Kotak Special Opportunities NFO: Why investing in special opportunities is a great idea

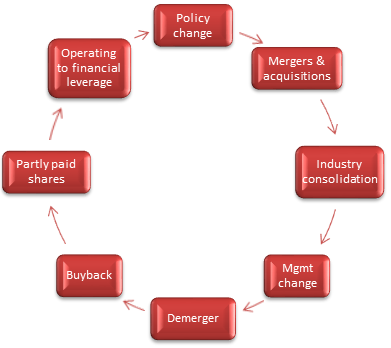

Special opportunities refer to changes or developments which can potentially have a large impact on the financial performance of a company. These developments may include capital restructuring, mergers and acquisitions, ownership change, new technology, new regulations, legislative changes, major disruptive events e.g. COVID-19 etc. These opportunities / changes can lead to significant valuation re-rating and superior returns for investors. Identifying special situations as investment opportunities requires considerable investment expertise. Kotak MF has launched an NFO, Kotak Special Opportunities Fund. The NFO opened for subscription on 10th June 2024 and will close on 24th June 2024.

What are special opportunities?

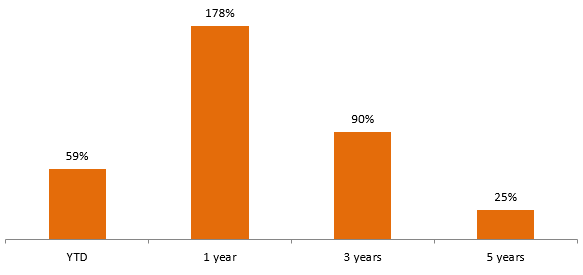

Examples of investment opportunities from special situations

- Make in India Defence Policy: Government’s focus on manufacturing in the defence sector by restricting imports have benefited companies which are engaged in defence related production / manufacturing. In the last 5 years (ending 31st May 2024) Nifty India Defence Total Returns Index (TRI) grew at a compounded annual growth rate (CAGR) of 24.7%. In the last 3 years, Nifty India Defence TRI grew at a CAGR of 90%. This is an example of how Government policy can help in significant wealth creation for investors.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st May 2024. Disclaimer: Past performance may or may not be sustained in the future. Returns over periods exceeding 1 year are in CAGR

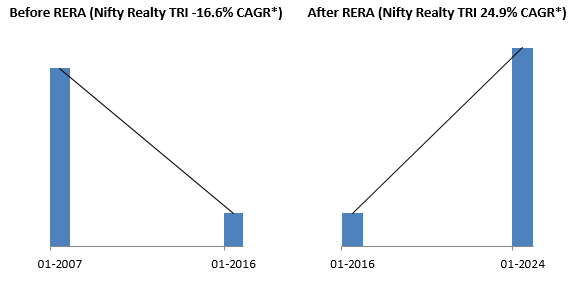

- Implementation of RERA (regulatory change in Real Estate sector): The real estate sector was in a market for many years (around a decade). In 2016 the Government got the Parliament to pass legislation to reform the real estate sector through Real Estate (Regulatory and Development) Act. This piece of legislation revived the real estate sector and investor returns in the sector (see the chart below).

Source: National Stock Exchange, Advisorkhoj Research, as on 31st May 2024. Disclaimer: Past performance may or may not be sustained in the future.

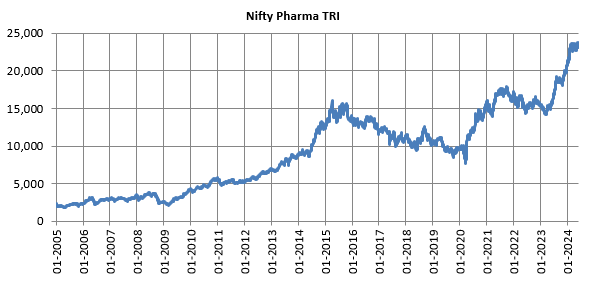

- Regulatory change in US Pharma industry: The Hutch Waxman Act in the US facilitated the entry of generic drugs into the US market post the expiry of patents. This export opportunity for Indian pharma companies led to developing chemistry skills and manufacturing processes for generics. In 2005 an amendment was made to TRIPS agreement of WTO nation to introduce product patent. This led to significant investments in R&D with the objective of product licensing. Product licensing eased the entry of Indian pharma products in the global markets especially the US market.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st May 2024. Disclaimer: Past performance may or may not be sustained in the future.

How special situations led to significantly higher share price growth of individual stocks?

- Launch of Production Linked Incentive Scheme (PLI) in 2020 led to significant share price growth of select companies in electronic manufacturing

- Consolidation in the aviation (airlines) industry led to significantly higher growth of market share for the Top 2 players

- Consolidation in the cement industry led to significantly higher growth of market share for the Top 5 players

- Demerger of a diversified group’s stock into cement and consumer durable (electric) business led to significant shareholder value creation.

- A steel manufacturer used its Cash Flow to reduce debt, supported by strong commodities cycle. Market rewarded it in higher share price

Why special situation investments can lead to superior returns?

- Financial markets are slow to recognize disruptive innovations

- The impact of the unanticipated change is often overlooked

- Exploit gap in market expectations and actual growth potential

About Kotak Special Opportunities Fund

Is this is a good time to invest in Kotak Special Opportunities NFO?

The market is trading at all time high after the formation of NDA 3.0. India is in a macro sweet spot with strong GDP growth, control on fiscal deficit and reducing bond yields with rate cuts on the horizon. However, when the market is at record high investors may be concerned about valuations getting stretched and impact of the tail end of high interest rate cycle on earnings growth. Kotak Special Opportunities Fund presents an attractive opportunity to get tactical exposure to stocks in unique situations that may be on the cusp of higher than average earnings growth or valuation rerating in the near to medium term. One of the biggest advantages of investing in an NFO is that there is no burden of legacy investments; you can get the benefits of new start. Fund manager, Devender Singhal has 22 years of expertise in equity market with a strong track record of performance in fund management. Kotak Mutual Fund, as a fund house, has an outstanding track record of alpha creation for investors.

Who should invest in Kotak Special Opportunities Fund?

- Suitable for investors looking for tactical satellite allocations to their overall equity portfolio

- Investors who want superior returns on investment over sufficiently long investment tenure

- Investors with investment horizons of at least 5 years or longer

- Investors with very high risk appetites

- You can invest in lump sum or SIP depending on your financial situation and investment needs

- Investors should consult with their financial advisors or mutual fund distributors if Kotak Special Opportunities Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY