ETFs and Index Funds: Where should you invest?

What are passive funds?

Passive funds invest in a basket of securities replicating a market benchmark index. The weights of securities in the fund mirror the weights of the constituents in the index. Unlike actively managed mutual funds, passive funds do not aim to beat the market. There are two types of passive funds – exchange-traded funds (ETFs) and index funds. In this article, we will discuss ETFs and index funds; compare and contrast ETFs versus Index Funds.

You may like to read: What you need to know before you start investing in ETFs

Passive funds – Global trend and India

Passive funds are mutual fund schemes that track a benchmark market index. Unlike actively managed funds, passive funds do not aim to beat the benchmark index. Passive investments have gained increasing popularity globally, over the last two decades, especially in developed markets. In the US, passive equity assets (AUM) overtook active equity assets last year (source: Financial Times, June 2022). As per a Bloomberg report (February 2023), global passive equity AUM is expected to overtake active equity AUM sometime in 2023, according to the forecast of Societe Generale.

Passive investing has taken off in a big way since the outbreak of the COVID-19 pandemic. As per AMFI data, in the last four years ending June 30th, 2023, passive AUM grew by nearly four times at a CAGR of nearly 40% (source: AMFI June 2023 data). As on 30th June 2023, passive AUM stood at over Rs 7 lakh crores. While institutional investors, e.g. EPFO, contribute a significant portion of the passive AUM in India, retail investors’ interest in passive funds is also increasing. Among passive funds, Exchange Traded Funds or ETFs have the lion’s share of AUM.

What are Exchange Traded Funds?

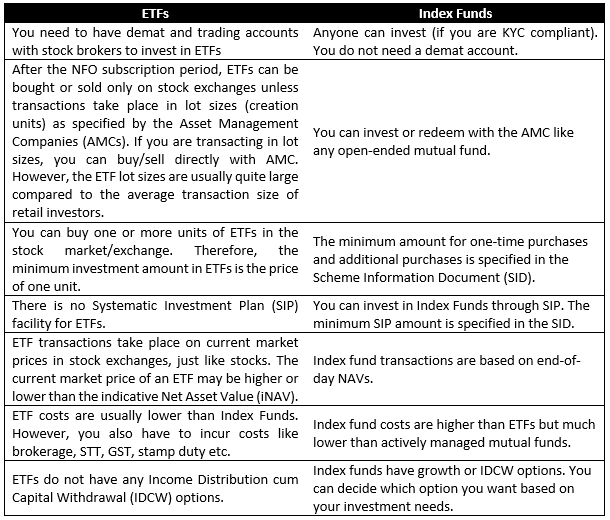

Exchange-traded funds (ETFs) are passive schemes tracking market benchmark indices like Nifty, Sensex etc. ETFs do not aim to beat the market benchmark index they are tracking; they aim to give market returns. ETFs are listed on stock exchanges and trade like shares of companies. You need to have demat and trading accounts to invest in ETFs. We suggest that you read what are the benefits of investing in ETFs.

What are index funds?

Index funds are also passive mutual fund schemes that track market benchmark indices like Nifty 50, Sensex etc. Index funds are very similar to ETFs, with one major difference. Index funds are like any other open-ended mutual fund scheme. You do not need Demat and trading accounts to invest in index funds.

ETFs versus Index Funds

Where should you invest – ETFs versus Index Funds?

- Demat account: You must have Demat and trading accounts to invest in ETFs. If you do not have Demat and trading accounts, then you can invest in index funds. However, this should not be the only consideration. Let us discuss the other factors.

- Cost: The cost of ETFs, including the transaction costs like brokerage, STT, GST, stamp duty etc, are lower than Index Funds. Purely from a cost viewpoint, ETFs have an advantage over Index Funds.

- Tracking error: Tracking error is the deviation of the returns of ETFs and Index Funds from the benchmark index returns. The standard deviation of the differences in monthly returns of the ETFs and index funds and the market benchmark index is defined as a tracking error. There are various sources of tracking error, e.g. fees and expenses of the scheme, cash balance held by the scheme due to dividends received, halt in trading on the stock exchange due to circuit filter rules, etc. Tracking errors of ETFs are usually lower than that of index funds because of lower TERs and cash holdings.

- Liquidity: This is a very important consideration because you can sell ETF units only in the stock exchange (unless you are redeeming in lot sizes which are usually quite large). Some ETFs are quite liquid, while others may not be liquid. You have to look at the average daily trading volumes of your ETF to get a sense of its liquidity. Liquidity also depends on market conditions. This may require some investment experience. Liquidity is not an issue with index funds because you can redeem with the AMC.

- Experience: If you have investment experience in the stock market buying and selling stocks, then investing in ETFs will be easier for you because ETFs are very similar to stocks. You should know about different types of orders (e.g. market orders, limit orders etc.), understand bid/offer prices, understand trading data (price, volume data) etc. Index funds, on the other hand, are mutual funds. As such, they have all the advantages that are associated with mutual funds, e.g. convenience, flexibility, investing through SIP / STP etc.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY