Mirae Asset Corporate Bond Fund Regular Growth

Fund House: Mirae Asset Mutual Fund| Category: Debt: Corporate Bond |

| Launch Date: 01-03-2021 |

| Asset Class: Fixed Income |

| Benchmark: CRISIL Corporate Debt A-II Index |

| TER: 0.63% As on (30-12-2024) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 41.76 Cr As on 31-12-2024(Source:AMFI) |

| Turn over: - | Exit Load: Nil |

12.2131

0 (0.0074%)

5.34%

Benchmark: 7.31%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY COMPOSITE G-SEC INDEX

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

There is no value for 2x

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme seeks to provide income and capital appreciation by investing predominantly in AA+ and above rated corporate bonds.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 1.21 |

| Sharpe Ratio | -0.54 |

| Alpha | -0.63 |

| Beta | 0.57 |

| Yield to Maturity | 7.39 |

| Average Maturity | 7.12 |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Mirae Asset Corporate Bond Fund Regular Growth | 01-03-2021 | 7.69 | 6.96 | 5.64 | - | - |

| HDFC Corporate Bond Fund - Growth Option | 01-06-2010 | 8.32 | 7.76 | 6.36 | 6.9 | 7.65 |

| Aditya Birla Sun Life Corporate Bond Fund - Growth - Regular Plan | 03-03-1997 | 8.24 | 7.74 | 6.61 | 7.07 | 7.74 |

| BARODA BNP PARIBAS CORPORATE BOND FUND - Regular Plan - GROWTH OPTION | 01-01-2013 | 8.23 | 7.54 | 5.72 | 5.7 | 5.9 |

| Nippon India Corporate Bond Fund - Growth Plan - Growth Option | 14-09-2000 | 8.12 | 7.6 | 6.59 | 6.74 | 7.28 |

| Kotak Corporate Bond Fund- Regular Plan-Growth Option | 21-09-2007 | 8.0 | 7.46 | 6.24 | 6.36 | - |

| Tata Corporate Bond Fund-Regular Plan-Growth | 29-11-2021 | 7.93 | 7.35 | 5.77 | - | - |

| HSBC Corporate Bond Fund - Regular Growth | 01-01-2013 | 7.91 | 7.14 | 5.69 | 6.56 | 6.86 |

| ICICI Prudential Corporate Bond Fund - Growth | 12-06-2009 | 7.82 | 7.71 | 6.77 | 6.88 | 7.54 |

| Axis Corporate Debt Fund - Regular Plan Growth | 01-07-2017 | 7.8 | 7.27 | 6.13 | 6.67 | - |

Scheme Characteristics

Minimum investment in corporate bonds - 80% of total assets (only in highest rated instruments).

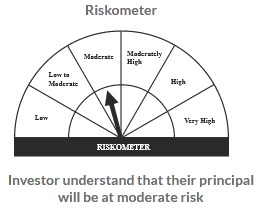

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.0%

Scheme Documents

There are no scheme documents available