Kotak Energy Opportunities Fund: An attractive long term investment theme

Kotak Mutual Fund is launching a New Fund Offer (NFO) Kotak Energy Opportunities Fund. The fund will invest in companies in the energy theme. The energy theme covers industries like Oil & Gas, coal, power generation, transmission as well as related sector like capital goods (associated with energy theme). Energy sector is vital for a rapidly industrializing economy. As India's economy grows, energy demand will increase at a much faster pace than the past. As such, the energy theme is attractive from a long-term investment perspective. The NFO will open for subscription on 3rd April 2025 and will close on 17th April.

Why invest in the energy theme?

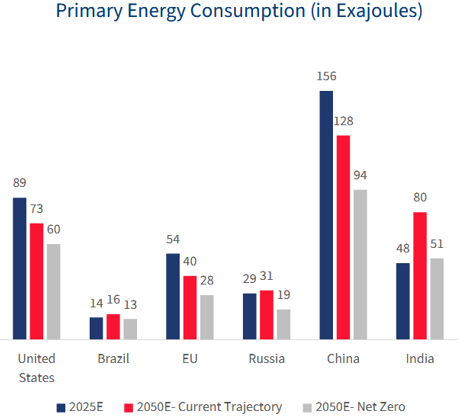

- There is a direct correlation between per capita income and per capita energy consumption. India is ranked 85th in per capita energy consumption. India's per capita income is expected to grow by 70% from US$ 2,700 to US$ 4,200 by 2030. Accordingly, we can expect a big jump in energy demand over the next 5 years.

- India is expected to fastest growing energy consumer in the world over the next two and half decades, both in terms of current trajectory / net zero net scenario.

Source: BP Energy Outlook 2024

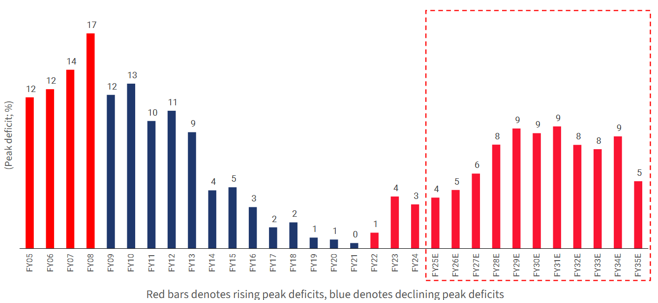

- India is heading towards multi-year power supply deficit (see the chart below). India's installed power generation capacity is expected to double in the next 11 years. 90% of the growth in our power generation is expected to be driven by renewable energy sources (e.g., wind, solar, geothermal, biomass, biomethane and biofuels).

Source: CEA, Goldman Sachs Global Investment Research, Data as on Jan 2025, as per latest data available

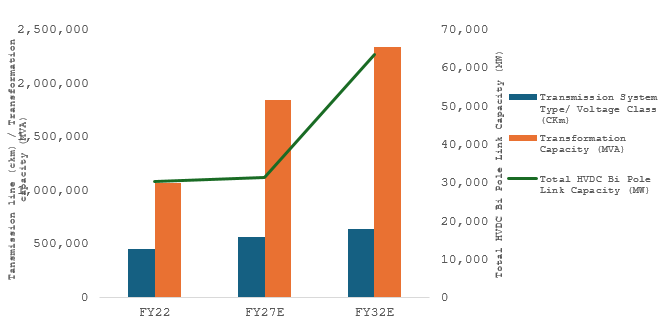

- Transmission infrastructure needs to be expanded to serve the energy needs of industries and consumers. This includes transmission lines, transformers and HVDC capacity.

Source: NEP, CEA. MACM Research, Ckm = circuit kilometres, MVA=mega volt ampere, MW= Megawatt

- New age industries e.g., electric vehicles, data centres, metro railway expansion, railway electrification, green hydrogen and mining can drive the next energy demand growth paradigm. Electric vehicles and data centres can account for 16% of India's incremental electricity demand by 2030 (Source: Kotak MF, Nomura Research report dated November 2024).

- Policy reforms by the Government will boost the energy sector. Pipeline Tariff Rationalization, Gas pricing reforms, Target to increase gas share in energy mix from 6.7% to 15%, Saubhagya Scheme, SHAKTI Scheme, Commercial Coal Mine Auction, RDSS, Atmanirbhar package, LPS Scheme, DISCOM Privatization etc, will incentivize investments in the sector, improve operational efficiencies and margins.

India is in an advantageous position

- 61% of India's installed power generation capacity will be from renewable sources by 2035 (source: Kotak Institutional Equities, January 2025)

- Solar power is a big opportunity for a country like India where there is abundant sunshine. India's installed solar module capacity is expected grow to 80 – 100 GW by FY 2028 (source: MNRE, CLSA, JP Morgan, PV Magazine, as per latest data available; CL stands for CLSA's Estimate).

- PM Surya Ghar is world's largest rooftop solar initiative. Solar panel rooftop installations are projected to grow from 6.3 lakhs in December 2024 to 1crore in March 2027 (source: pib.gov.in, Data as on 12th Feb 2025)

- India's nuclear power generation capacity has grown from 4,780 MW in 2014 to 8180 MW in January 2025. Small modular nuclear reactors can fuel India's Green Energy transition, with nuclear power generation capacity expected to grow to 22,480 MW by 2031-32 (Source: pib.gov.in, as on 3rd Feb 2025).

- India's natural gas consumption is expected to triple by 2050. Global supply of liquified natural gas (LNG surplus) is exceeding demand. In 2025 global LNG supply will exceed demand by 14 billion cubic metres (source: Morgan Stanley report dated Jan 2025). The global surplus of LNG will suit India's energy requirements.

- The Government's thrust on Green Hydrogen will go a long way in achieving energy reliance and net zero emissions by 2050. The Government has set a target of producing 5MMT Green Hydrogen by 2030, with 125GW installed capacity for Green Hydrogen based power generation and transmission network.

How has the energy theme performed?

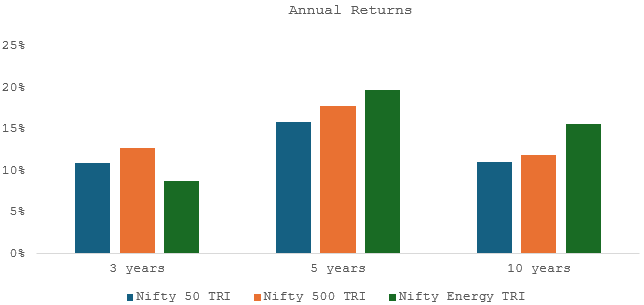

- The chart below shows the annual returns of Nifty 50, Nifty 500 and Nifty Energy indices over the last 10 years. The energy index has show more resilience than the broad market indices, beating the broad market indices 6 times in the last 10 years.

Source: NSE, as on 31st December 2024

- Energy as an investment theme has outperformed the broad market over long investment tenues (see the chart below).

Source: NSE, as on 28th February 2025

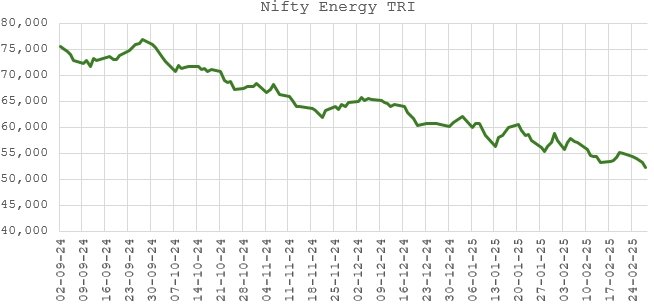

- Nifty Energy TRI has corrected by 30% in last 6 months ending 28th February 2025 (see the chart below). The deep correction can provide attractive entry opportunity for long term investors.

Source: NSE, as on 28th February 2025

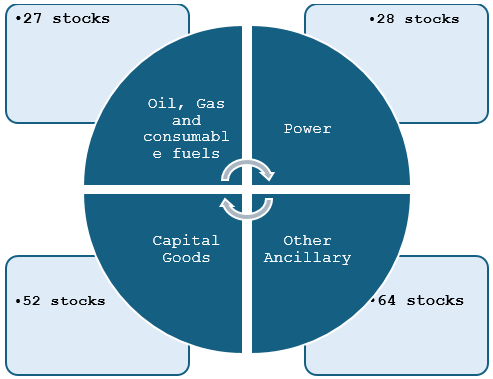

Kotak Energy Opportunities Fund – Investment Universe

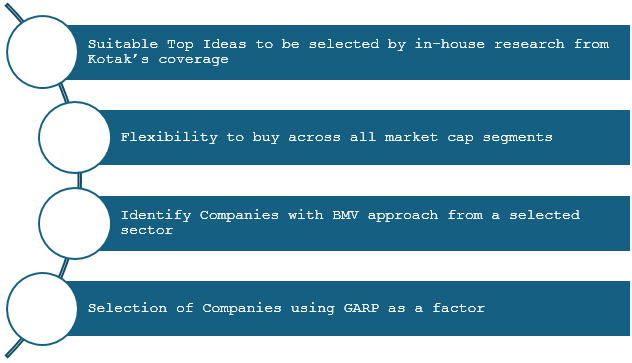

Stock selection strategy

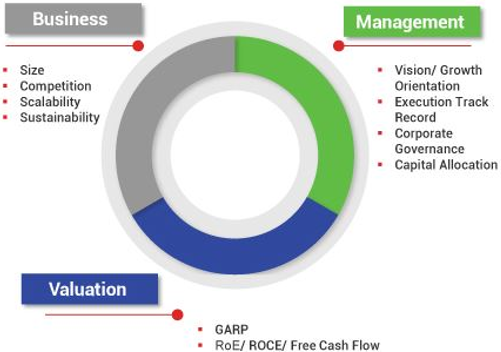

BMV Model

Who should invest in Kotak Energy Opportunities Fund?

- Investors looking for capital appreciation over long investment tenures from the energy theme

- Investors looking for satellite allocations to their core portfolios

- Investors with high to very high-risk appetites

- Investors with minimum 5-year investment tenures

Investors should consult their financial advisors or mutual fund distributors if Kotak Energy opportunities Fund NFO is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY