Kotak MNC Fund: Why does it make sense to invest in MNC theme?

Kotak Mutual Fund has launched a New Fund Offer (NFO), Kotak MNC Fund. Kotak MNC Fund is an actively managed thematic fund which will invest in the MNC theme. Multinational companies (MNCs) are enterprises which have businesses in multiple countries around the world. MNCs can be subsidiaries of foreign companies, JVs of Indian and foreign companies, Indian companies with more than 50% revenues from other countries or transnational companies with more than 50% from countries, other than the parent country. Currently there are only 5 schemes that invest in the MNC theme. Kotak MNC Fund will open for subscription on 7th October and will close on 21st October.

Characteristics of MNCs

- MNCs have high brand recognition or recall. They can command large market share. Consumers tend to associate MNC brands with high quality products. MNCs spend more on advertising compared to local companies, which enhances brand awareness, customer loyalty and directly or indirectly, sales or revenue growth of the company.

- Parent companies of MNCs invest a significant percentage of their cash-flows in Research and Development to provide competitive advantage to their global business. MNCs in the India can benefit from the technology / R&D spends of their parent companies to get technological edge over competitors.

- MNCs are able to attract top talent across different roles, especially senior management roles. MNCs can provide exposure to their senior management employees in different roles, domains and even geographies. The global and local expertise of MNC management team can give them a competitive advantage through mergers and acquisitions (M&A), strategic investments and technological innovations made by the management.

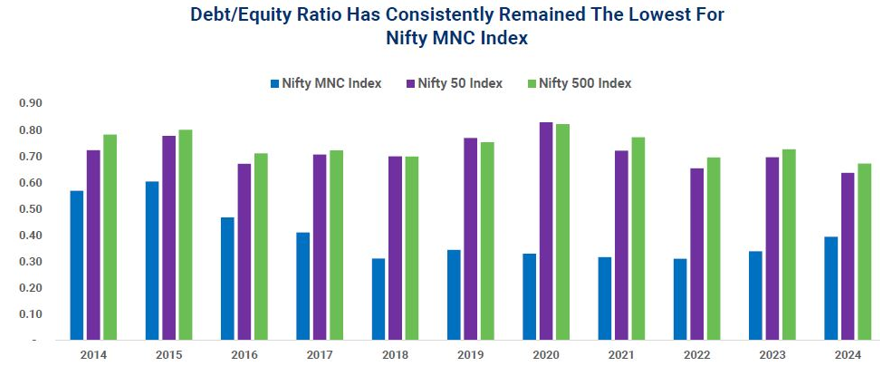

- MNCs usually have lower leverage than domestic companies (see the chart below) for a variety of reasons e.g. benefitting from R&D investment of the parent company, capex funded through FDI made by parent company etc.

Source: Kotak MF, as of 30th August 2024

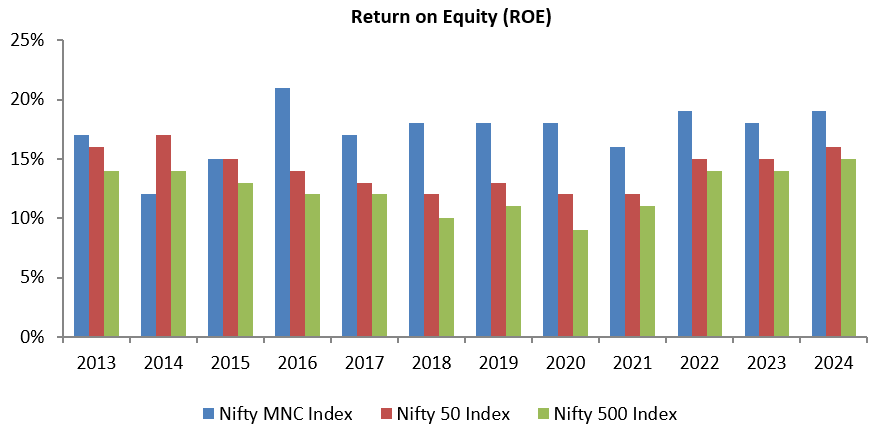

- MNC stocks usually have higher Return on Equity than the broad market index ROEs (see the chart below). ROE is one of the best indicators of quality of a stock.

Source: Kotak MF, as of 30th August 2024

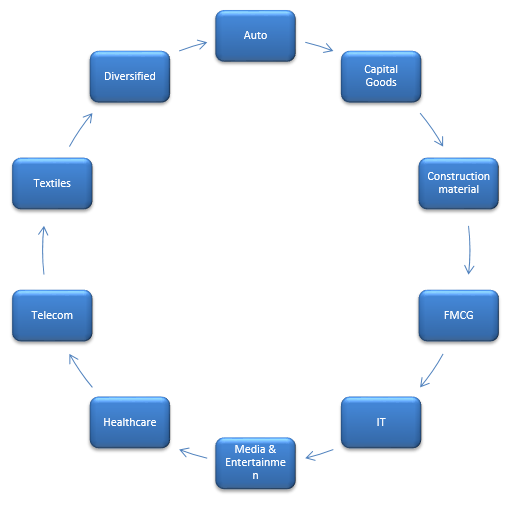

MNCs are market share leaders in many industry sectors

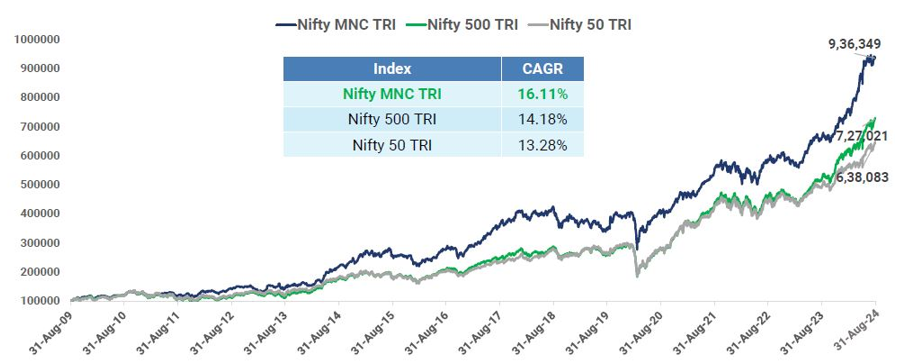

MNC as an investment theme has outperformed the broad market

Source: Kotak MF, as of 30th August 2024

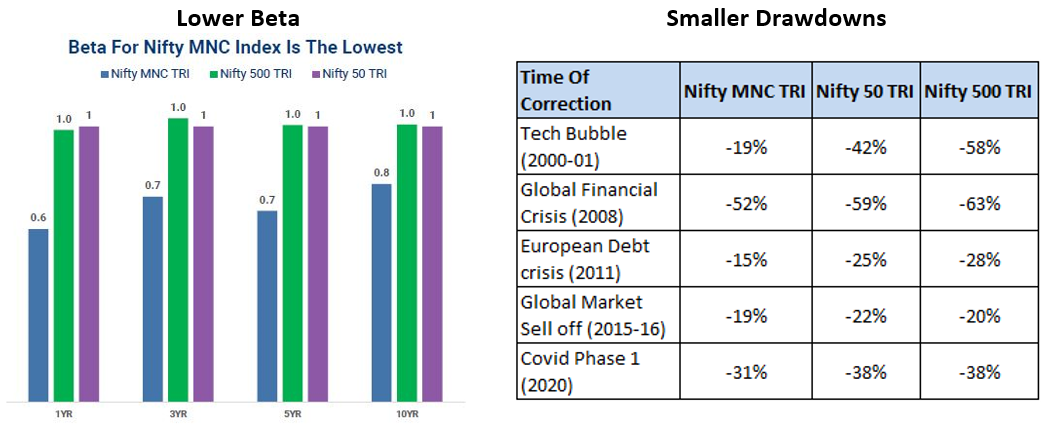

MNCs have lower beta and lesser drawdowns (greater resilience)

Source: Kotak MF, as of 30th August 2024

Why invest in MNCs now?

- India is a booming consumer market. India is projected to become the third largest consumer market by 2026 (source: BMI).

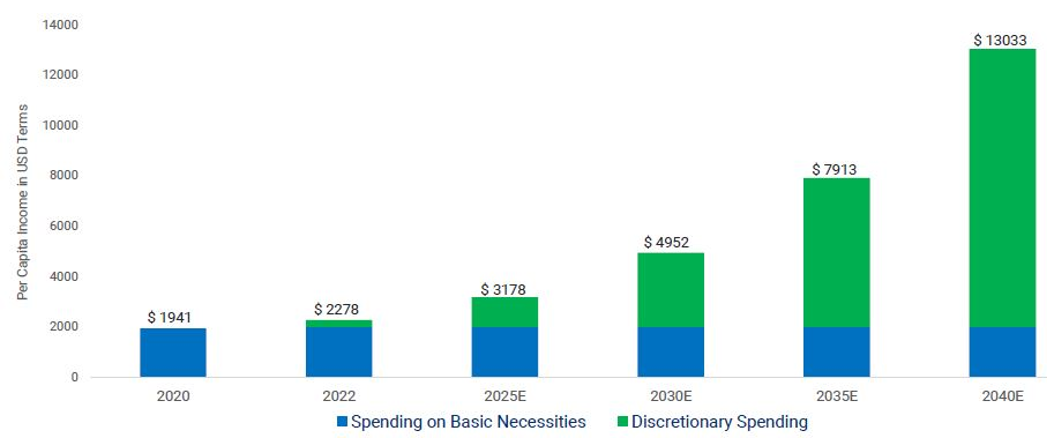

- Rising income will fuel consumption growth in India. India crossed the $2,000 per capita income in 2022. $2,000 is an important threshold because at a $2,000 per capita income level, basic needs are met. Above $2,000 per capita income level, discretionary spending will increase. By 2030, discretionary spending on a per capita basis will exceed the spending on basic needs.

Source: Kotak MF

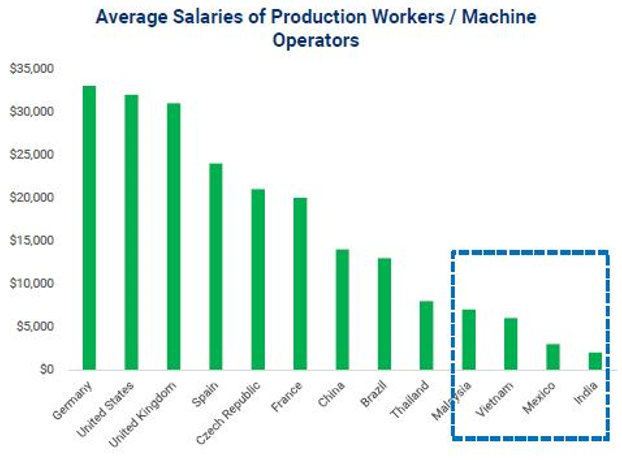

- India’s low labour costs (see the chart below) can give it a competitive advantage in the changing global supply chain dynamics. Labour intensive manufacturing is more suited to be based in low cost countries. India can emerge as a global manufacturing hub, as companies look to reduce their dependency on China (China + 1 Strategy).

Source: Kotak MF

- Demand supply mismatch make MNC stocks more valuable. There is less issuance of MNC stocks through FPOs, QIP, rights issue etc, because MNCs are strongly capitalized. There is also low float of MNC stock in the market limiting its supply. High demand and low supply can result in price surges.

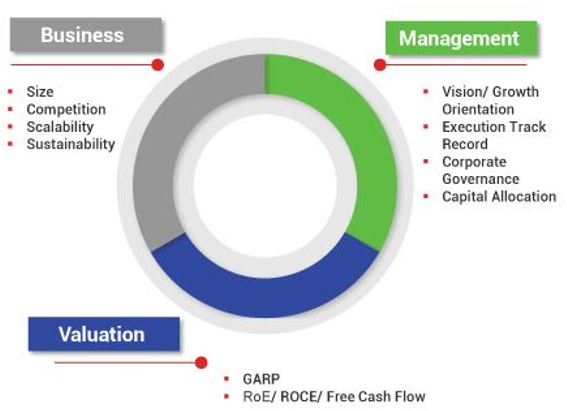

Kotak MNC Fund – Investment Strategy

BMV Model

Who should investment in Kotak MNC Fund?

- Investors looking for capital appreciation over long investment tenures from the MNC theme

- Investors looking for satellite allocations to their core portfolios

- Investors with high to very high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs

Investors should consult their financial advisors or mutual fund distributors if Kotak MNC Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY