Kotak ELSS Tax Saver Fund: Strong performance track record

As we enter the final quarter of the year, you must ensure that you complete your tax planning so that you can fulfil your tax obligations for FY 2024-25 / AY 2025-26. Taxpayers, who have chosen the Old Tax Regime, must make their tax savings investments before 31st March 2024. Tax payers can claim deductions of up to Rs 1.5 lakhs from their gross taxable incomes every year by investing in various schemes allowed in Section 80C of Income Tax Act. Investors in the highest tax bracket save up to Rs 46,800 in taxes by claiming deductions u/s 80C. One of most popular 80C investment options is Equity Linked Savings Schemes. In this article, we will review Kotak ELSS Tax Saver Fund, an ELSS mutual fund which enables you to save taxes u/s 80C.

Why is investment in ELSS an attractive proposition?

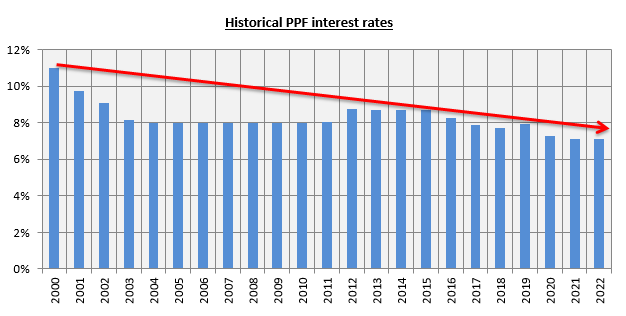

- Interest rates of 80C Government Small Savings Schemes like PPF rates have been steadily declining over the long term

Source: Advisorkhoj Research

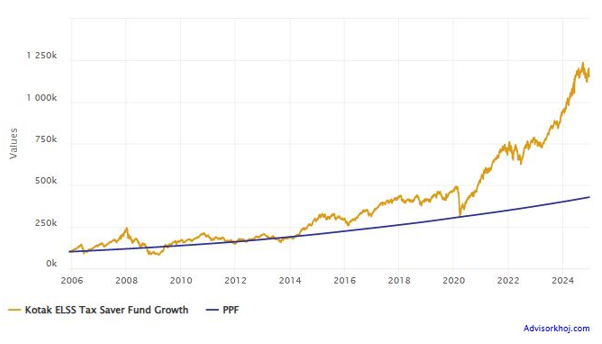

- Historically, equity investment has given better returns compared to other asset classes in the long term. See the chart below which shows the returns from a Rs 1 lakh investment in Kotak ELSS Tax Saver Fund compared to returns from PPF since the inception of the scheme about 19 years back.

Source: Advisorkhoj as on 26th December 2024

- The 3-year lock in period in ELSS helps fund managers invest in high conviction stocks with less redemption pressures.

- The lock in period of 3 years is the lowest amongst all the tax saving investments.

- ELSS is one of the most tax efficient investments u/s 80C. Capital gains of up to Rs 1.25 lakhs from the fund is exempted from tax and taxed at 12.5% thereafter.

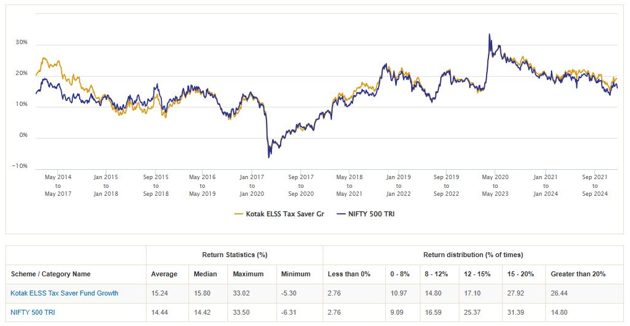

Kotak ELSS Tax Saver Fund – Consistently outperformed the benchmark

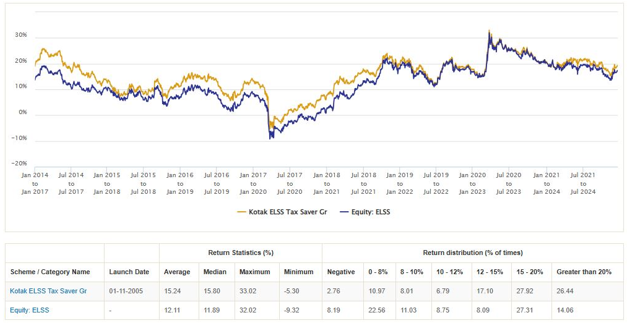

The graph below shows the 3-year rolling return of the fund versus its benchmark index (Nifty 500 TRI) over the last 10 years, since 1st January 2014. The fund was able to beat the category average most of the times across various market conditions. The fund has given negative returns over 3 year investment tenures in less than 3% of the instances, while giving 15%+ CAGR returns in more than 54% instances. You can see that the fund fares favourably in terms of risk / return trade-off.

Source: Advisorkhoj Research

Kotak ELSS Tax Saver Fund – Consistently outperformed peers

The fund has consistently outperformed most of its peers (see the 3 year rolling returns of the fund versus the category average). You can see that average and median rolling returns of the Kotak ELSS Tax Saver were significantly higher than the category average

Source: Advisorkhoj Research

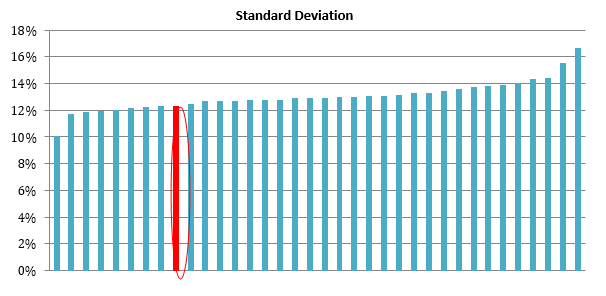

Kotak ELSS Tax Saver Fund – Lower volatility relative to peers

We looked at standard deviations of ELSS funds which have completed at least 3 years. You can see that Kotak ELSS Tax Saver Fund (marked in red) had lower standard deviations relative to most of its peers.

Source: Advisorkhoj Research

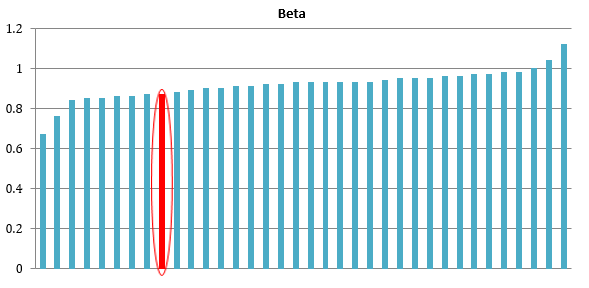

Kotak ELSS Tax Saver Fund – Lower systematic risks relative to peers

Beta is a measure of systematic risk. We looked at betas of ELSS funds which have completed at least 3 years. You can see that Kotak ELSS Tax Saver Fund (marked in red) had lower betas relative to most of its peers.

Source: Advisorkhoj Research

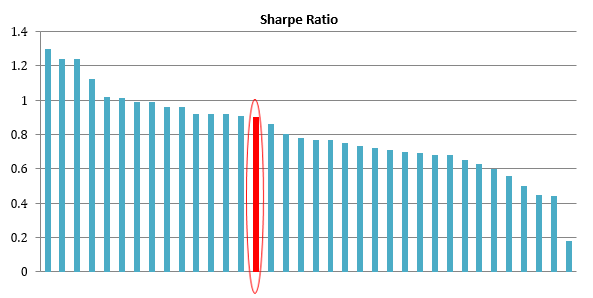

Kotak ELSS Tax Saver Fund – Superior risk adjusted returns relative to peers

Sharpe Ratio is a measure of risk adjusted returns. We looked at the Sharpe Ratios of ELSS funds which have completed at least 3 years. You can see that Kotak ELSS Tax Saver Fund (marked in red) had higher Sharpe relative to most of its peers.

Source: Advisorkhoj Research

Kotak ELSS Tax Saver Fund – Favourable market capture ratios

Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund. Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of Kotak ELSS Tax Saver Fund over the last 3 years.

The Up Market Capture Ratio of Kotak ELSS Tax Saver Fund over last 3 years was 97% which implies that if the benchmark index (Nifty 500 TRI) went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 0.97%. The Down Market Capture Ratio of the fund was 86% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by 0.86%. The market capture ratios of Kotak ELSS Tax Saver Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

Kotak ELSS Tax Saver Fund – Consistently in top quartiles

The Scheme has ranked in the upper quartile for 7 out of the last 11 years since 2014. Out of these the scheme claimed the top quartile 3 times. This shows strong performance consistency relative to peers.

Source: Advisorkhoj Research

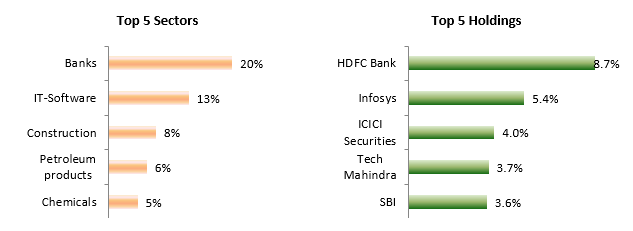

Current Portfolio Positioning

The investment strategy of the fund is based on the principle of GARP or Growth at a Reasonable price. A bottom-up stock selection strategy with a top-down thematic outlay is adopted as an investment strategy to identify the best stock opportunities.

Source: Kotak MF, as on 30th November 2024

Who should invest in the Kotak ELSS Tax saver Fund?

- Investors who have chosen the Old Tax regime and want to avail tax benefits under section 80C of the Income Tax Act, 1961.

- Investors who want wealth creation along with tax savings benefits.

- Investors who can stay invested for minimum 3-5 years period.

- Investors who have high risk appetite.

Consult your financial advisor or mutual fund distributor to understand if the Kotak ELSS Tax Saver Fund is suitable for your tax planning.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY