How is Mutual Fund Systematic Withdrawal Plan better than Dividend Option: Part 2

In the first part, How is Systematic Withdrawal Plan better than Dividend Option: Part 1, we discussed how dividend options in mutual funds work. We also discussed several incorrect perceptions about mutual fund dividends. Incorrect perceptions often lead investors to make wrong decisions and harm their long term financial goals. You should not invest in dividend or dividend re-investment option thinking it is less risky than growth option. If your long term goal is wealth accumulation then you should invest in growth option. Some investors need income from their investments. Dividend option is suitable for such investors. However, there is another smart option, of getting regular income from your mutual fund investments. This smart option is Systematic Withdrawal Plan (SWP) of mutual funds.

We are seeing a lot of interest in Systematic Withdrawal Plans among investors visiting Advisorkhoj.com website. Our Mutual Fund SWP Calculator is one of the most popular online SWP tool in India. Several lakh visitors on our website have used this tool. The interest in SWP among investors and financial advisors is very encouraging because it shows the growing maturity of the investor population and the willingness to try new solutions. However, based on the queries received by us from investors, we felt the need of educating investors more about mutual fund SWP to get the best out of this smart investment option.

What is SWP?

Systematic Withdrawal Plan is a mutual fund option, whereby you can withdraw fixed amounts from your investment at a regular frequency to meet your income needs. By filling out a one-time SWP mandate, the fund will credit fixed sums of money every month (or any other frequency specified by you) to your bank account. You can cancel or stop your SWP at any time by notifying the AMC (Asset Management Company) or the concerned RTA (Registrar and Transfer Agent).

How does it work?

In an SWP the AMC will generate cash-flows for you by redeeming units of your mutual fund schemes. The number of units redeemed will depend on your SWP amount and the prevailing Net Asset Value (NAV) of the scheme on the SWP date. Let us understand with the help of an example. Let us assume you invested Rs 1 lakh in a mutual fund scheme at a NAV of Rs 100. The AMC will allot 1,000 units to you.

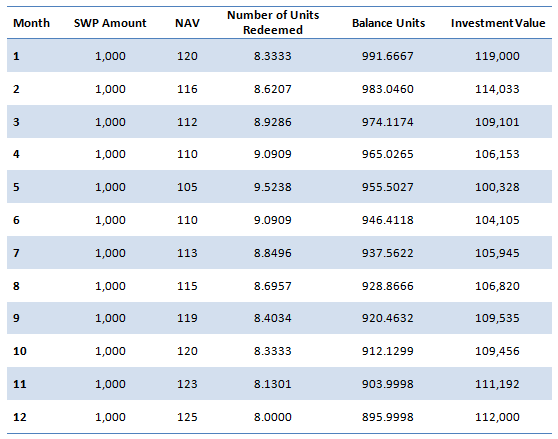

Let us now assume that you want to start a monthly SWP of Rs 1,000. Assume that the NAV of the scheme on the first SWP date is Rs 120. The AMC will redeem 8.333 units (Rs 1,000 divided by NAV of Rs 120) and credit Rs 1,000 to your bank account. You will still be left with 991.667 units and the value of investment will be Rs 119,000 (Rs 120 X 991.667). Assume the NAV on next month’s SWP date is Rs 116. The AMC will redeem 8.621 units (Rs 1000 divided by NAV of Rs 116) and credit Rs 1,000. You will still be left with 991.667 units and the value of investment will be Rs 119,000 (Rs 120 X 991.667). The table below shows how the SWP will work for the first 12 months (please note that the NAVs are purely illustrative).

You can see that, at the end of 12 months you are left with lesser number of units, yet your investment has grown in value. The SWP will continue till the time all the units have been redeemed or you stop the SWP.

See SWP returns with a live example

Difference between SWP and dividend option

The biggest difference between SWP and dividend option from the point of view of the investor is that, SWP amounts are fixed and determined by the investor, whereas dividends declared by a scheme are completely at the discretion of the AMC. In the How is Systematic Withdrawal Plan better than Dividend Option: Part 1 we had discussed that mutual fund dividends are not assured either in amount or frequency. For example if the monthly dividend option of a mutual fund scheme paid dividend at the rate Rs 5 per unit last month, there is no assurance that it will pay at the same rate next month.

There is even no assurance that, the scheme will pay a dividend at all next month, no matter how consistent the dividend pay-out track record is because there may be factors, beyond the control of the AMC, which may prevent the scheme from paying dividends. If there is a big market crash and large scale redemptions, which wipes out the accumulated profits of a mutual fund scheme, the scheme will now not be able to pay dividends. SWP on the other hand will provide you fixed cash-flows irrespective of market conditions or scheme performance.

Tax Advantage of SWP versus dividend options in debt mutual funds

Though dividends paid by debt mutual funds are tax free in the hands of the investors, the AMC has to pay dividend distribution tax (DDT) at the rate of 28.8% before paying out dividends to investors; naturally, the dividend paid out to investors is lower to that extent. SWP pay-outs take place through redemption of units. In the event of redemptions capital gains tax applies. If redemptions take place within 3 years of investment in debt funds, the profits (capital gains) are taxed as per the income tax slab of the investors. For investors in the highest tax bracket, capital gains tax rate in the first 3 years of the SWP is higher than the DDT, but for investors in the lower tax brackets, the capital gains tax rate even in the first three years is lower than the DDT.

Long term (investment held for more than 3 years) capital gains in debt funds are taxed at 20% after allowing for indexation benefits. Indexation benefits reduces effective capital gains tax rate significantly – much lower than DDT. Let us understand this with the help of an example. Let us assume you invested Rs 500,000 in a debt fund. The scheme NAV at the time of investment was Rs 100. Let us assume your SWP amount per month in Rs 3,000. After 3 years the scheme NAV is Rs 130. The AMC will redeem 23 units to pay you Rs 3,000. Profit made on these 23 units will attract long term capital gains tax. Let us suppose Cost Inflation Index (CII) at the time of purchase was 250 and after three years it is 290. Purchase price of the 23 units was Rs 2,300 (at NAV of Rs 100). You will be allowed to index the purchase by the ratio of the CII at the time of redemption to the time of purchase (290:250). So the indexed price of the 23 units redeemed will be Rs 2663. The capital gains after indexation will be Rs 338 (Rs 3000 – 2663). You will be required to pay a capital gains tax of only Rs 67. However, if the scheme wanted to pay a dividend of Rs 3,000 before DDT, it would have pay DDT of Rs 865.

You can see that SWP is much more tax friendly after three years from investment in debt funds compared to dividends. In fact, it is always advisable to start your SWP in debt funds, three years after you have made the investment, especially if you are in the higher tax brackets.

Difference between SWP and dividend option in Equity and Balanced mutual funds

The dividends paid by equity and balanced mutual funds are tax free and there is no Dividend Distribution Tax (DDT) applicable. Therefore, while dividend is always tax free for the investor, in case of profits made on SWP withdrawal in the first year, it is treated as short term capital gains and tax @15% is payable by the investor. Therefore, it is always advisable to start your SWP from balanced and equity funds after one year from the date of investment.

SWP rate is important for financial planning

We have seen that SWP has several advantages over dividends. It is more tax friendly in debt funds and most importantly it gives fixed cash-flows to investors. SWP can be especially useful for senior citizens, who rely only on investment income to meet their expenses. However, there is a flip side as well. SWP is very attractive because it gives power to investors to generate cash-flows as per their needs; however, this power can be a double edged sword. If you draw too much through SWP every month (or any other frequency) then your long term financial interests can be seriously jeopardized.

Remember, SWP generates cash-flows for you through redemptions of units. SWP is sustainable as long as the return on investment is more than your withdrawal rate. If your investment (scheme) is giving 10% returns, whereas your withdrawal (SWP) rate is 15%, you will eventually extinguish your investment. Therefore, you should try to ensure that your SWP rate (the total money that you will draw every year divided by your investment amount) is lower than the expected rate of return.

The problem with high SWP withdrawals gets exacerbated in bear markets especially if the bear market arrives early in the SWP tenure. Refer to the table illustrating SWP earlier in this post. You will see that, more units are redeemed for SWP as the NAVs keep falling. In severe bear markets, prices can fall very sharply (10% or even more in certain months). In such situations, the AMC may have to redeem large number of units, especially if your withdrawal rates are very high. When the bear market finally ends, you may be left with a small unit balance and consequently investment value; as you continue to draw every month, the base cannot grow fast enough even though the market is rising. You may even run out of money much before you anticipated and face a financial crisis. Therefore, it is very important that you withdraw at a rate which meets your requirements but at the same time ensure that is sustainable.

Conclusion

In this two part blog post, we discussed about dividend options and Systematic Withdrawal Plans of mutual funds. SWP can be the more convenient and tax friendly (in the case of debt funds) option for smart investors. However, you should plan carefully and make sure that your mutual fund SWP is sustainable despite market volatility. If you do not have sufficient experience or knowledge about mutual funds, you should consult with a financial advisor.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY