Kotak Nifty Top 10 Equal Weight Index Fund: Invest in the bluest of blue chips

Kotak Mutual Fund has launched a New Fund Offer (NFO) Kotak Nifty Top 10 Equal Weight Index Fund. This NFO is a passive fund which will invest in Nifty Top 10 Equal Weight Index. Nifty Top 10 Equal Weight Index is a new index, launched in June 2024. The index constituents are the 10 largest companies by market capitalization in the Nifty 50 index. The NFO will open for subscription on 7th April 2025 and will close on 21st April 2025.

What is an equal weight index?

An equal weight index is an index, where all the constituents have equal weights. Market capitalization weighted indices (e.g. Nifty 50), on the hand, assign higher weights to stocks whose market caps are higher. Equal weight indices provide more balanced exposure to the underlying stocks of the index. Also, the underperformance of higher market cap stocks has lesser impact in equal weight indices compared to market cap weighted indices.

About Nifty Top 10 Equal Weight Index

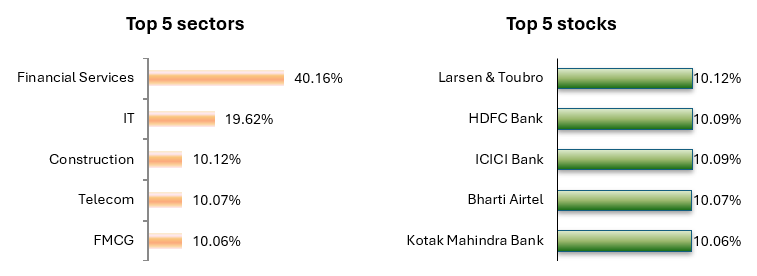

The index is derived from the constituents of the Nifty 50. It includes the top 10 stocks from Nifty 50 Index based on 6-month average free-float market capitalisation. Each of the 10 stocks are equally weighted.

Source: NSE, as on 28th March 2025

Why invest in Nifty Top 10 Equal Weight Index?

- Top 10 stocks represent 16% of the profits, 17% of revenues and 24% of market cap of Nifty 500 index (source: Bloomberg, as on 28th February 2025)

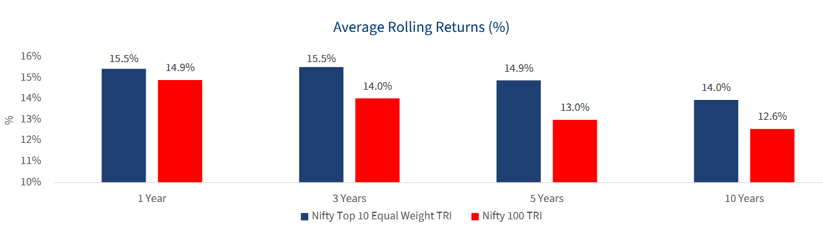

- The chart below shows the rolling returns of Nifty Top 10 Equal Weight TRI versus Nifty 100 TRI for different investment tenures (1, 3, 5 and 10 years), over the last 10 years. You can see that the Top 10 stocks have outperformed the overall large cap stocks segment across different investment tenures.

Source: Kotak MF, NSE, ICRA MFI explorer, as on 28th February 2025

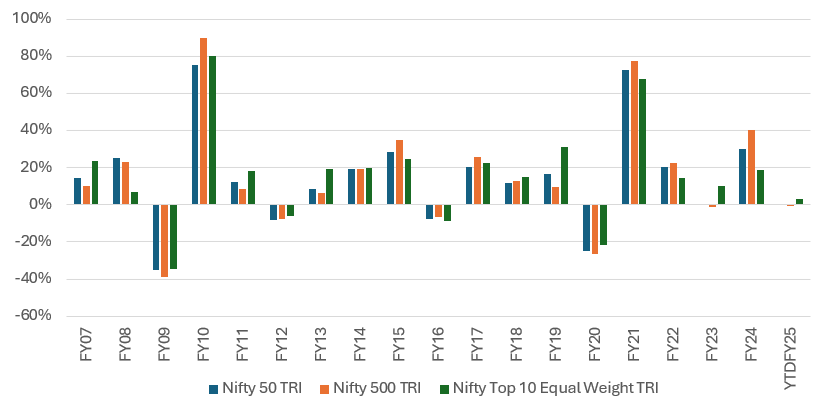

- The chart below shows the fiscal year performance of Nifty Top 10 Equal Weight TRI versus the broad market indices, Nifty 50 and Nifty 500 TRI. Nifty Top 10 Equal Weight TRI outperformed either Nifty 50 TRI or Nifty 500 TRI or both, 11 times in the last 19 years.

Source: Kotak MF, NSE, ICRA MFI explorer, as on 28th February 2025

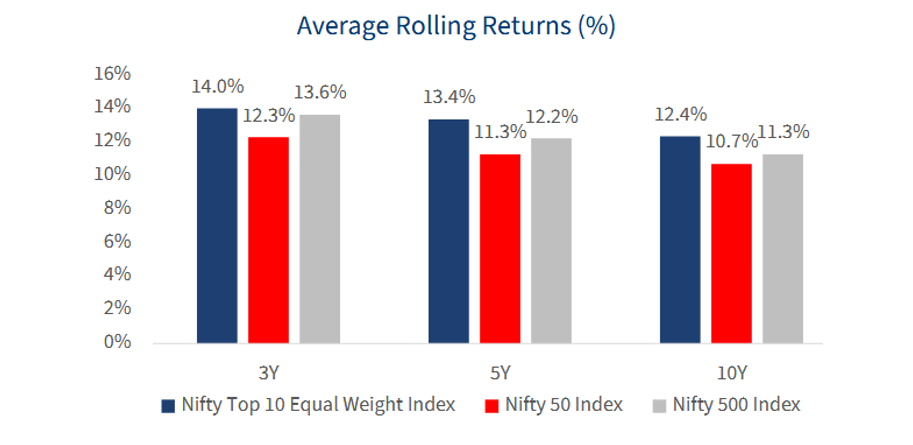

- The chart below shows the rolling returns of Nifty Top 10 Equal Weight TRI versus Nifty 50 and Nifty 500 TRI for different investment tenures (3, 5 and 10 years), over the last 10 years. You can see that the Top 10 stocks have outperformed the broad market indices across different investment tenures.

Source: Kotak MF, NSE, ICRA MFI explorer, as on 28th February 2025

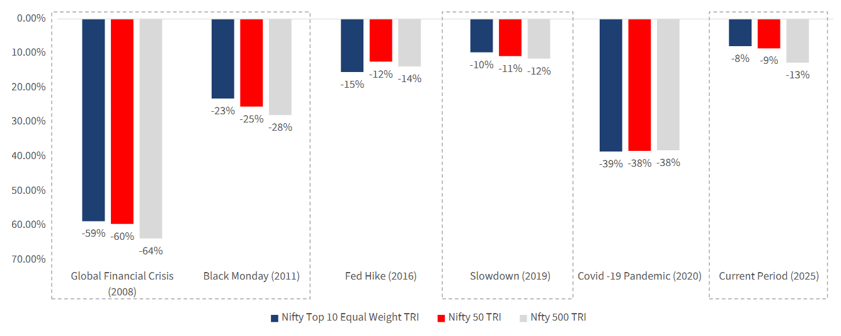

- The chart below shows the major yearly drawdowns of Nifty Top 10 Equal Weight TRI versus the broad market indices, Nifty 50 and Nifty 500 TRI. Nifty Top 10 Equal Weight Index experienced lower drawdowns compared to the broad market indices.

Source: Kotak MF, NSE, ICRA MFI explorer, as on 28th February 2025

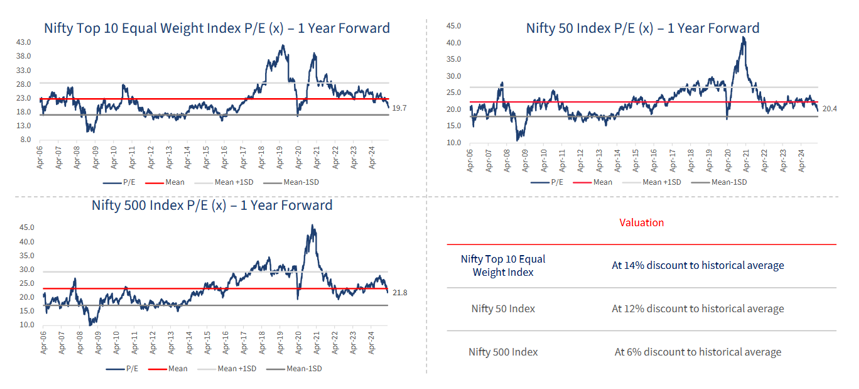

- Nifty Top 10 Equal Weight Index is trading at lower valuations compared to broad market indices like Nifty 50 and Nifty 500. Furthermore, Nifty Top 10 Equal Weight Index is trading at higher discounts (trading at discount of 14%) relative to its historical average compared to Nifty 50 (trading at discount of 12% to historical average) and Nifty 500 (trading at discount of 6% to historical average).

Source: Kotak MF, NSE, as on 28th February 2025

Salient features of Kotak Nifty Top 10 Equal Weight Index Fund

- Underlying stocks diversified across 6 sectors (data as on 28th February 2025)

- Exposure to top 10 companies based on 6-months average free-float market capitalisation of Nifty 50 Index

- Equal weight exposure to each stock – balanced exposure

- Index is rebalanced every quarter

- Lower cost investments compared to actively managed equity funds.

- Investors can invest from their regular savings through systematic investment plan

Who should invest in Kotak Nifty Top 10 Equal Weight Index Fund?

- Investors seeking capital appreciation over long investment tenures

- Investors who invest in the large cap stock exposure

- Investors who want concentrated exposure to largest blue-chip stocks

- Investors having a long-term investment horizon (minimum 5 years)

- Investors with high to very high-risk appetite

- Investors can invest in lump sum or SIP depending on their investment needs

- Investors do not need demat accounts to invest in this fund

Investors should consult their financial advisors or mutual fund distributors if Kotak Nifty Top 10 Equal Weight Index Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY