Why is it best to invest in Multi Cap Funds

Multi-Cap funds are equity mutual fund schemes which invest across industry sectors and market capitalization segments i.e. large cap, midcap and small cap. These mutual funds tend to perform well across different market conditions, reducing volatility and at the same, good alphas (relative returns) for investors in the long run. As such, multi-cap funds are ideal long term investment options for retail mutual fund investors who may not have the expertise to understand different stages of investment cycles.

Flexibility to invest across market cap segments

Different market capitalization segments outperform or underperform each other in different market conditions. For example, midcap and small cap stocks tend to outperform large cap stocks in bull markets, while large cap stocks outperform in volatile markets. In volatile markets or corrections, small cap stocks tend to underperform midcap stocks.

SEBI has clear definitions with regards to the constitution of different market cap segments. The Top 100 stocks by market capitalization are classified as large caps stocks. The next 150 stocks by market capitalization are classified as midcap and the rest as small cap.

In its mutual fund reclassification circular SEBI has also laid out mandates for different equity mutual fund categories. Large cap funds must invest at least 80% of their assets in large cap stocks. Midcap and small cap funds must invest at least 65% of their assets in midcap and small cap stocks respectively. Another equity fund category, Large and Midcap funds must invest at least 35% of their assets in large cap stocks and another 35% (minimum) in midcap funds.

There is no such restriction in the case of multi-cap funds. This enables multi-cap fund managers to take more advantage of different investment opportunities which emerges from time to time, compared to other equity fund categories which have restricted mandates. For example, in bear markets when midcap and small cap valuations become attractive, multi-cap funds can increase their midcap and small cap allocations without any restriction; a large cap fund, on the other hand, can invest a maximum of 20% in midcap and small cap stocks. Similarly at bull market peaks, when midcap and small cap valuations get overheated, midcap and small cap funds can increase allocations to large cap and cash only up to 35%. For the balance of their stock portfolio, if there over-valued stocks, fund managers have to look at opportunities in midcap or small cap space only. This can often be challenging because free float market capitalization of midcap and small cap stocks in India is still quite low.

The flexible mandate of multi-cap funds enable fund managers to book profits at the right time in over-valued stocks, exploit attractive investment opportunities and also provide relative stability to investors in highly volatile markets. From a diversification perspective, multi-cap funds are the truest diversified equity funds.

Risk Profiles

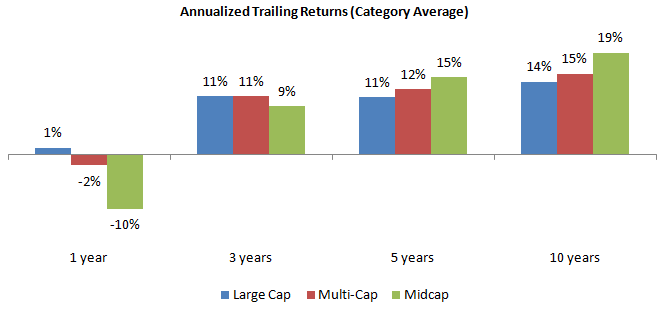

The risk profile of multi-cap funds is midway between large cap funds and midcap funds. Multi-cap funds have higher risk profiles compared to large cap funds, but lower risk profile compared to midcap funds - these funds tend to be more volatile than large cap funds, but less volatile than midcap funds. They are likely to underperform versus large cap funds in bear markets, but outperform midcap and small cap funds in corrections. In the long term, multi-cap funds tend to outperform large cap funds and can often give returns similar to midcap funds. Over very long investment periods however, midcap funds tend to outperform multi-cap.

How to invest in Multi-Cap Funds

You can invest in multi-cap funds both in lump sum and through Systematic Investment Plans (SIP). Since multi-cap funds tend to give superior long term returns compared to large cap funds, the power of compounding is more amplified in multi-cap funds compared to large cap funds when investing through SIP. At the same time, since they are more volatile than large cap funds, multi-cap funds can reap bigger benefits of Rupee Cost Averaging when investing through SIP. However, since multi-cap funds are less volatile than midcap and small cap funds, you can also take advantage of market corrections by tactically investing in lump sum with lesser worries of downside risk, if market corrects even further. Deep corrections offer the best investment opportunities for equity investors. Investing tactically in deep market corrections can significantly boost your portfolio returns. Both lump sum investments and SIP in multi-cap funds can give excellent returns in the long term. You should invest according to your financial situation and goals. You should consult with a financial advisor, if required.

Conclusion

- Multi-cap funds invest across market cap segments. There are no restrictions with regards to allocations to a specific market cap segment.

- The large cap allocation of multi-cap funds provide stability in volatile markets, while the midcap and small cap allocations enable multi-cap funds to beat market returns and generate alphas for investors.

- The flexible mandate of multi-cap funds enables their fund manager to take advantage of emerging opportunities and reduce risk more effectively than other equity fund categories.

- You can invest both in lump sum and through SIPs in multi-cap funds. However, you should have long investment tenure (ideally at least 5 years) for investing in these funds.

- Multi-cap funds are suitable for investors with moderately high to high risk appetites for their long term financial goals like children’s education, marriage and retirement planning etc.

- However, if you are a new investor or do not have sufficient experience in mutual fund investing, then you should consult with a financial advisor.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

ITI Mutual Fund aims to offer high-quality investment solutions to investors seeking long term wealth creation. We have access to some of the finest minds in the Investment Management, Equity Research and Credit Research space that enables us to run a very unique investment philosophy and also deploy robust investment strategies that can stand the test of time. The agility, no baggage and fresh perspective can help investors get ahead in a rapidly evolving economy.

Welcome to your future, to ITI Mutual Fund.

Our Products

POST A QUERY