How Sustainable Is Stellar Growth Of India

BFSI Industry Interview

Sukumar Rajah is the Managing Director, Chief Investment Officer, Franklin Templeton Local Asset Management, Asian Equity. India's stellar market performance over the last 12 months has left many observers asking whether it is sustainable longer term. He finds reasons to believe India's star is on the rise and long-term confidence can be restored. He looks at some of the details of the newly unveiled 2015 Union Budget and points to some low-hanging fruit for new Indian Prime Minister Narendra Modi to consider as he embarks on a much-anticipated reform programme.

India’s stellar market performance over the last 12 months has left many observers asking whether it is sustainable longer term. Sukumar Rajah, managing director and chief investment officer, Local Asset Management, Asian Equity, finds reasons to believe India’s star is on the rise and long-term confidence can be restored. He looks at some of the details of the newly unveiled 2015 Union Budget and points to some low-hanging fruit for new Indian Prime Minister Narendra Modi to consider as he embarks on a much-anticipated reform programme.

By most reckonings, India had an astounding 2014: The MSCI India Index was up a global chart-topping 24.9%1 for the year, representing its best 12-month performance in five years, while corporate earnings grew at 16%,2 outstripping virtually every other country in the world.

With that in mind, it is understandable that investors should be cautious about whether such a stellar performance is sustainable or even repeatable.

Our team of analysts and other investment professionals on the ground in India believe it is one of the few markets in the world where long-term fundamentals, as well as short-term fundamentals, are on track to show continued improvement.

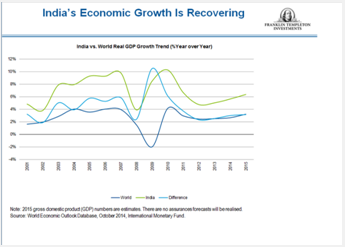

From a short-term point of view, India appears to be recovering from a slowdown which has weighed on the economy in the last few years. Now we’re seeing an acceleration in India’s gross domestic product (GDP) growth. At the same time, some of the imbalances which have been putting pressure on the economy, such as current account deficit, high inflation and high fiscal deficit, show signs of receding. We believe there is evidence of a cyclical recovery in India and also signs that the market has already turned.

It is not just the prospect of this cyclical recovery that is driving our thinking. We also think India looks very attractive from a long-term point of view. Indeed, in our view, the growth potential for India, on a long-term basis, is far higher compared to a lot of other markets in the world, thanks to a number of factors including industrialisation, changing demographics and the programme of reforms the government is planning to implement.

Like many other emerging markets, India is seeing a push towards greater industrialisation and a growing need for infrastructure that is prompting governments to spend significant amounts of money on roads and railways for instance.

Underpinning these trends are strong demographics, represented by a growing middle class, an increasing population of consumers and a deepening pool of workforce talent.

We see India’s growth driven in part by domestic consumption of durable goods from a vast number of educated consumers under the age of 25. Furthermore, the country’s youthful population creates a positive demographic with a lower dependency ratio than many other developed countries.

And we believe India’s middle class has the potential to grow further, contributing to an even greater consumer market. Meanwhile, we will also be watching the progress of promised structural reforms. In the aftermath of last year’s Indian general election, there was a belief that newly elected Prime Minister Narendra Modi would lead a more business-friendly administration. His National Democratic Alliance government has certainly spoken a lot about reform, both administrative and legislative.

We believe administrative reforms—such as speeding up the issuing of business licences—are low-hanging fruit because the government should be able to deliver them without requiring Parliamentary approval.

The legislative reforms, in contrast, are going to be a longer-term project, we believe, and are likely in most cases to require the agreement of India’s Parliament. We’re hopeful the government will be able to achieve these reforms, but depending on the particular Parliamentary procedures it decides to use in each case, it could take anywhere between six months and a year and a half to push the reforms through.

Union Budget

Prime Minister Modi’s landslide election victory in May 2014 left many observers with high expectations that he would impose a sweeping round of reform on the country’s fiscal and economic systems.

Setting out fiscal plans for the year in this Union Budget, the government has shown more restraint, in our view, preferring to take a pragmatic approach, with a focus on long-term reforms, refraining from attempting a “quick fix” for the economy.

The government appears to have chosen to adopt a slower path towards fiscal consolidation than anticipated by many observers in the market. However, we believe the 2015–2016 budget struck a good balance between supporting the cyclical economic recovery in the short to medium term and structural reform for long-term growth.

We think the government’s loosening of its fiscal consolidation target to increase public spending is positive for the revival of the investment cycle in the short to medium term.

There were a number of items included in the budget that we view as key positives, including:

- Introduction of a nationwide Goods and Services Tax: Measures are to be implemented by 1 April 2016. We view this as a large step forward for a nation that houses a plethora of state-wide taxes which make trade a challenge.

- Increased measures on battling corruption and tax evasion: A proposed 2% tax for India’s ultra-wealthy and a 10-year prison sentence for those evading taxes is set to help clean up the black money market. These new measures should help to deter tax evasion, which has been a widespread issue in India for many years.

- Increased allocation towards infrastructure: A new national fund is to be set up with an annual flow of INR200 billion in tax-free bonds for projects in rail, road and irrigation sectors. In addition, the recent decline in crude oil prices reduces the subsidy bill and provides the central government flexibility to support a proposed US$11.3 billion in increased infrastructure spending.

- Realistic revenue assumptions: Nominal GDP is forecast to grow at 11.5% and gross tax revenue at 16% year-on-year.3 Such assumptions are realistic, even conservative in our view, especially compared to the budgets presented in the last few years that projected fiscal consolidation on aggressive revenue assumptions.

- Measures to encourage financial savings: Incentives have been proposed to move away from physical gold and real estate towards insurance and pension funds.

- Reduction in corporate taxes: Plans are expected to cut corporate taxes to 25% from 30% over four years, starting from FY2017. India, which has one of Asia’s highest corporate tax rates, can now look to promote more foreign direct investment (FDI) and help create jobs in the world’s second-largest country by population.

- Higher devolution of taxes to states: The increase will reduce the fiscal dependence of state governments on central resources, by giving states greater autonomy in financing and designing projects as per their needs, thus hopefully improving spending efficiency, and impacting the economy more quickly.

However, the budget was not all good news, in our view, and there were a number of elements that we feel may create some short-term market volatility, notably slower than hoped for progress in reducing the fiscal deficit and a lack of clarification on the recapitalisation of stated-owned banks. This latter point is somewhat mitigated by the decision to set up an autonomous bank bureau to improve governance, which is encouraging in our view.

Indian Valuations

Despite the magnitude of the corporate developments and stock market movements over the last 12 months, we think valuations in India are close to the long-term average. Furthermore, we believe a significant acceleration in economic growth and earnings growth is possible going forward, which has not been factored into the current valuation of the market.

Of course, from our perspective as investors in India, we also think there is scope for value to be added to our portfolios, but careful stock selection is important.

In that regard, we believe there are very interesting opportunities in India’s financial sector. Private sector banks are gaining market share and growing faster compared with those in the state-owned banking arena. The banking system itself appears to be growing at a healthy rate, in our view, and the private sector banks are growing even faster. Private sector banks also, in general, have enjoyed higher levels of profitability and have tended to maintain better-quality balance sheets.

We also believe a number of industrial stocks may be well positioned for any recovery or improvement in the economic growth rate, and we see some interesting potential opportunities there, too.

Recent Interviews

-

In conversation with Mr Vaibhav Shah Head Products: Business Strategy & International Business Mirae Asset Mutual Fund India

Apr 18, 2025

-

In conversation with Mr Kaustubh Sule Senior Fund Manager Fixed Income with Groww Mutual Fund

Apr 18, 2025

-

In conversation with Mr Abhishek Tiwari Chief Business Officer of PGIM India Mutual Fund

Apr 5, 2025

-

In Conversation with Mr Akhil Chaturvedi Executive Director & Chief Business Officer with Motilal Oswal Mutual Fund

Mar 26, 2025

-

In conversation with Mr Rohit Seksaria Fund Manager Equity with Sundaram Mutual Fund

Mar 7, 2025

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team