Importance of Equity in Asset Allocation

What is Asset Allocation?

Asset allocation is simply your investment strategy where you balance the risk and return by investing in the appropriate mix of assets (like fixed income, equity, gold, real estate etc.) according to your investment objectives, investment horizon and risk tolerance.

Why is it important?

- Risk and reward are interrelated. Lower the risk, lower is the return and vice versa. It is not possible to get high returns without taking risks. At the same time, your investment risk should be aligned with your investment goals. If you have a short term investment goal, then you cannot take risk with the money you have been saving for that goal. On the other hand, if you want to create wealth then you have to take some risks.

- Asset allocation protects you from the vagaries of the market. All asset markets, equity, bond, commodities, real estate etc have their ups and downs. If you are invested too much in an asset class, you may be unfavourably impacted by the movement in prices of that particular asset class.

- Situations in life can be unpredictable and therefore, liquidity is extremely important in asset allocation. Liquidity is the ability to convert your asset into cash, whenever you need to. While it is perfect to have some illiquid assets, having a major portion of your assets in illiquid assets can be risky, in case you have to meet an exigency.

- There are no fixed asset allocation percentages applying to different asset classes (fixed income, equity, gold, real estate etc.). Your asset allocation will depend on your own financial goals, investment horizon and risk tolerance and sub-optimal asset allocation, may adversely impact both your short term and long term financial goals.

Equity is a vastly under-invested asset class in India

Each of the different asset classes, have their own risk return characteristics and play important roles in asset allocations. Unfortunately, in India, despite the increasing popularity of equity mutual funds, equity as an asset class still forms a very small portion of our average household savings. As per Bloomberg, only around 2% of India’s household savings are exposed to equities compared to 45% in the US. This is in direct contrast to the demographic profiles of the two countries. 65% of India’s population is below the age of 35, whereas around 47% of the US population is below the age of 35. Usually, equity is the preferred asset class for young investors. Investors across most age groups need to have exposure to equities, to meet their longer term financial goals. Studies have proven that asset allocation has the biggest impact on our overall investment returns. In this blog post, we will discuss the five key reasons, why equity investment is important in your asset allocation.

Why is Equity important in Asset Allocation?

Equity as an asset class can beat inflation in the long term:

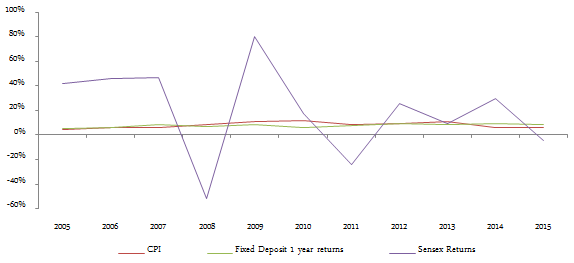

Inflation is inevitable, more so, in a country like India. The most basic commodity we consume is food. Over the last 5 years, food price inflation has been around 8.5%. For the sake of simplicity, if we assume that our entire consumption basket is just made up of food, then we will lose money in real terms (on an inflation adjusted basis) if the return on investment is lower than food inflation.. The chart below shows the Consumer Price Index (CPI) inflation rate, fixed deposit interest rates (based on historical State Bank of India 1 to 2 year term deposit rates) and Sensex annualized returns over the last 10 years.

![The Consumer Price Index inflation rate, fixed deposit interest rates and Sensex annualized returns over the last 10 years The Consumer Price Index inflation rate, fixed deposit interest rates and Sensex annualized returns over the last 10 years]()

Source: BSE, Inflation.eu and SBI

You can see in the chart above that, the 1 year term fixed deposit interest rate struggled to keep up with CPI inflation, even on a pre-tax basis. On a post tax basis, the fixed deposit interest rate would have been definitely lower than the CPI inflation rate in most years, especially for investors in the highest tax bracket. On the other hand, the Sensex was able to beat the CPI inflation rates by a wide margin in most years.

Equity provides the highest return among all other asset classes in the long term:

Over a long term investment horizon, equity investments in India have given the highest returns compared to all other asset classes. From the year 2007 to 2015, diversified equity mutual funds gave on an average 12% annualized returns (as per Morningstar, 15.04.2016). Some of the top performing diversified equity funds have given over 15% returns. As far as fixed income returns are concerned, the average 10 year Government bond yield from 2007 to 2015 was around 8.3%. Retail investors who prefer fixed deposits would have got an average 8 to 8.5% interest rates over this period. This is much lower than the returns which you could have got, on an average, from equity mutual funds.

We, Indians, have a preference for physical assets like property (real estate) and gold. About three years back, physical assets comprised nearly two thirds of our total assets, which have declined somewhat since then, but still they comprise a much bigger proportion of our total assets. Let us now see how physical assets have done from 2007 to 2015. Over this period, residential real estate prices in Mumbai rose 11% on an annualized basis, while those in Delhi rose by 8% on an annualized basis, as per National Housing Board data. Equity has outperformed real estate across the majority of real estate markets in India. Let us now see the Gold price appreciation from 2007 to 2015. Gold price in Rupee terms have risen 10% on an annualized basis from 2007 to 2015. We can see that, equity has outperformed both real estate and gold over the 2007 to 2015 time period.

Different asset classes outperform / underperform others in different market conditions:

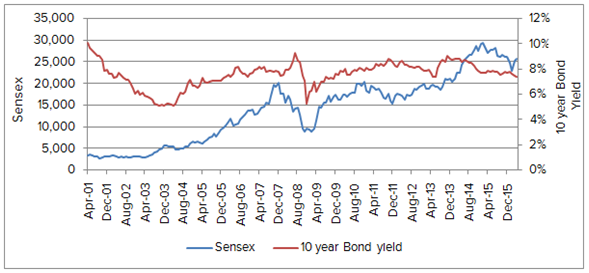

The asset markets are dynamic. Even if you are a purely fixed income investor, your investment returns will change with market conditions. If you invest in traditional fixed income products like, bank fixed deposits, government small savings schemes etc, your income will be higher, when interest rates are high and it will be lower, when interest rates are low. On the other hand, interest rates and stock market returns, have a negative correlation (please see the chart below).

![Interest rates and stock market returns, have a negative correlation Interest rates and stock market returns, have a negative correlation]()

Source: BSE and Investing.in

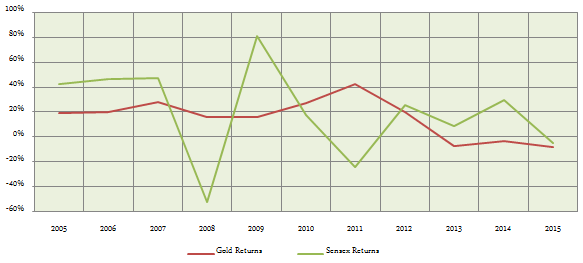

Therefore, when interest rates are lower, equities tends to perform better. Therefore, if you have both debt and equity mutual funds in your portfolio you can get good returns in different interest rate scenarios and therefore de-risk your overall portfolio to an extent from market movements. How about Gold? The chart below shows the returns of Gold (in India) versus the Sensex from 2005 to 2015.

![The returns of Gold (in India) versus the Sensex from 2005 to 2015 The returns of Gold (in India) versus the Sensex from 2005 to 2015]()

Source: Goldpriceindia.com, BSE

You can see from the chart above that Sensex has risen when gold prices have fallen and gold prices have risen when the Sensex has fallen. Having multiple asset classes provides stability to your portfolio in different market conditions.

Most equity investments provide higher liquidity than many other assets:

We had discussed earlier that, liquidity should be an important investment consideration in your asset allocation. Liquidity is not just the ability to convert your assets into cash, but also imply that you make minimal losses when you make such conversion. Cash obviously is the most liquid asset class, but provides low returns. On the other hand, assets like real estate can be very illiquid. It can take you from three months to even three years or even more to sell a property. In case of delayed possession of your property, the liquidity is severely hampered. There are many long maturity fixed income investments, which have very limited liquidity before maturity. Tax free bonds, Capital Gains bonds, small savings schemes like PPF, NSC etc are very illiquid before their maturities. Equity shares in publicly traded companies, for retail investors, are very liquid across most categories of shares, except some very small cap or micro cap companies. Open ended equity mutual funds can be redeemed at any time, though you may have to pay exit load, if redeemed during the exit load period.

Equity is the most tax efficient asset class in India:

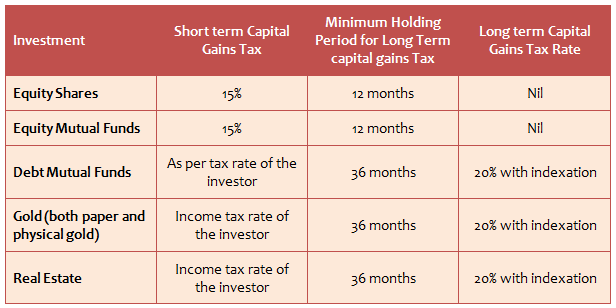

Equity is undoubtedly the most tax efficient among all asset classes. Short term capital gains (investment period of less than 12 months) in equity investments are taxed at 15%, while long term capitals (investment period of more than 12 months) are entirely tax free. Dividends up to a limit of

र10 lacs received by equity investors are tax free in the hands of the investors and that in excess ofर10 lacs will be taxed at 10% in the hands of the investor. Dividends paid by equity mutual funds are entirely tax free in the hands of the investor. Interest income from most fixed income investments, on the other hand, are taxed as per the income tax rate of the investor. The table below shows the short term and long term capital gains tax of different asset types.

![The short term and long term capital gains tax of different asset types The short term and long term capital gains tax of different asset types]()

Conclusion

Studies have proven that asset allocation is the most important contributing factor in a portfolio’s total return. In this post we have discussed the importance of equity in asset allocation. You can get some high level asset allocation guidance by going to our Asset Allocation Calculator. However, to get a more refined and informed guidance, you should consult with a financial planner and take investment decisions accordingly.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY