Kotak Multicap Fund: Best performing multicap fund crosses Rs 10,000 crore AUM

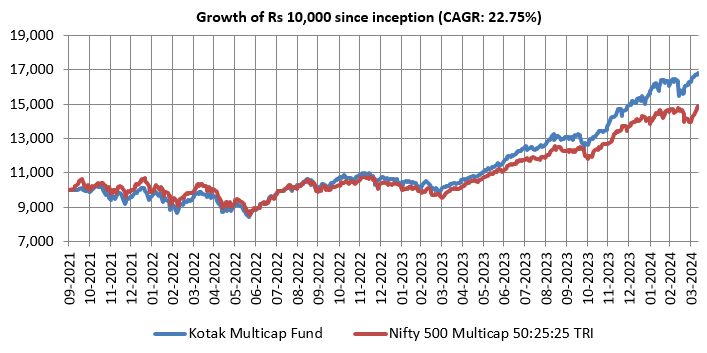

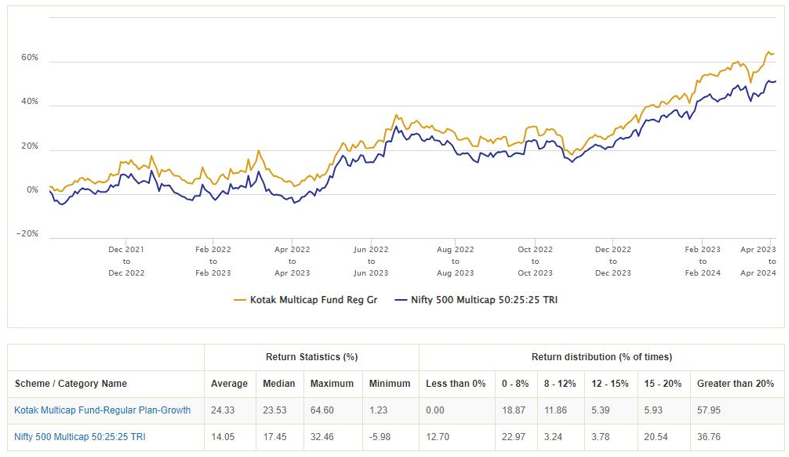

Kotak Multicap Fund has been the best performing multicap fund in the last 1 year. In the last 1 year, the fund has given 63.81% returns, around 14% excess returns (alpha) relative to its benchmark market index (as on 10th April 2024, source: Advisorkhoj). As on 1st April 2024, the scheme assets under management crossed the landmark of Rs 10,000 crore in just about 2.5 years since launch of the fund. Though 2.5 years is a not a sufficiently long period to evaluate the performance, the alpha created by the fund since its inception has grabbed attention (see the chart below). In this article, we will review Kotak Multicap Fund.

Source: Advisorkhoj Research, as on 10th April 2023

Multicap Funds as a category

Diversified equity funds which invests across different market cap segments e.g. large cap, midcap and small cap, have been popular with mutual fund investors for decades. In September 2020, SEBI issued a circular mandating minimum 25% allocation to different market cap segments (i.e. large cap, midcap and small cap) for multicap funds, in order to make funds of these categories “true to label”. Shortly afterwards, SEBI allowed a new equity category called flexicap funds which can invest dynamically across any market cap segment without any restrictions. The erstwhile Kotak Standard Multicap Fund which is a 15 year old fund was renamed Kotak Flexicap Fund. In September Kotak MF launched Kotak Multicap Fund which would conform to SEBI’s mandate for multicap funds.

The main difference flexicap and multicap funds is that there is no market cap limits in flexicap, while multicap funds must have minimum 25% allocations to large, mid and small caps. In other words, at any point of time, minimum 50% of the assets of a multicap fund must be invested in midcap and small cap stocks. On the other hand, flexicap funds can have any allocation to large, mid and small cap stocks. Historical asset allocation data of different flexicap and multicap funds suggest that flexicap funds usually have higher allocations to large cap stocks compared to multicap funds. As such, multicap funds may be more volatile than flexicap funds.

Both Kotak Multicap Fund and Kotak Flexicap Fund have strong performance track records. You should invest according to your risk appetite and consult with your financial advisor or mutual fund distributor if you need help.

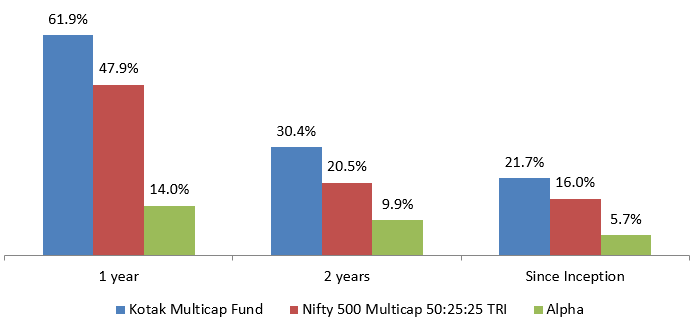

Kotak Multicap Fund performance across different periods

Source: Advisorkhoj Research, as on 28th March 2024. Returns over periods exceeding 1 year are annualized (CAGR)

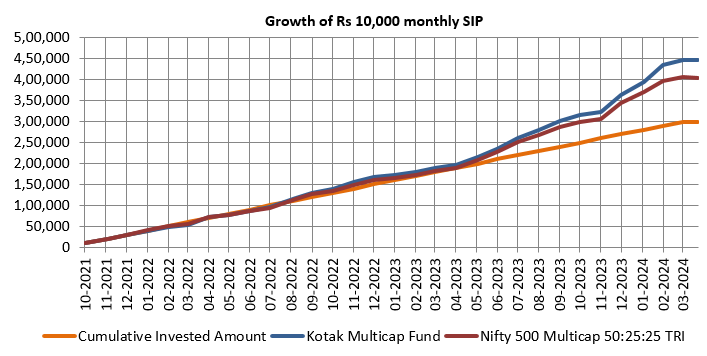

Kotak Multicap Fund SIP Returns since inception

The chart below shows the growth of Rs 10,000 monthly SIP in Kotak Multicap Fund versus its benchmark index since the inception of the fund; you can see that the fund was able to outperform the benchmark even in terms of SIP returns. The SIP XIRR of Kotak Multicap Fund (as on 28th March 2024) was 34%, while that of the benchmark index was 24.5%.

Source: Advisorkhoj Research, as on 28th March 2024.

Rolling returns

The chart below shows the 1 year rolling returns of Kotak Multicap Fund versus its benchmark index since the inception of the fund. You can see that the fund has consistently outperformed the benchmark index over 1 year investment tenures since the inception. The average 1 year rolling return of the fund is significantly higher than the benchmark index. You can also observe that the fund has given 12%+ returns, in nearly 70% of the instances since the scheme’s inception.

Source: Advisorkhoj Rolling Returns, as on 11th April 2024

How does Kotak Multicap Fund decide market cap allocation?

Kotak MF’s proprietary model guides the fund manager on which market cap segment to be overweight. It is based on 2 primary factors i.e. Mean reversion – which suggests when exactly to go overweight in a particular market cap, and Momentum – which will essentially suggest the duration of the overweight position.

Stock selection has the ability to enhance returns potential further. The fund has a high active share of 86% (as on 28th March 2023, source: Kotak MF).

Current portfolio positioning

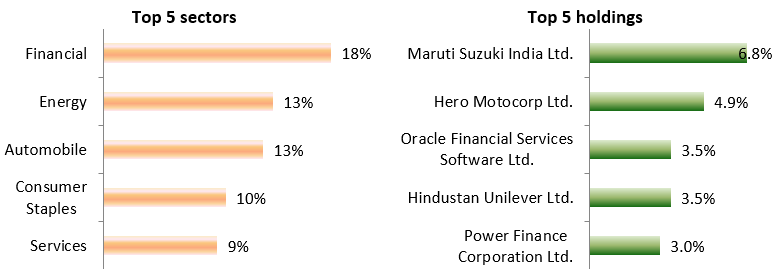

The fund invests in companies which have strong balance sheets and are also likely to deliver better earnings growth than the broader market over the next two years. The fund is overweight on sectors like, Financials, Auto, power and consumer staples. The exposure to small and midcaps in the portfolio is currently just above the benchmark levels.

Source: Advisorkhoj Research, as on 28th March 2024.

Why invest in Kotak Multicap Fund?

Who should invest in Kotak Multicap?

- Investors looking for capital appreciation over long investment tenures

- Suitable for long term financial goals children’s education, children’s marriage, home purchase, retirement planning etc

- Investors with very high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest in lump sum or SIP depending on your investment needs

- You can also invest in this fund through 6 – 12 months STP from Kotak Liquid or Kotak Savings Fund if you are concerned about volatility

Investors should consult their financial advisors or mutual fund distributors if Kotak Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY