Should you invest in Kotak Nifty India Tourism Index Fund?

Kotak MF has launched a New Fund Offer (NFO), Kotak Nifty India Tourism Index Fund. This is a passive fund, which will track the Nifty India Tourism Index. India is a land of great geographical diversity (mountains, oceans, deserts, jungles etc), historical heritage, cultural diversity and religious centres.

Tourism and Hospitality is one of India's largest service industries and can an important role in economic growth of the country. The Government recognizes the enormous potential of tourism in India and has firmly placed tourism as a key sector in Union Budget 2024, with allocations of Rs 2,400 crores towards this sector. Nifty India Tourism Index can provide attractive thematic investment opportunities for investors.

Prior to the launch of Kotak Nifty India Tourism Index Fund, there was only one tourism thematic fund, which was also launched recently. The Kotak Nifty India Tourism Index Fund NFO has opened for subscription on 2nd September 2024 and will close on 16th September 2024. In this article, we will review the NFO.

Tourism is booming in India

With rising per capita income and a growing middle class, the tourism industry is thriving in India. Here are some key highlights:-

- India is the 3rd largest Aviation in the world. We have 153 operational airports in the country and annual passenger traffic of 181 million which is expected to nearly triple by 2030. There is strong demand both from domestic and international travellers

- The hotel market in terms of number of rooms has grown at a CAGR of 8.9% from FY 2012-22. Number of hotel rooms grew by 2X+ from 78 lakhs in 2012 to 1.7 crores in CY 2022. Average daily rate and occupancy are at decade highs.

- India provides low cost (relative to developed economies) and high quality medical treatment for foreigners. 7.3 million tourists are expected visited India for medical treatments in 2024

- India is currently ranked number 9th in the world in terms of business travel spending

- With changing consumer preferences and lifestyles, restaurant business is growing. India’s overall food industry is expected to grown from Rs 4-5 Trillion in 2023 to Rs 9-10 Trillion in 2030

- We are seeing new travel trends like Staycations and Workcations since the COVID-19 related lockdowns. Staycations have surged by 30%, while Workcations have surged by 25% since lockdowns.

- The Government has increased budgetary allocation for Tourism sector by nearly 45% from Rs 1,692 crores in FY 2022-23 to Rs 2,400 crores in FY 2023-24.

Source: Kotak MF

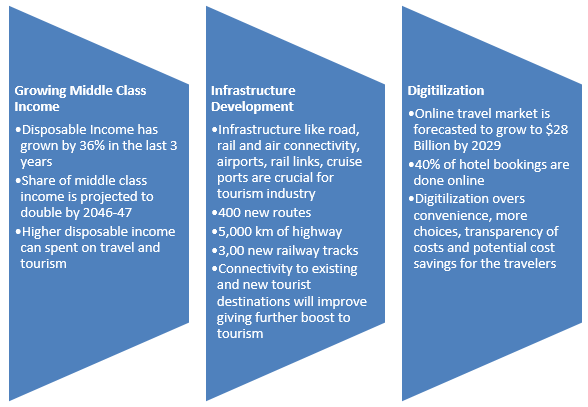

Drivers of tourism growth in India

Source: Kotak MF

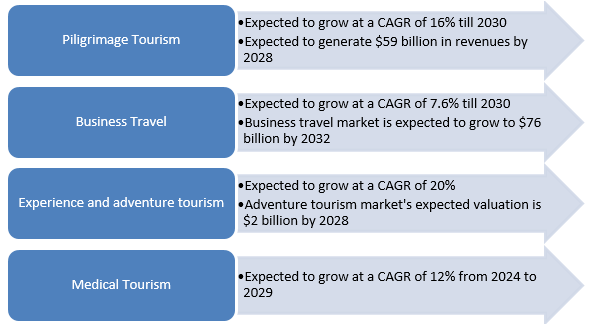

Glimpses of the growth potential of toursim market

About Nifty India Tourism Index

Nifty India Tourism Index aims to track the performance of stocks from the Nifty 500 Index which represents the travel and tourism theme. The weight of each stock in the index is based on free float market capitalization. Stock weights are capped at 20%. The index is reconstituted semi-annually and rebalanced quarterly.

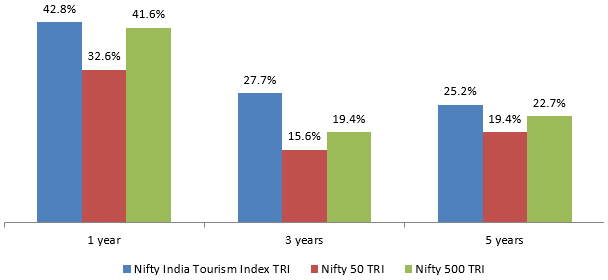

How has Nifty India Tourism Index performed versus broad market indices?

Source: NSE, Advisorkhoj Research, as on 30th August 2024

Why invest in Kotak Nifty India Tourism Index Fund?

- Travel Surge: Tourism is the new wave of consumer spending.

- Infrastructure Boom: Highways, airports, and routes are making travel easier.

- Broad Exposure: Invest in airlines, hotels, restaurants and more.

- Diverse Destinations: From pilgrimages to business hubs and adventure trails, India offers it all

- Low Cost Fund: The TERs of index funds are much lower than TERs of actively managed equity mutual fund schemes

- Convenience of mutual funds: You do not need demat account to invest in Kotak Nifty India Tourism Index Fund. You can invest in this fund through SIP. You redeem your units with the AMC instead of selling it the stock exchange.

Who should invest in Kotak Nifty India Tourism Index Fund?

- Investors looking for capital appreciation over long investment tenures through passive investing

- Investors who want to invest in the tourism theme

- Investors with very high risk appetites

- You should have minimum investment tenure of 3 to 5 years

- Investors should consult with their financial advisors or mutual fund distributors if Kotak Nifty India Tourism Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY