Kotak Transportation and Logistics Fund: Mega opportunity in this theme

Kotak MF has launched an NFO, Kotak Transportation & Logistics Fund. Kotak Transportation &Logistics Fund is a thematic fund, which will invest in the transportation and logistics theme. The transportation and logistics theme covers automobiles and auto ancillaries, roads, railways, shipping, ports, aviation, airports, services etc. Transportation and logistics as an investment theme has outperformed the broader markets in the long term. The NFO will open for subscription on 25th November 2024 and will close on 9th December 2024. In this article, we will review this NFO.

Changing landscape and growth potential of the transportation space in India

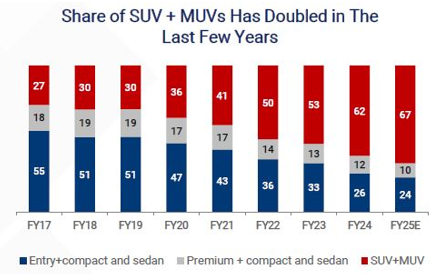

- Increasing premiumisation in the automobile market: The share of sports utility and multi utility vehicles in car sales have doubled in the last few years.

Source: Elara Securities, Data as on Mar’23, latest available data.

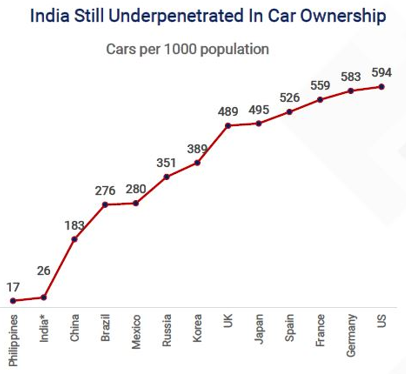

- Relatively low car ownership penetration: Car ownership (per 1,000 people) is relatively low compared to emerging and developed markets.

Source: Data for CY 2021, India Data for Fiscal 2024. Source: Hyundai DRHP, International Road Federation-World Road Statistics 2023, CRISIL MI&A, Data as on Jun’24, latest available data.

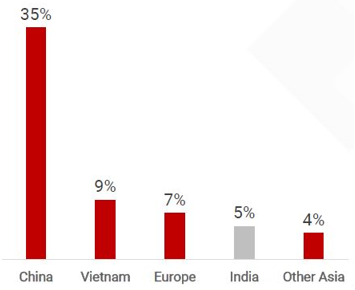

- Relatively low EV penetration: Penetration of electric vehicles in much lower compared to China. There is huge growth potential for electrical vehicles in India.

Source: International Energy Association (IEA), Data as on Dec, 2023, Other Asia includes Bangladesh, Singapore, Sri Lanka, Taiwan, Pakistan, Myanmar, Nepal & Mongolia, latest available data.

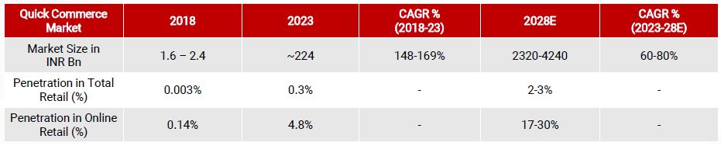

- Explosive growth of Quick Commerce: Market size of quick commerce, which refers to ecommerce with focus on quick deliveries, has grown by nearly 100X in the last 5 years. In the next 5 years quick commerce market is expected to grow 10 to 20X at CAGR of 60 – 80%.

Source: Redseer Research and Analysis; Calculated at the selling price before cancellations and returns. GOV reported by quick commerce players are at MRP, which is typically 10-20% higher than selling price. Data as of Dec’23, latest available data

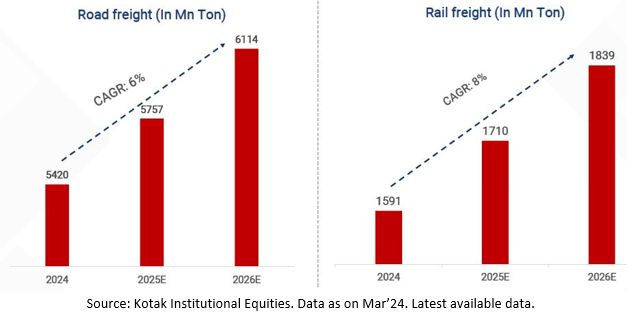

- Freight tonnage to grow in line with growing consumption in India: Freight tonnage (both road and trail) is likely to increase with growth in consumption and manufacturing. This is will translate into revenue growth for the respective industries with the transportation and logistics theme.

Source: Kotak Institutional Equities. Data as on Mar’24. Latest available data.

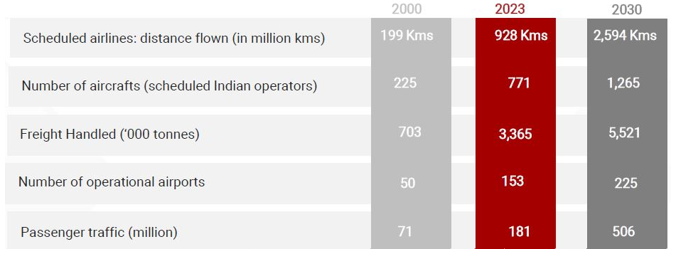

- Growth potential of the aviation industry: By 2030 we will have 70 additional airports (total 225 airports). Passenger traffic is likely to nearly triple to 506 million by 2030.

Source: IBEF Report, May 2024; CRISIL Ratings’ webinar on the airline industry (Feb’2024) ; As per the latest data available. The stocks/sectors mentioned do not constitute any kind of recommendation and are for information purpose only. Kotak Mahindra Mutual Fund may or may not hold position in the mentioned stock(s)/sector(s).

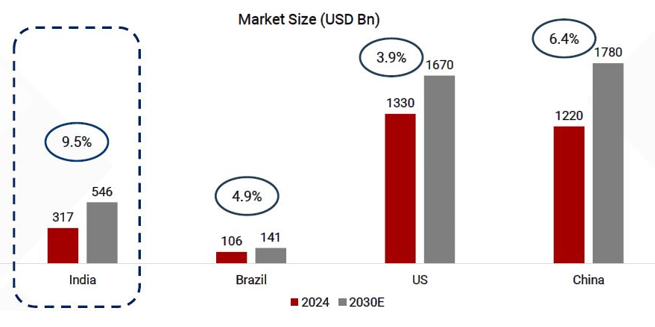

- Fastest growing logistics market: India is set to become fastest growing logistics market, outperforming both emerging and developed markets. The logistics market size is expected to grow at a CAGR of 9.5% between 2024 and 2030.

Source: Mordor Intelligence, Data as on Mar’24, latest available data.

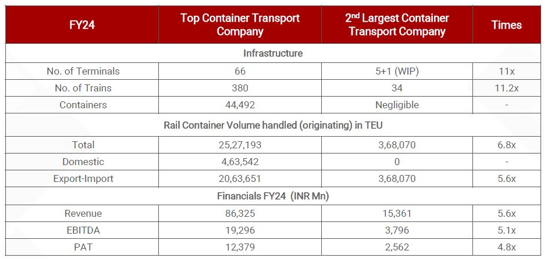

- Consolidation potential in the logistics industry: There are limited large players in the logistics space. There is opportunity for new players to enter the logistics space and grow.

Source: Philip Capital, Company Report, Data as on 31st March, 2024; TEU -Twenty-foot Equivalent Unit. *No of times is calculated by dividing, where numerator is value for Top Container Transport Company and denominator is corresponding value for 2nd Largest Container Transport Company.

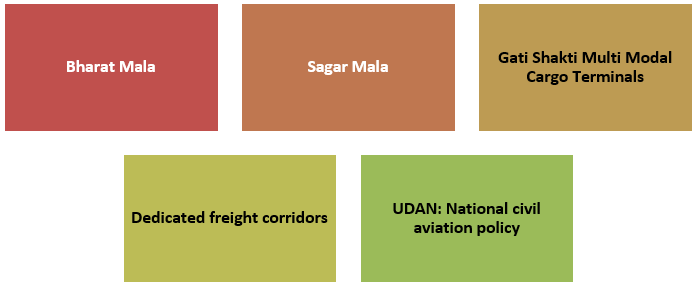

Government initiatives

How has Transportation and logistics as investment theme performed?

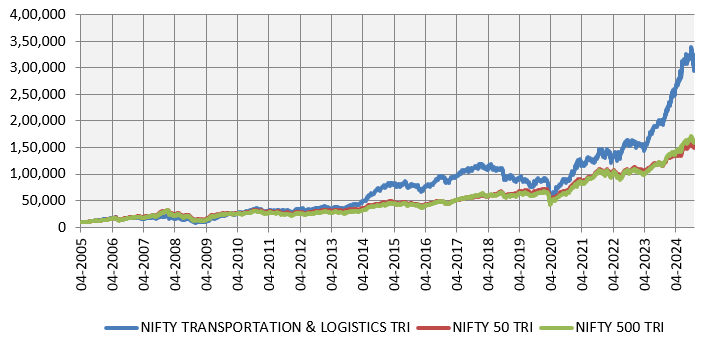

- Outperformed the broad market indices over long investment horizon: The chart below shows the growth of Rs 10,000 investment in Nifty Transportation and Logistics TRI versus the broad market indices like Nifty 50 TRI and Nifty 500 TRI. You can see that Transportation and Logistics has outperformed the broad market.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st October 2024.

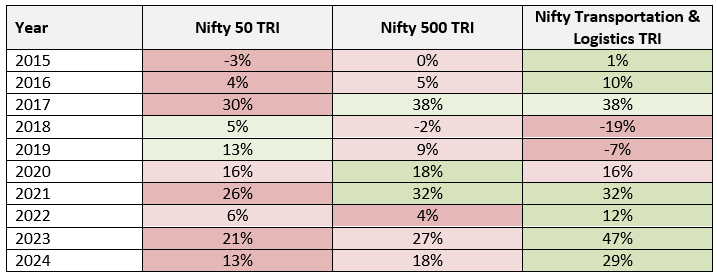

- Transportation and logistics is more resilient: The chart below shows the calendar year wise returns of Nifty Transportation and Logistics TRI versus the broad market indices like Nifty 50 TRI and Nifty 500 TRI. You can see that Transportation and Logistics had been more consistent and outperformed the broad market indices in most calendar years.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st October 2024.

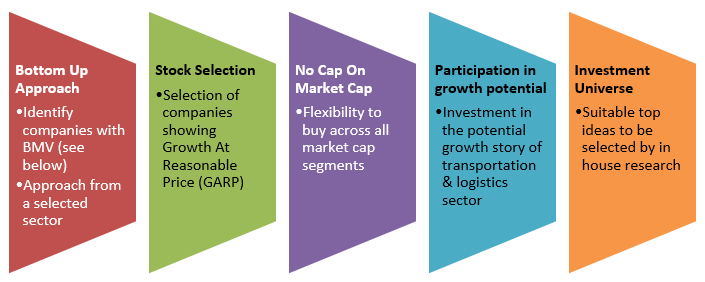

Investment Strategy of Kotak Transportation and Logistics Fund

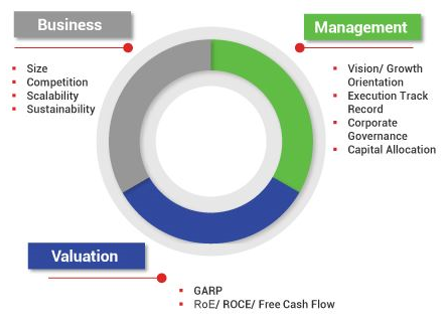

BMV Model

Why invest in Kotak Transportation and Logistics Fund NFO?

- Kotak Transportation and Logistics Fund is a true to label fund

- Transportation and logistics is one of the key themes and will be a core part of the India Growth Story

- This theme will benefit from the growth in consumption and manufacturing in India

- Valuations are favourable and quality of stocks in this theme is continuously improving

- Kotak MF actively tracks 87% of the market cap universe

- Kotak MF has a track record of avoiding accidents in their active equity funds

Who should investment in Kotak Transportation and Logistics Fund NFO?

- Investors looking for capital appreciation over long investment tenures from the transportation and logistics theme

- Investors looking for satellite allocations to their core portfolios

- Investors with high to very high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs

Investors should consult their financial advisors or mutual fund distributors if Kotak Transportation and Logistics Fund NFO is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY