Kotak India EQ Contra Fund: A proven wealth creator suitable for volatile markets

Market context

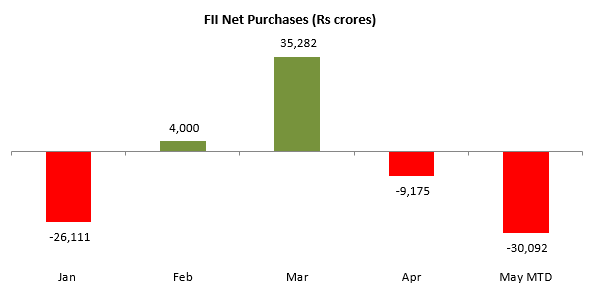

After closing 2023 at record high, the equity market has been volatile in 2024. Among other factors, valuation is a source of concern for investors. In February SEBI issued an advisory about froth building up in valuations of midcap and small cap stocks. Volatility was seen both in Nifty 50 as well as the broader market stocks. FIIs have been net sellers on YTD basis as on 16th May 2024 (se the chart below).

Source: NSE, as on 16th May 2024

We may continue to see volatility in the coming weeks or months due to the Lok Sabha polls and expectations regarding timing of interest rate cuts by the Fed. However, the long term outlook for Indian equities is bright. According to IMF India will be the fastest growing major (G-20) economy in FY 2024-25. For investors, who want to invest for the long term and do not want high volatility, contra funds may be good investment opportunities.

What is contra investing?

Contra fund are equity mutual fund schemes following the contrarian investment style, where you invest in stocks that are currently out of favour in the market. Contrarian fund managers invest in stocks or sectors in which they expect price recovery in the future. Since contrarian investors buy stocks at deep discounts relative to their intrinsic value, they can get good returns in the long term. The terms value investing and contra investing are often used interchangeably, though there a subtle differences in value funds and contra funds category. We will not discuss the differences in this article; suffices to say all contra funds essentially follow the value investment style.

Why contra is a good strategy in volatile markets?

Contrarian investment involves doing the opposite of what the majority of investors are doing and try to buy stocks which have been neglected by the market. In markets is near its highs, contra funds can buy stocks with strong earnings growth potential at relatively low prices. Since these are usually stocks, which the market is ignoring and trading at low prices, they are relatively less affected by volatility. Once the stock is able unlocks its growth potential, it can create high alphas for investors.

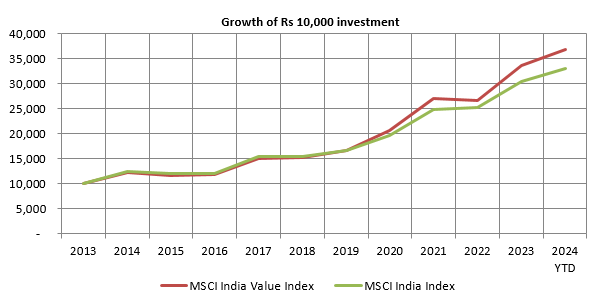

Value investing has outperformed the broad market over long investment horizons

The chart below shows the growth of Rs 10,000 investment in MSCI India Value Index versus MSCI India Index over the last 10 years. You can see that value investing has outperformed the broad market.

Source: MSCI, as on 30th April 2024.

About Kotak India EQ Contra Fund

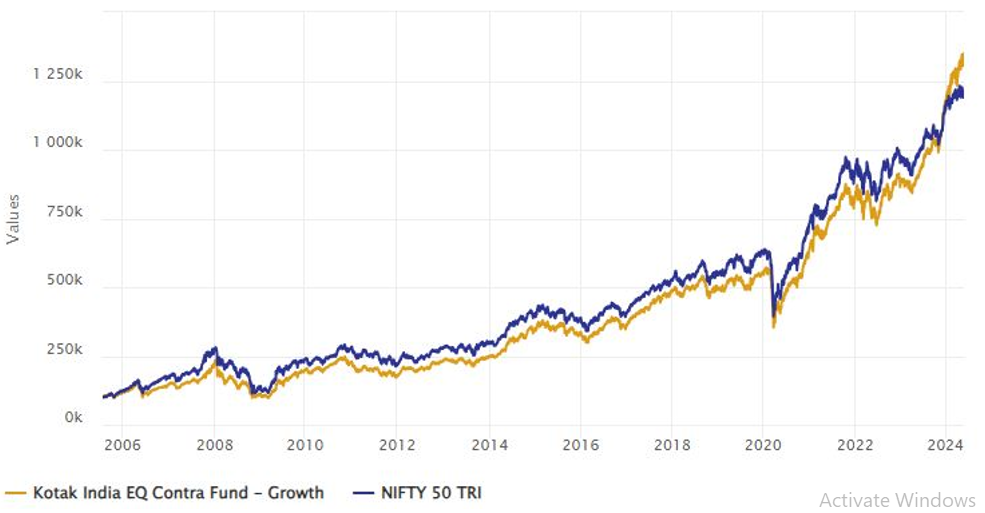

Kotak India EQ Contra Fund, erstwhile Kotak Classic Equity Fund, was launched in 2005. The fund has a track record of wealth creation - Rs 1 lakh invested in the NFO of the fund would have grown to Rs 13.5 lakhs (see the chart below). It is the best performing contra fund in the last 1 year. Ms Shibani Kurian has been managing this fund for the past 5 years or so.

Source: Advisorkhoj Research, as on 16th May 2024

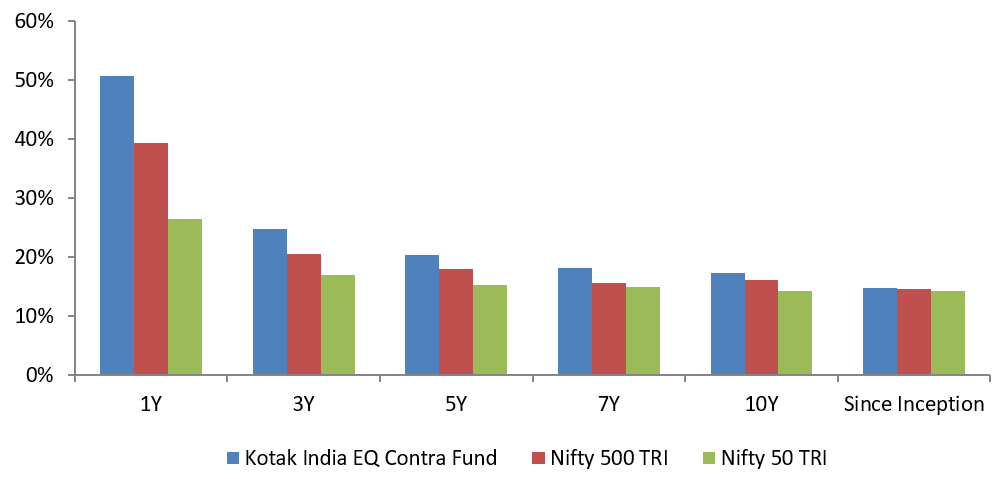

Alpha creation over different performance periods

The chart below shows the CAGR returns of Kotak India EQ Contra Fund over different time-scales versus its benchmark index, Nifty 500 TRI and the secondary benchmark Nifty 50 TRI. You can see that fund has outperformed the market benchmarks across all the periods creating alphas.

Source: Advisorkhoj Research, as on 30th April 2024

Downside risk limitation

The table below shows some of the biggest market corrections in the last 20 years. You can see that Kotak India EQ Contra Fund had lesser drawdowns compared to the benchmark index Nifty 100. Since value stocks trade at relatively lower valuations (margin of safety), their downside risk in deep market corrections compared to stocks trading at more expensive valuations. We looked at the down market capture ratio of the fund over the last 3 years and we saw that for 1% monthly decline for the benchmark index (Nifty 500 TRI), the fund fell by only 0.86%.

Source: Advisorkhoj Research, as on 30th April 2024. Disclaimer: Past performance may or may not be sustained in the future

Superior risk adjusted returns

While the down market capture ratio of Kotak India EQ Contra Fund was 86%, the up market capture ratio of the fund was 106%, which means for every 1% rise of Nifty 500 TRI, he fund rose by 1.06%. Contra investing can produce superior risk adjusted returns since they have margin of safety (trading at discount to their intrinsic valuation) in bear markets and the potential valuation re-rating in the market recovery phases. The 5 year rolling returns of the fund since inception also shows how the fund produced risk adjusted returns relative to the market index. You can see that fund has very less instances negative returns compared to the market index and at the same time more instances of 12%+ CAGR returns (almost 60% of the instances) compared to the market index.

Source: Advisorkhoj Rolling Returns, as on 30th April 2024. Disclaimer: Past performance may or may not be sustained in the future

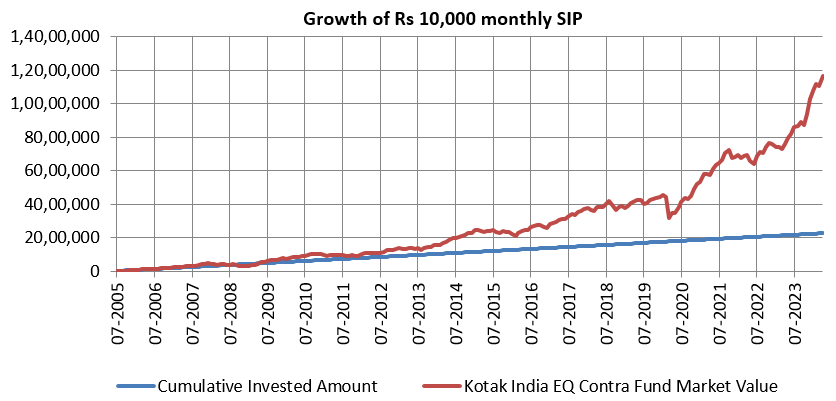

SIP Returns – A wealth creation story

The chart below shows the growth of Rs 10,000 monthly SIP in Kotak India EQ Contra Fund since the inception of the fund. With a cumulative investment of Rs 22.6 lakhs, you could have accumulated a corpus of more than Rs 1.17 crores (as on 30th April 2024). The SIP XIRR over the last 19 years or so was nearly 15.5%.

Source: Advisorkhoj SIP Returns, as on 30th April 2024. Disclaimer: Past performance may or may not be sustained in the future

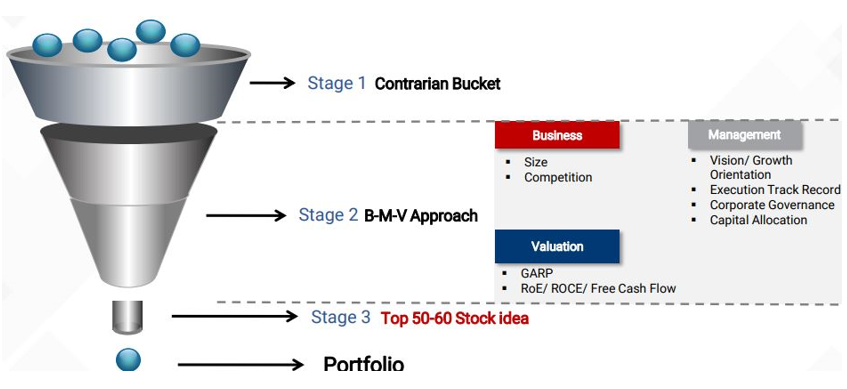

Kotak India EQ Contra Fund – Investment Universe

- Stocks which have underperformed the respective Sector Index

- Stocks which are trading below their Long term average valuations

- Stocks which are trading at valuations which are lower than its peers in the industry

- Stocks trading below 200 DMA (daily moving average)

- Stocks which are fundamentally sound and have long term growth potential but have underperformed Nifty 500 Index

Stock Selection

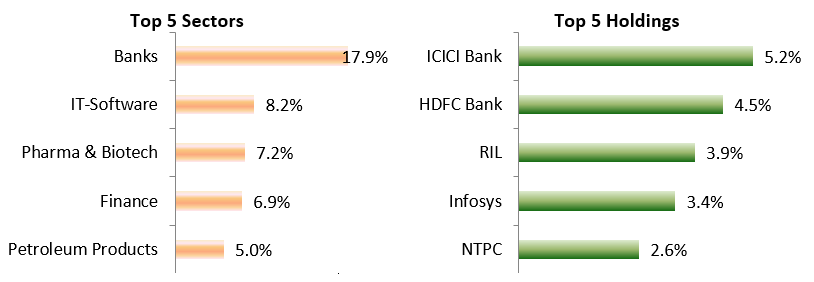

Current Portfolio Positioning

- The fund is positive on capital goods, industrials, pharma, automobiles, cement and select banks and NBFCs

- The fund is OW on pharma sector with greater focus on companies with revenues from the domestic formulations business

- The fund has exposure to Power utilities and power financiers where valuations appear reasonable

- The fund has exposure to select PSUs where by valuations are fair and there is improvement in fundamentals

- The fund is equal weight to the technology sector given the resilience of US economic growth and reasonable valuations

Source: Kotak MF Factsheet, as on 31st March 2024.

Who should invest in Kotak India EQ Contra Fund?

- Investors looking for long capital appreciation using contrarian investment strategy

- Investors with high to very high risk appetites

- Investors with long investment horizons e.g. minimum 5 years

- Investors may invest in the scheme through lump or SIP depending on their financial situation and investment needs

Investors should consult with their financial advisors or mutual fund distributors, if Kotak India EQ Contra Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY