Kotak Technology Fund NFO: Should you invest in this fund

Kotak MF is launching a thematic equity fund, Kotak Technology Fund, which will invest in companies in the technology sector or technology related sectors. The New Fund Offer (NFO) will open for subscription on 12th February 2024 and will close on 26th February 2024. Technology is the fastest growing industry in the world over the past decade or so (source: Fortune). The Top 6 companies in S&P 500 index are all technology companies. Technology as a sector has the second highest weight in the Nifty 50 Index after financial services (source: NSE, as on 31st January 2023). India is the largest exporter of IT services in the world. In this article, we will review Kotak Technology Fund. Technology has been the fastest growing industry sector of the last decade or so (source: Fortune).

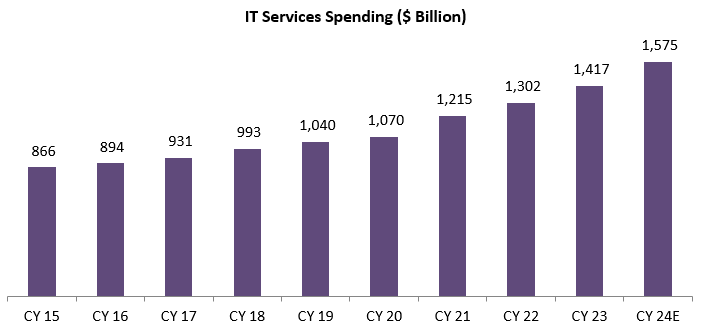

Global IT spending is rising

- IT Services spending is growing at 7 – 10% over the past few years (see the chart below).

Source: Kotak MF

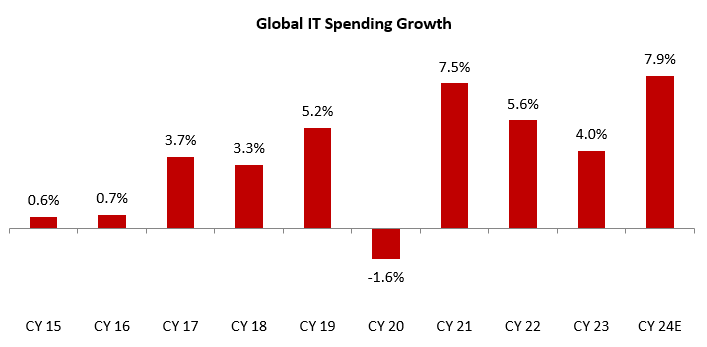

- Global IT spending has been growing a healthy rate (see the chart below).

Source: Kotak MF

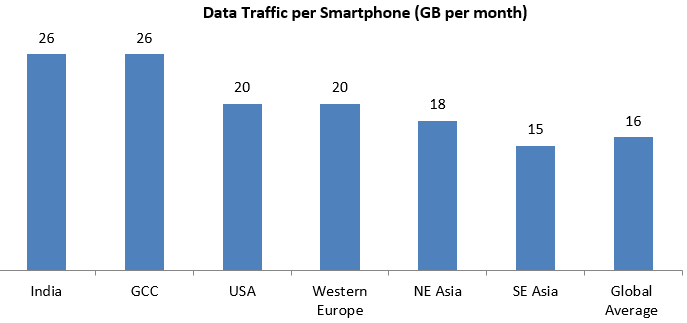

Domestic market opportunities

- India is the one highest smartphone data (per user) consumers in the world.

Source: Kotak MF

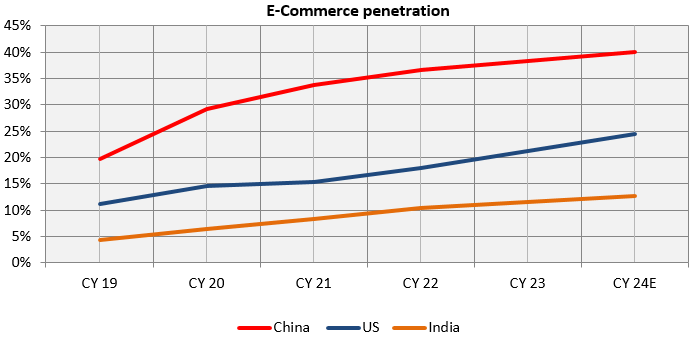

- Though we have made great strides in e-commerce over the past few years, there is a huge market opportunity if we compare India’s e-commerce penetration with China and the US.

Source: Kotak MF

IT sector is fundamentally strong*

- EBIT Margins are consistently strong ~ 20% (source: Kotak MF)

- Return on equity is increasing ~ 30% (source: Kotak MF)

- Operating cash flows are increasing. Operating cash flows as percentage of EBITDA is around 90% (source: Kotak MF)

- High dividend payouts

*The above data pertains to the average of the Top 5 IT companies in India.

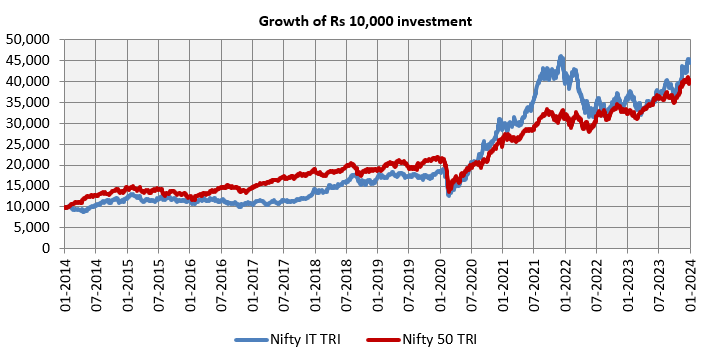

Technology has outperformed the broad market

The chart below shows the growth of Rs 10,000 investment in Nifty IT TRI and Nifty 50 TRI over the past 10 years. You can see that Nifty IT Index has outperformed over the last 10 year period.

Source: National Stock Exchange, as on 31st January 2024

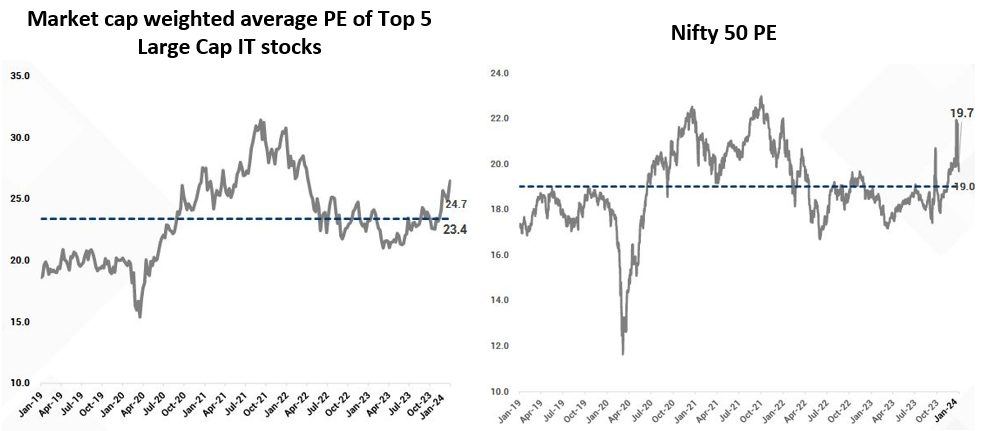

Valuation premia of large cap IT stocks are broadly in sync in market

Source: Kotak MF

Kotak Technology Fund – Salient Features

- Bottom-Up Approach: Identify companies with Business Management Valuation (BMV) approach from technology or related sectors

- Stock Selection: Selection of companies showing Growth At Reasonable Price (GARP)

- Flexibility to invest across Market Caps: Flexibility to buy across all market capitalization segments

- Participation In Growth Potential: Investment in the potential growth story of technology sector

- Investment Universe: Suitable top ideas to be selected by in-house Research

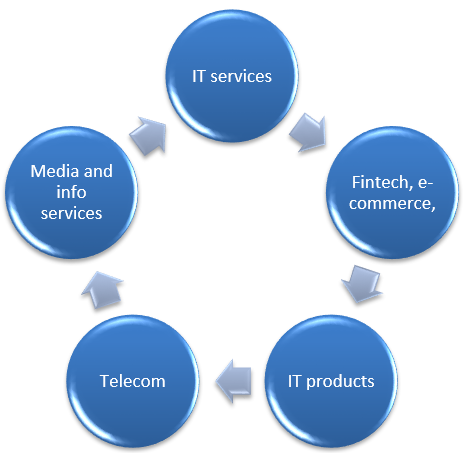

Kotak Technology Fund – Investment Universe

Why invest in Kotak Technology Fund now?

- Multiple new technologies like digital, cloud and Gen AI are disrupting businesses

- Enterprise Technology adoption / upgrade cycle could boost long-term growth

- Consumers’ Tech adoption continues to be another key growth lever for tech firms

- Rate hikes caused tech export uncertainty, however now we are at the cusp of a macro recovery as central banks pivot to rate cuts.

- Pent up demand for technology should potentially drive a strong recovery in growth and profitability

- Sector’s divergence v/s historical valuations is largely in-line with the broader market

- Adjusted for the high growth in the post Covid era, PE multiples are potentially attractive in many cases

Who should invest in Kotak Technology Fund?

- Investors willing to have Tactical Allocation to overall equity portfolio

- Investors looking for capital appreciation over long investment tenures from manufacturing theme

- Investors with very high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if Kotak Technology Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY