It is a concentrated growth oriented portfolio with high conviction ideas

BFSI Industry Interview

Mr. Dhimant Shah is the Senior Fund Manager at ITI Mutual Fund. Dhimant is a Chartered Accountant. He has 26 years of experience in the Capital Market.

Mr. Rohan Korde is the Fund Manager at ITI Mutual Fund. Rohan is a MMS (Finance). He has 19 years of experience in the Capital Market.

What is your outlook on US interest rates and global economic growth for the next 12 - 18 months?

The US Fed expectedly raised the benchmark rate by 25 bps (100 bps = 1.0%) to 5.0% - 5.25% target range in the May 2023 FOMC meeting. While the FOMC’s latest statement omitted the prior language that signalled additional hikes ahead, the Committee indicated that it would monitor the extent to which more firming would be appropriate would hinge on the lag effect of the past cumulative rate hikes on economic activity and inflation and economic and financial developments.

Importantly, the FOMC’s inflation forecast outlook does not support rate cuts in 2023, and thus gap between the US Central Bank stance and market expectations continues to be a significant risk.

Whereas market appears to be factoring in near-term peaking out of interest rates, possibly followed by a rate cut cycle after a span of stability in rates.

What will be the impact of global macro-economic events on Indian equities in the short to medium term? What is your outlook for Indian equities?

Market appears to be factoring in near-term peaking out of interest rates, possibly followed by a rate cut cycle after a span of stability in rates. For India, valuations are benign amidst supportive macro provides comfort. Indian equities are trading at mean levels, both relative to long term averages (price to earnings, price to book, market cap to GDP), and relative to emerging and developed markets. Supportive macros (normal monsoon, benign crude and commodity prices, strong domestic capex triggers, continued traction in domestic economic activity levels, and softer than earlier anticipated global slowdown) provide comfort, hence we remain optimistic on Indian equities.

Compared to other nations, including the advanced economies, India is relatively better prepared to handle external shocks that could be created by the tightening of the monetary policy stance. We reiterate our observation that as compared to previous periods of hawkish policy stance, this time around, the inflation differential is in India's favour, due to which policymakers may not follow the Fed completely. India has been a fast-growing economy, even during the difficult times of the pandemic, underpinned by structural reforms, which should serve well ahead.

Strong fundamentals of the Indian banking system and unlikelihood of any system risk to it, positive trends from the Budget 2023, and persistent selling by FPI's being absorbed by domestic investors give credence to the long-term India story regardless of any near-term blips or volatility. Of course, the FII flow trend has reversed in the near-term as FIIs flows remained positive at USD1.9b for the second consecutive month in CY23. DIIs remained net buyers with inflows of Rs0.3b. Consumption remains K-shaped with rural growth yet to return. However, construction activity has become more broad based and upcoming elections should help boost public capex.

In this backdrop, we maintain our strategy of holding largely sector neutral portfolios to navigate this uncertainty.

Are you seeing attractive investment opportunities for across market cap segments at current valuations for long term investors?

Valuations have corrected significantly. Out of NSE 500 companies universe, 67% of companies have provided returns in range of less than 0% to -50% from Oct 2021 till March 2023.

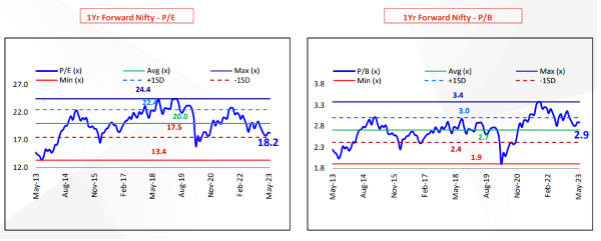

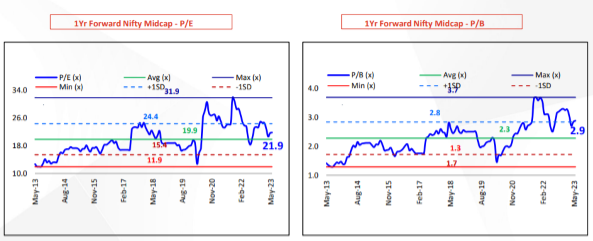

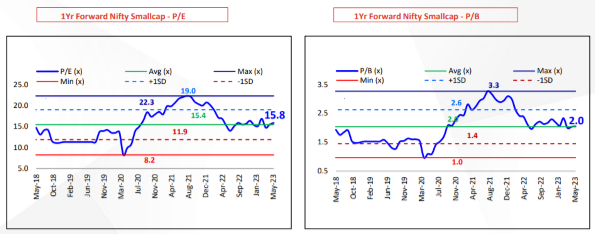

Also 1yr Forward P/E of Large Cap, Mid cap, Small Cap suggest moderation in correction multiples of Large Cap, Mid Cap, & Small Cap.

Valuations: Large Cap

Valuations: Mid Cap

Valuations: Small Cap

Source: Bulls & Bears Report, Motilal Oswal, April 2023

You are launching a focused fund, ITI Focused Equity Fund. Please describe the salient features of this scheme?

Yes, so as mentioned above with opportunities being available across Market Cap, we are launching ITI Focused Equity NFO starting on 29th May 2023 till 12th June 2023.

ITI Focused Equity fund is a concentrated growth oriented portfolio with maximum 30 stocks across Market Cap.

The Salient features of ITI Focused Equity Fund are as follows: -

- Portfolio that comprises of compounding picks which have better earnings prospects & faster growth.

- Portfolio that is Sector Agnostic with focus being on bottom up stock picking

- Portfolio that is Market Cap Agnostic with no specific constraint on Market Cap with proportion being decided merely by risk reward potential.

- It is a concentrated growth oriented portfolio with high conviction ideas by the Fund Manager.

For the benefit of retail investors and mutual fund distributors please explain benefits of concentration versus diversification, which retail mutual fund investors are more familiar with?

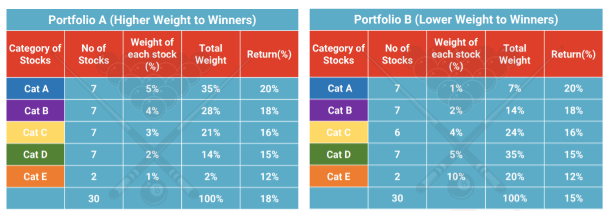

Let us illustrate same using following examples

Higher allocation to conviction stocks may pay off. Portfolio A delivered 18% returns due to optimal weights to top performers. Portfolio B delivered returns of 15% due to lower weightage to top performing stocks. Therefore, Alpha of 3% from Portfolio A due to right weight to winners helps provide an added edge over a diversified approach.

Note: Illustration to highlight that higher weight allocation to stocks with higher returns will help portfolio to generate higher returns. Above is for illustration purpose only Higher returns attracts higher risks. The above table is an illustration of a stated example and is not the actual performance of the scheme. The above is for representation only and should not be construed as return projection or be used for development or implementation of an investment strategy. Past performance may or may not be sustained in future

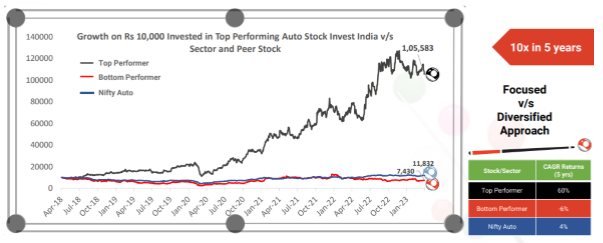

Similarly a focused v/s a diversified approach can make significant difference to Investor returns

For e.g. In example above, the Top Performer has generated sizeable wealth i.e 10x in 5 years compared to a bottom performing auto stock.

The Top performing stock has generated significant ROE, ROCE & is associated with a leading conglomerate group and has expanded capacity into precision blades, gear boxes, etc.

Whereas the bottom performing auto stock could not cope up with intense competition, high dependance towards foreign countries & cyclicality of the business.

Thereby, focused funds may help provide reasonable risk adjusted returns compared to a diversified approach.

Source: NSE, Internal data & Calculations; Data as on Apr 2023, All returns are 5 Year CAGR. Past performance may or may not be sustained in the future. Sector(s) / Stock(s)/Issuers(s) mentioned above are for the purpose of illustration to explain the concept of focused approach and should not be construed as recommendation or indication of any future returns in the company. The fund manager(s) may or may not choose to hold the stock mentioned from time to time. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). Sectors/Stocks mentioned may or may not form part of actual portfolio of ITI Focused Equity Fund

How will you identify high conviction stocks for your focused fund? Please describe your approach?

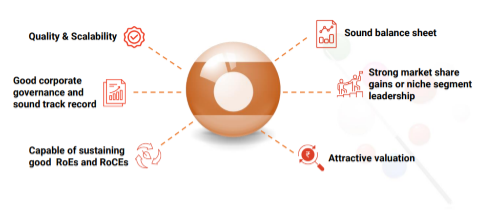

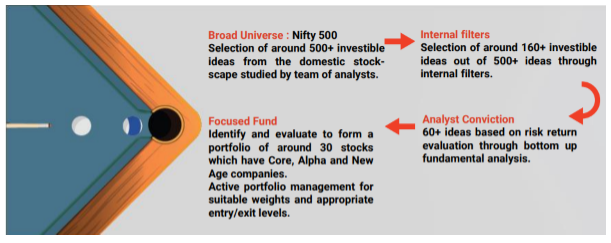

The portfolio shall comprise of stocks that are filtered based on following Portfolio Creation Approach. Stocks are identified based on:-

- Strong size of opportunity

- Areas where it involves high technology intensity and entry barriers

- Companies able to maintain leadership augmenting capacities, market share & newer capabilities in their space

- Turnaround candidates vitiated by temporary events like duties, unabated imports, labour problems etc

- Focus on stocks which have characteristics & management capability to sustain high growth resulting into their ability to outgrow peers

- Stocks that transgress from being a small cap to a midcap, &/or from a midcap to a large cap functionally these buckets will be strongest buckets of wealth creation

- New Age Companies

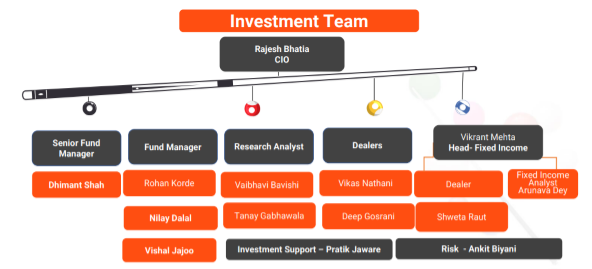

Please describe the capabilities your equity investment team including your research team. Briefly describe your fund management process?

Our Team comprises of our CIO, Mr. Rajesh Bhatia followed by experienced Fund Managers like Mr Dhimant Shah & Mr Rohan Korde having experience of 26 years & 19 years in financial markets respectively.

We also have Mr Nilay Dalal & Mr Vishal Jajoo who have been recent additions to the Investment Team along with 2 Equity Research Analysts, & 2 dealers

Our Fixed Income funds managed by Mr Vikrant Mehta.

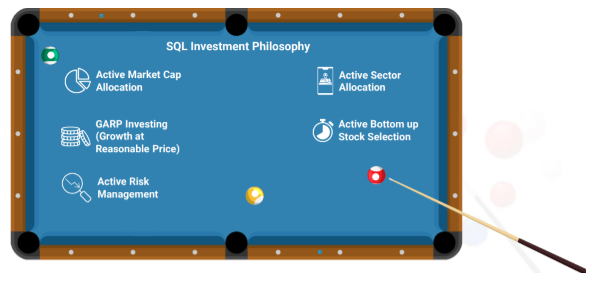

At ITI, we follow a robust SQL framework S-Margin of Safety; Q-Quality of Business & L-Low Leverage which we follow across funds. The Key attributes to same are:

The Process for stock selection that stems from same is described in the image

What will be your general advice to investors or MFDs looking to invest in ITI Focused Equity Fund? How should they approach this fund? What should be the minimum investment horizon?

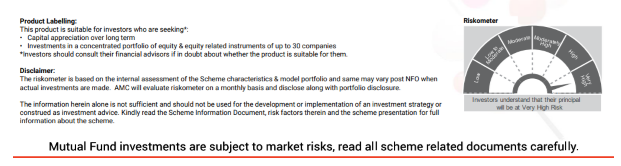

The fund is ideal for investors with a long-term investment horizon of 5 years and above.

MFDs can consider same for their investors looking to invest in Focused Portfolio as a part of their Asset Allocation & those having relatively higher risk appetite and willing to take exposure to equities.

It is also ideal for investors seeking potential for higher risk-adjusted returns with ability to with-stand higher volatility.

Focused Funds help build reasonable wealth as they are optimally positioned in relation to broader market indices for potential alpha creation

The hand picked ideas reflect fund manager’s conviction and all these stocks are backed by adequate research and filtration process as mentioned below.

The NFO opens on 29th May 2023. So give your portfolio the edge of focus with ITI Focused Equity Fund.

Recent Interviews

-

In conversation with Mr Vaibhav Shah Head Products: Business Strategy & International Business Mirae Asset Mutual Fund India

Apr 18, 2025

-

In conversation with Mr Kaustubh Sule Senior Fund Manager Fixed Income with Groww Mutual Fund

Apr 18, 2025

-

In conversation with Mr Abhishek Tiwari Chief Business Officer of PGIM India Mutual Fund

Apr 5, 2025

-

In Conversation with Mr Akhil Chaturvedi Executive Director & Chief Business Officer with Motilal Oswal Mutual Fund

Mar 26, 2025

-

In conversation with Mr Rohit Seksaria Fund Manager Equity with Sundaram Mutual Fund

Mar 7, 2025

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team