Kotak BSE PSU Index Fund NFO: Why it makes sense to invest in PSUs now?

Kotak MF has launched a passive fund New Fund Offer (NFO), Kotak BSE PSU Index Fund. As the name implies, the fund will track the BSE PSU Index. The BSE PSU index comprises of major Public Sector Undertakings (Government owned companies) listed on the Bombay Stock Exchange. The NFO has opened for subscription on 10th July 2024 and will close on 24th July 2024.

Why invest in index funds?

Index funds have been gaining popularity globally and here in India. In the last 4 years, the assets under management in index funds multiplied by more than 20 times (source: AMFI, 28th June 2024). Index funds do not aim to beat the benchmark market index, they simply track the index. There are several reasons why index funds appeal to investors.

- Cost Advantage – The Total Expense Ratios (TERs) of index funds are much lower than actively managed funds.

- No Fund Manager Risk – No risk of errors in judgement or human biases since index funds simply track the benchmark index.

- Simple investments – Ideal for new and seasoned investors. No need to check performance track records of different fund managers and understand their investing style.

About BSE PSU Index

Public Sector Undertaking refers to any undertaking wherein the Central Government holding is equal to or more than 51%. BSE PSU index selects all PSUs in BSE 500, top 500 stocks by full market capitalization in Bombay Stock Exchange. There are 61 stocks in total in BSE PSU Index.

Why invest in PSUs (BSE PSU Index)?

- PSUs play an important role in key sectors of the economy e.g. Power (in which PSUs contribute 45% to the market cap), Oil and Gas (PSUs are 36% of market cap), Banking and Financial Services (PSUs are 31% of market cap) and Capital Goods (PSUs are 29% of market cap).

- 90% allocation of BSE PSU Index is to key sectors. Hence the performance of BSE PSU Index is directly correlated to the long term economic growth of India.

- India is in a macro sweet spot with benign inflation, improve fiscal situation (narrowing fiscal deficit), strong GDP growth (highest GDP growth among G-20 economies in FY 2024 and FY 2025 forecasts), strong manufacturing and services sector growth etc. India is expected to become the 3rd largest economy by 2027 (as per IMF’s forecasts). PSUs will play an important role in the India Growth Story are likely to be beneficiaries of economic growth from an investment standpoint.

- PSUs are spread across diverse sectors like Power, Financial Services, Energy, Metals, Defence, Fertilizers, Agriculture etc. You will get diversified stock and sector exposure and reduce portfolio risks.

- PSUs are key beneficiaries of Government reforms like Pradhan Mantri Jan Dhan Yojana (Banking), Pradhan Mantri Awas Yojana (Housing), Ujjwal DISCOM Assurance Yojana (Power), Atmanirbhar Bharat (Manufacturing, Industrial Products, and Defence), Insolvency and Bankruptcy code (Banking) and Direct Benefit Transfer (Banking).

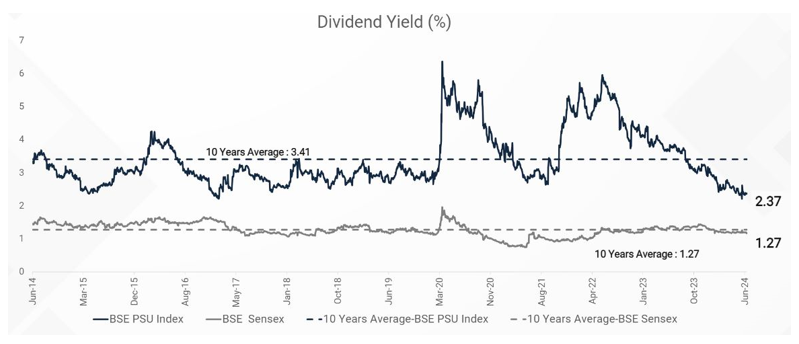

- PSUs with strong financial performance have a track record of paying dividends since the dividends are a source of income for the Government. The historical dividend yields of BSE PSU Index are significantly higher than Sensex on average (see the chart below).

Source: Bloomberg, Kotak AMC, as on 28th June 2024

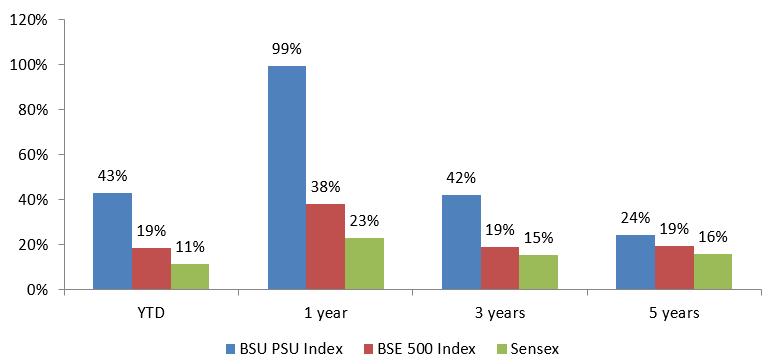

- BSE PSU Index has outperformed Sensex and broad market index like BSE 500 in recent times (over the last 5 years or so, see the chart below). The PSU Index has continued its outperformance in 2024 also.

Source: BSE, Advisorkhoj Research, as on 9th July 2024

Why has PSU Index Outperformed?

The outperformance can be attributed to a combination of cyclical and structural factors. Key reasons benefiting PSU companies in various sectors include:

- Energy: Rising coal prices by over 30% and increased production

- Oil & Gas: Higher global oil and gas prices, improved refining margins, higher revenues and PAT

- PSU Banks: Improved financial performance, reduction in NPAs and increased profitability

- Defence: Increased Government spending in defence and substantial order book growth

- Power: Increased infrastructure spending by Government and higher capex spending

- Metals and mining: Higher global commodity prices and production volumes

- Shipping: Strategic disinvestments and improved operational efficiencies.

PSUs are vital for a resilient and future ready Amrit Kaal economy. Accordingly, the outlook for these stocks is bright in the long term.

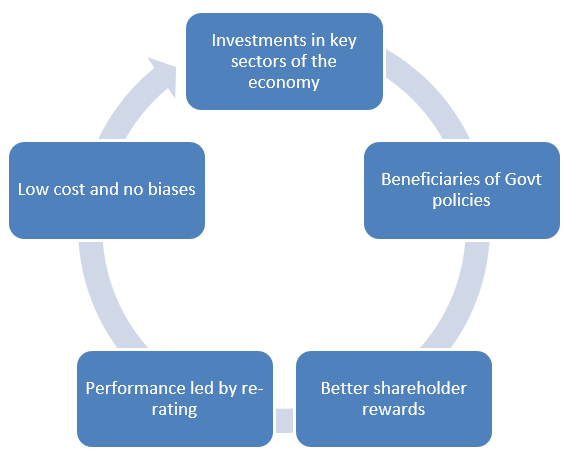

Summarizing - Why invest in Kotak BSE PSU Index Fund?

Who should invest in Kotak BSE PSU Index Fund?

- Investors looking for capital appreciation over long investment tenures

- Investors with high to very high risk appetites

- Investors who seek exposure to PSU stocks with diversification across multiple sectors.

- Investors with minimum 5 years investment horizon

- You can invest in lump sum or SIP according to your financial situation and investment needs

Investors should consult their financial advisors or mutual fund distributors if Kotak BSE PSU Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY