Kotak ELSS Tax Saver Fund: Tax planning with a consistently performing fund

With just about a month left for the end of the financial year, taxpayers who have chosen the Old Tax Regime, must make their tax savings investments before 31st March 2024. Tax payers can claim deductions of up to Rs 1.5 lakhs from their gross taxable incomes every year by investing in various schemes allowed in Section 80C of Income Tax Act. Investors in the highest tax bracket save up to Rs 46,800 in taxes by claiming deductions u/s 80C. One of most popular 80C investment options is Equity Linked Savings Schemes. In this article, we will review Kotak ELSS Tax Saver Fund, an ELSS mutual fund which enables you to save taxes u/s 80C.

Should you opt for New or Old Tax Regime?

The New Tax Regime introduced in the budget 2020 altered the tax slabs with lower tax rates and removed the deductions that were allowed till then as per the Old Tax Regime. However, if you are able to avail various tax exemptions that are allowed in the Old Tax Regime E.g. Section 80C, 80(D), 80 (CCD), Sec 24 etc. depending on your financial situation, the Old Tax Regime may be more beneficial to you than the New Tax regime. Talk to your tax consultant who can guide you on the Tax Regime that will be the best match to your specific financial situation.

Why is investment in ELSS an attractive proposition?

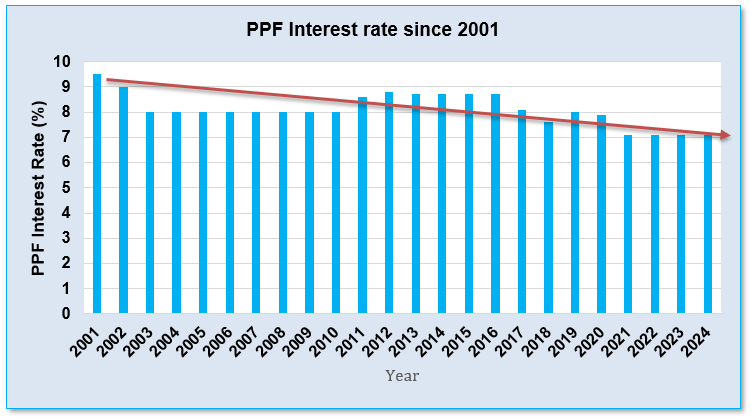

- Interest rates of 80C Government Small Savings Schemes like PPF rates have been steadily declining over the long term

Source: Advisorkhoj

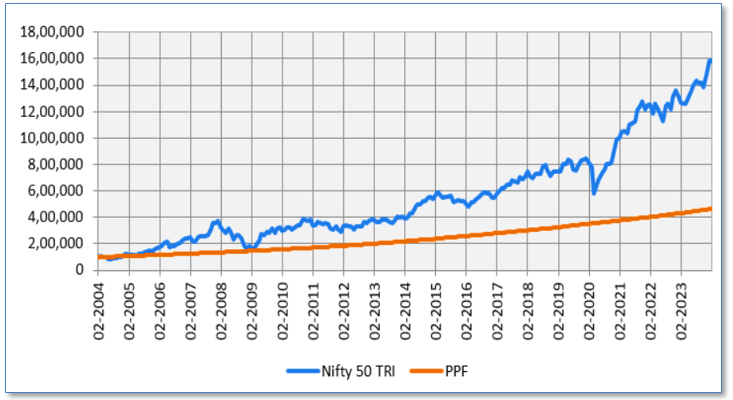

- Historically, equity investment has given better returns compared to other asset classes in the long term. See the chart below which shows the returns from a Rs 1 lakh investment in Nifty 50 TRI compared to returns from PPF over the last 20 years.

Source: NSE, Advisorkhoj as on 31st January 2024

- The 3-year lock in period in ELSS helps fund managers invest in high conviction stocks with less redemption pressures.

- The lock in period of 3 years is the lowest amongst all the tax saving investments.

- ELSS is one of the most tax efficient investments u/s 80C. Capital gains of up to Rs 1 lakh from the fund is exempted from tax and taxed at 10% thereafter.

Kotak ELSS Tax Saver Fund Regular Plan

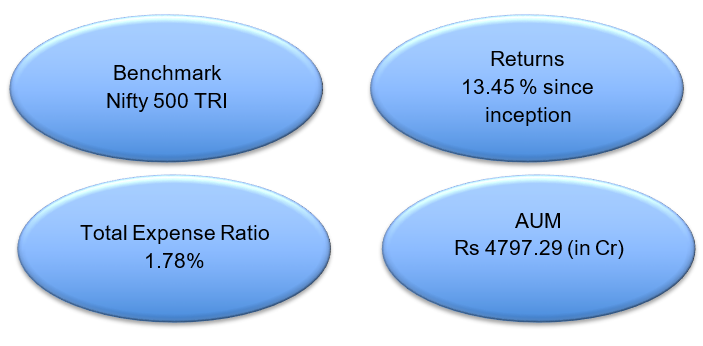

The Kotak ELSS Tax Saver Fund is an open-ended scheme launched in November 2005. The fund is managed by Mr. Harsha Upadhyaya.

Source: Kotak MF factsheet (as on Jan 2024), Advisorkhoj (as on 28th Feb 2024)

Fund Performance

Rs 10,000/ lump sum invested in the fund at its inception would have grown to Rs 99,076/- as on 28th Feb 2024 giving a return of 13.37%.(Source: Advisorkhoj Research).

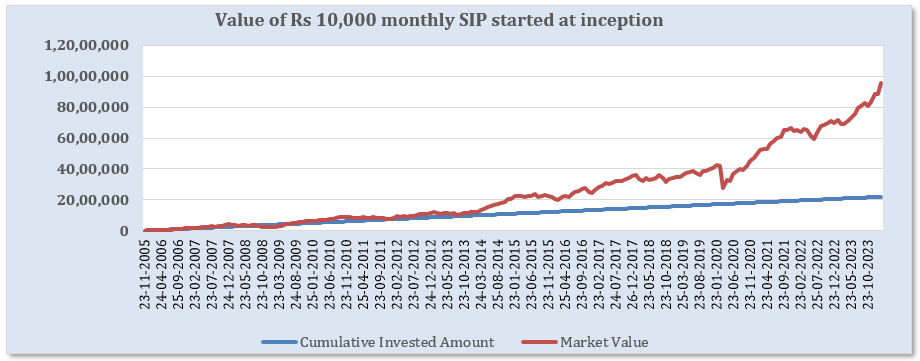

The chart below represents the value of a monthly SIP of Rs 10,000/- started at inception of the fund. The value of the investment is Rs 95.5 lakhs as on 28th February 2024 with a cumulative investment of Rs 22 lakhs giving an XIRR of 14.36%.

Source: www.advisorkhoj.com as on 28th Feb 2024

Rolling Returns

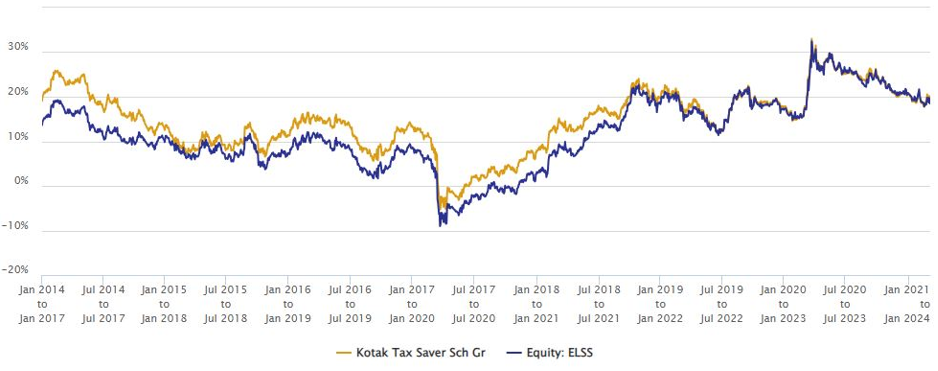

The graph below shows the 3-year rolling return of the fund compared to the category average returns in last 10 years, since 1st January 2014 (Source Advisorkhoj research as on 29th Feb 2024). The fund was able to beat the category average most of the times across various market conditions. The average rolling returns was 14.73% while maximum was 33.02%. The Fund gave over 12% return 68% times in this period.

Source: www.advisorkhoj.com

Quartile Ranking

The scheme has ranked in the upper quartile for 7 out of the last 11 years since 2014. Out of these the scheme claimed the top quartile 3 times. This shows strong performance consistency relative to peers.

Source: Advisorkhoj Research

Investment Strategy

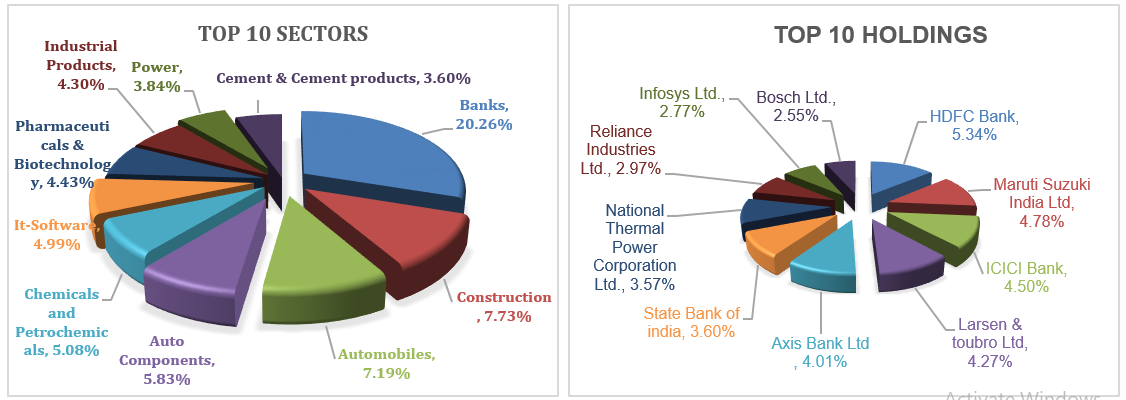

The investment strategy of the fund is based on the principle of GARP or Growth at a Reasonable price. A bottom-up stock selection strategy with a top-down thematic outlay is adopted as an investment strategy to identify the best stock opportunities.

Fund Portfolio

Source: Kotak Mutual Fund Factsheet (31st January 2024)

Why should you invest in the Kotak ELSS Tax Saver Fund?

- It is possible to save taxes worth Rs 46,800/ by investing Rs 1.5 lakhs per year.

- The fund has a flexible investment approach with no bias to any market capitalization. This offers diversified portfolio to investors.

- The 3-year lock in period helps you remain invested through volatility, increasing the chances of long-term capital appreciation.

Who should invest in the Kotak ELSS Tax Saver Fund?

- Investors who have chosen the Old Tax regime and want to avail tax benefits under section 80C of the Income Tax Act, 1961.

- Investors who can stay invested for minimum 3-5 years period.

- Investors who have high risk appetite.

Consult your financial advisor or mutual fund distributor to understand if the Kotak ELSS Tax Saver Fund can align to your financial goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY