Kotak Nifty Smallcap 250 Index Fund: Invest in wealth creation potential of smaller companies

Kotak MF has launched a new fund offer (NFO), Kotak Nifty Smallcap 250 Index Fund. Nifty Small Cap 250 Index comprises 251st to 500th companies by market capitalization listed on National Stock Exchange (NSE). Kotak Nifty Smallcap 250 Index Fund is a passive scheme which will track the Nifty Small Cap 250 Index. The NFO will open for subscription on 6th January and will close on 20th January.

Why invest in small caps?

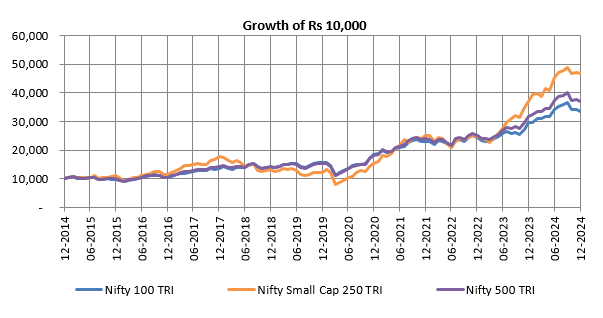

- The chart below shows the growth of Rs 10,000 investment in Nifty Small Cap 250 TRI versus other broad market indices over the last 10 years (ending 31st December 2024). You can see that the wealth creation by Nifty Small Cap 250 TRI was significantly higher than large cap (Nifty 100 TRI) and broad market index (Nifty 500 TRI).

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2024

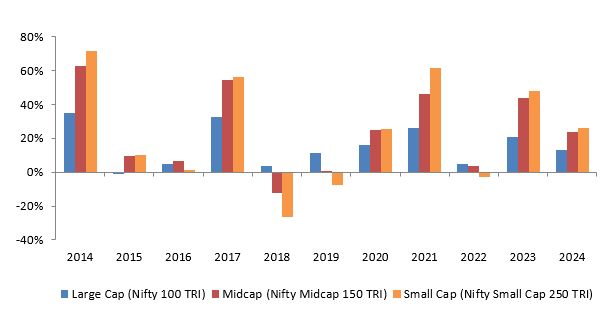

- The chart below, shows calendar year returns of Nifty 100 (large cap), Nifty Midcap 150 (Midcap) and Nifty Small Cap 250 TRI. The small cap index outperformed the large and midcap indices, 7 times in the last 11 years.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2024

- Nifty Small Cap 250 TRI outperformed the broad market index over sufficiently long investment horizon most of the times since inception. The chart below, shows the 3 year rolling returns of the small cap index versus the broad market index (Nifty 500 TRI) since inception of the index. You can see that barring short term setbacks (circled in red), the small cap index was able to outperform the broad market index most of the times. Instances (number of observations) of Nifty Small Cap 250 index giving 15%+ CAGR returns (nearly 50% of the observations) were significantly higher than that of Nifty 500 TRI.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2024

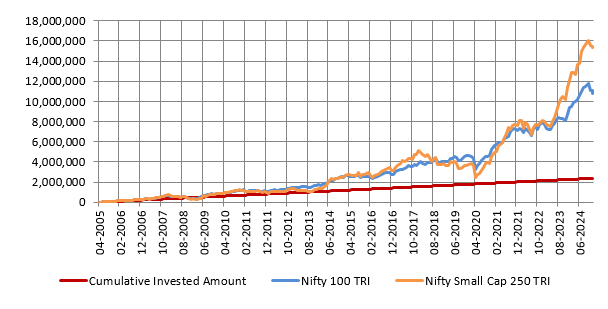

- Since small caps have higher volatility and the potential of giving higher returns in the long term, they can be more suited to Systemic Investment Plan (SIP) investments compared to large caps. The chart below shows the growth of Rs 10,000 monthly SIP investment in Nifty Small Cap 250 TRI versus the large cap index, Nifty 100 TRI. You can see that the wealth creation of Nifty Small Cap 250 TRI through SIP was much higher than Nifty 100 TRI (large cap).

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2024

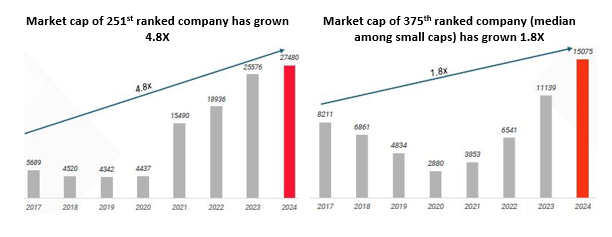

- Small cap companies have grown substantially in terms of size. The market cap of the largest and median small cap companies have multiplied 4.8X and 1.8X respectively, in the last 7 years.

Source: AMFI Market Capitalization, Kotak MF, as on 27th June 2024

- Approximately 5% of the small-cap stocks excelled and transitioned into the mid-cap stocks semi-annually. On an average 10 - 11 stocks moved up from small cap to midcap segment on a half yearly basis in the last 6 years.

- Nifty Small Cap 250 index has higher exposure to emerging sectors like Capital Goods, Healthcare, Chemicals, Consumer Durables etc compared to midcap and large cap segments.

Why invest in Small Cap now?

- Consumption revival (including rural consumption) – Overall retail consumption is expected to grow at a CAGR of 10.5% in the next 3 - 4 years.

- Shift from unorganized to organized retail – Organized retail penetration, which was around 10% in 2018, has increased to nearly 16% (by 2023). Organized retail penetration is expected to increase to nearly 23% by 2027.

- Capex cycle revival - India is at the cusp of a multi-year capex cycle. Capex spending has grown at a CAGR of 28% post COVID, from Rs 26,220 billion (in FY 2021) to Rs 55,122 billion (in FY 2024).

- Healthcare opportunities – As the population ages, spending on healthcare will also rise. Also with rising per capita income, spending on healthcare is likely to increase.

Why invest in small caps through index fund?

- Low cost – The cost (expense ratio) of an index fund is much less than that of active funds

- No unsystematic risk – Small cap stocks have higher risks compared to large and midcap stocks. There can be two types of risk – systematic or market risk and unsystematic or stock specific risk. There is no unsystematic risk in the index funds, since it will track the Nifty Small Cap 250 Index

- No fund manager bias – Since the fund will be simply tracking the Nifty Small Cap 250 Index, there will be no human bias towards / against any stock / sector.

Who should invest in Kotak Nifty Smallcap 250 Index Fund?

- Investors looking for capital appreciation over long investment horizon

- Investors with a high-risk appetite

- Investors having a long-term investment horizon (minimum 5 years)

- Investors do not need to have demat account to invest in the fund

- Investors can invest in the fund through SIP

Investors should consult their financial advisors or mutual fund distributors if Kotak Nifty Smallcap 250 Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY