Nifty Alpha 50 Index aims to add stocks that have displayed high alpha compared to the market

BFSI Industry Interview

Mr. Gaurab Parija is the Head - Sales and Marketing. He has over 25 years of experience in sales, marketing, business development, and driving strategic initiatives.

Mr. Parija is responsible for driving accelerated business growth working with seasoned sales and marketing teams across India, focusing on building strong partnerships and enhancing value to clients. He brings in over two decades of mutual fund experience in Retail Sales and Distribution and is amongst the most seasoned sales and marketing professionals in our industry. His deep relationships and passion to add value to clients make him stand out in the industry.

He has been associated with the fund house since March 2017. Prior to Bandhan Mutual Fund, he was associated with Franklin Templeton Services (I) Pvt Limited as a Director, responsible for New Initiatives and Business Development, CEMEA/India (March 2014 to March 2017). Prior to that he was associated with Franklin Templeton Asset Management (I) Pvt Ltd as National Sales Director (April 2009 to Feb 2014), Head – Retail Advisory Services (Jan 2008 to March 2009), and Head – Alternate Distribution (June 2006 to Dec 2007).

Mr. Parija holds a Post Graduate Diploma in Business Management (PGDBM) from IIM – Bangalore.

How would you define factor investing, and how is it different from plain vanilla passive investing in broad-based indices or sector indices?

Factor investing is an investment approach that selects securities based on ‘factors’ historically linked with potentially high returns or lower risk. A factor is a characteristic beyond the overall market that makes some investments perform better (higher return or lower risk). One can target multiple factors; some of the most commonly tracked factors are Momentum, Alpha, Low Volatility, Quality, and Value.

Factor investing combines the best of both active and passive investing. It aims to outperform the market, akin to active investing, but does so through rule-based and cost-effective methods, aligning with the principles of passive investing.

With the growing awareness around passive investing, Indian investors are increasingly embracing factor investing over traditional market beta strategies.

What are the drivers of a favorable portfolio return? How have the drivers of portfolio returns changed over the years?

A common question every investor or data enthusiast have is why some portfolios perform better than others. Before the 1960s, investors thought that certain portfolios did well due to the fund manager’s skill, but between 1960-80, research indicated that fund managers' skill wasn’t the sole contributor, but the market return was also a major component. By the 1990s and early 2000s, research identified that ‘factors’ also contributed to the portfolio return in addition to market return and fund manager’s skill.

Interestingly, the drivers of return are ever-evolving, and as we speak, there could be more return drivers being discovered.

You have launched the Bandhan Nifty Alpha 50 Index Fund. For the benefit of retail investors and mutual fund distributors, please describe the characteristics of the Nifty Alpha 50 Index?

The Bandhan Nifty Alpha 50 Index fund will track the Nifty Alpha 50 Index, which is a factor-based index designed to capture the alpha factor. The index aims to add stocks that have displayed high alpha compared to the market and remove stocks where the alpha is diminishing. The alpha for each of the stock is based on Jensen’s Alpha computed using 1-year trailing prices.

Alpha, in simplest terms, means excess return in relation to the market after adjusting for the risk.

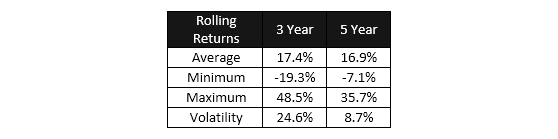

Most DIY investors attempt to implement a similar strategy. However, this approach requires constant monitoring and requires investors to manage their emotions. Additionally, it may not be tax efficient. In contrast, the strategy will be based on clear rules, weeding out emotions, and will be tax efficient. On a 3 & 5-year rolling return basis, over the past 15 years, the Nifty Alpha 50 Index has delivered an alpha of over ~5% over the Nifty 50, albeit with higher volatility.

Source/Disclaimer - Bandhan MF, NSE. Data as of the close of 01st April 2005 to 30th September 2023. Performance results may have inherent limitations, and no representation is made that any investor will or is likely to achieve. Past performance may or may not be sustained in the future.

How has the Alpha strategy in the benchmark index performed in different investment cycles?

The Nifty Alpha 50 Index (Referred to as Alpha strategy hereon) embraces a high-risk, high-reward approach and historically has tended to outperform the broad market significantly during strong bull markets. Conversely, it may underperform during bear markets. Investors might see volatility in the short term, but if investors stay invested for the long term, the strategy can potentially generate higher returns.

Disclaimer - Bandhan MF, NSE. Data as on 30th September 2023. Performance results may have inherent limitations, and no representation is made that any investor will or is likely to achieve. Past performance may or may not be sustained in the future.

From the investor’s perspective, how is Bandhan Nifty Alpha 50 Index Fund different from an actively managed diversified equity fund whose objective is also to create alphas? Please explain?

In an actively managed fund, a skilled fund manager tries to beat the market by investing in stocks based on their growth potential, valuation or other such parameters. As it requires a huge amount of research, it entails a relatively higher expense ratio. Actively managed funds are also exposed to respective fund manager biases. In contrast, the Nifty Alpha 50 index fund is a factor-based fund. Factor investing is a rule-based and low-cost approach that attempts to beat the broader market by focusing on specific factor/factors.

The market has been very volatile for the last few weeks. Is this a good time to invest in the Bandhan Nifty 50 Alpha Index Fund from a long-term perspective? Please share your views?

With markets being volatile and this strategy being high-risk, it is true that one may see heightened volatility in the near future. But that said, an investor needs to evaluate a strategy basis his goal and risk appetite. If an investor intends to hold the fund for the long term, the recent market volatility should not act as a deterrent. Also, staggered investments in a volatile market condition could offer an investor decent entry points.

And I will end by saying that time in the market is more important than timing the market.

What should the investors be prepared for while investing in the Bandhan Nifty Alpha 50 Index Fund? What is the minimum investment tenure you recommend for this fund?

An investment horizon of a minimum of 3-5 years is recommended. Historically, an investment horizon of 3 years has seen reduced volatility with the potential to generate excess return compared to the broader market.

Source - Bandhan MF, NSE. Data as on 30th September 2023. Performance results may have inherent limitations, and no representation is made that any investor will or is likely to achieve. Past performance may or may not be sustained in the future.

Index Funds are being favored by individual investors. The growth in the assets under management & folios for index funds represents the same. What could be the reasons for this? & why do individual investors prefer index funds over ETFs?

A significant factor driving investor interest in passive funds is the increasing awareness fostered by the industry. This awareness gained credibility as passive funds demonstrated strong performance after the pandemic. Furthermore, with the growing popularity of investment platforms, a lot of DIY investors have gravitated towards passive funds due to their simplicity and cost-effectiveness. Unlike an ETF, the operational aspect of index funds is very similar to mutual funds making it easy for investors to invest via Systematic Invest Plan (SIP), Systematic Transfer Plan (STP), and lumpsum.

Through this interview, what message would you like to give to Distribution Partners and investors, given the current market dynamics?

The core idea behind factor investing is to know which factors, beyond the overall market, make some investments better or worse and then specifically target those factors in a rule-based manner. The alpha factor strategically invests in securities displaying significant alpha compared to the market, and it systematically exits those positions as its alpha diminishes.

The Nifty Alpha 50 Index is designed to be nimble and adapts to changing market conditions, with dynamic allocation across sectors as well as market caps – the fund can take exposure across Large, Mid, and Small-cap segments. Since this is an aggressive strategy, we would recommend this fund to those investors with a high-risk appetite. One could also look at combining the Alpha strategy with a broader market strategy with an aim to build a portfolio with potentially higher return, albeit with slightly higher risk.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully

The Disclosures of opinions/in-house views/strategy incorporated herein are provided solely to enhance the transparency about the investment strategy/theme of the Scheme. They should not be treated as endorsement of the views/opinions or as investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information that is already available in publicly accessible media or developed through analysis of Bandhan Mutual Fund. The information/views/opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision, and the security may or may not continue to form part of the scheme’s portfolio in the future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals, and horizon. The decision of the Investment Manager may not always be profitable, as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither Bandhan Mutual Fund (formerly known as IDFC Mutual Fund)/ Bandhan Mutual Fund Trustee Limited (formerly IDFC AMC Trustee Company Limited) / Bandhan AMC Limited (formerly IDFC Asset Management Company Limited), its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

Recent Interviews

-

Partner Connect by Advisorkhoj with Mr Amit Kalra Glorious Path Pvt Ltd New Delhi

Dec 5, 2025

-

Partner Connect by Advisorkhoj with Mr Alok Dubey PrimeWealth Pune

Dec 1, 2025

-

In Conversation by Advisorkhoj with Ms Aparna Shanker Chief Investment Officer Equity The Wealth Company Mutual Fund

Nov 28, 2025

-

In Conversation by Advisorkhoj with Mr Sanjay Bembalkar Head Equity Union MF

Nov 28, 2025

-

In Conversation by Advisorkhoj with Mr Arjun Khanna Equity Fund Manager Kotak Mutual Fund

Nov 17, 2025

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team