-2013 |

| Asset Class: |

| Benchmark: NIFTY 500 TRI |

| TER: 2.25% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 500.0 |

| Minimum Topup: 500.0 |

| Total Assets: 1,212.38 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: 28% | Exit Load: NIL. Units under Sundaram Tax Savings Fund - A long term Tax saver Fund, issued under ELSS guidelines 2005, are eligible for tax deduction u/s 80C of the Income Tax Act, 1961 and can be repurchased/pledged/transferred after 3 years from the date of unit allotment. Investors are eligible for free accidental death insurance* vide policy number AG00062048000102 (TSF) / AG0002055000102 (PTSF) with Royal Sundaram General Insurance Co. Limited, for investments made upto March 31, 2014. "Personal Accidental Death Insurance" feature has been discontinued for any fresh subscriptions received / new units created in the scheme on or after April 1, 2014. Insurance claim papers need to be submitted within 30 days from the date of demise of the first unit holder at any branch of insu |

447.7591

-0.29 (-0.0639%)

14.02%

Benchmark: 12.16%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY 500 TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

-13 Years 0 Months

-7 Years -10 Months

-7 Years -3 Months

-5 Years -3 Months

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The fund seeks to build a high quality growth oriented portfolio to provide long term capital appreciation through investment primarily in equities.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 12.83 |

| Sharpe Ratio | 0.44 |

| Alpha | -0.29 |

| Beta | 0.87 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Sundaram ELSS Tax Saver Fund Regular Growth | 01-01-2013 | 2.14 | 16.71 | 12.82 | 21.41 | 12.0 |

| LIC MF ELSS Tax Saver-Regular Plan-Growth | 31-03-1997 | 11.25 | 19.42 | 13.88 | 16.93 | 10.02 |

| WhiteOak Capital ELSS Tax Saver Fund Regular Plan Growth | 14-10-2022 | 10.9 | 25.17 | - | - | - |

| DSP ELSS Tax Saver Fund - Regular Plan - Growth | 05-01-2007 | 9.39 | 23.52 | 17.45 | 24.13 | 14.31 |

| HSBC ELSS Tax saver Fund - Regular Growth | 01-01-2013 | 8.86 | 22.39 | 15.37 | 20.67 | 11.72 |

| Parag Parikh ELSS Tax Saver Fund- Regular Growth | 07-07-2019 | 7.65 | 19.81 | 16.84 | 24.95 | - |

| Motilal Oswal ELSS Tax Saver Fund - Regular Plan - Growth Option | 05-01-2015 | 7.26 | 25.65 | 20.15 | 21.45 | 14.54 |

| JM ELSS Tax Saver Fund (Regular) - Growth option | 31-03-2008 | 7.1 | 22.38 | 16.67 | 21.71 | 13.43 |

| HDFC ELSS Tax saver - Growth Plan | 05-03-1996 | 6.42 | 24.23 | 20.96 | 26.07 | 11.65 |

| HSBC Tax Saver Equity Fund - Growth | 05-01-2007 | 6.08 | 22.09 | 14.68 | 20.06 | 11.09 |

Scheme Characteristics

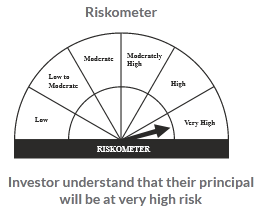

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

11.76%

Others

4.59%

Large Cap

69.87%

Mid Cap

13.79%