Mahindra Manulife Balanced Advantage Fund - Regular Plan - Growth

Fund House: Mahindra Manulife Mutual Fund| Category: Hybrid: Dynamic Asset Allocation |

| Launch Date: 30-12-2021 |

| Asset Class: |

| Benchmark: NIFTY 50 Hybrid Composite debt 50:50 Index |

| TER: 2.26% As on (28-02-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 1000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 843.27 Cr As on 28-02-2025(Source:AMFI) |

| Turn over: 284% | Exit Load: Exit load for units in excess of 10% of the investment 1% will be charged for redemption within 3 months. |

13.5773

-0 (-0.0081%)

9.87%

Benchmark: 11.41%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

AK Hybrid Balanced TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

There is no value for 2x

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The scheme seeks to provide capital appreciation and generate income through a dynamic mix of equity, debt and money market instruments. The Scheme seeks to reduce the volatility by diversifying the assets across equity, debt and money market instruments.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 8.66 |

| Sharpe Ratio | 0.45 |

| Alpha | 1.25 |

| Beta | 0.99 |

| Yield to Maturity | 7.12 |

| Average Maturity | 5.55 |

PEER COMPARISON

Scheme Characteristics

Investment in equity/ debt that is managed dynamically.

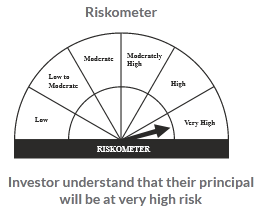

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

10.38%

Others

34.94%

Large Cap

40.97%

Mid Cap

13.71%

Scheme Documents

There are no scheme documents available