Why multicap strategy makes good investment sense for long term investors

Why is market cap important in investing?

Market capitalization or market cap is defined as the current market price of a stock times the number of shares outstanding. The market cap of a stock is one of the best measures of a publicly traded company’s size. Companies with larger market caps are usually larger in size compared to a company with smaller market cap. The risk / return characteristics of a stock depend on its market cap or size. Larger companies have more stable and mature businesses. They have market leadership and the financial strength to weather economic recessions. Smaller companies on the other hand, have more opportunities to grow their earnings faster than large caps, but are more vulnerable to business cycles. You should understand the risk profile of a stock or mutual fund before investing, so that you can make informed investment decisions.

What are different market capitalization segments?

According to the market regulator, Securities and Exchange Board of India (SEBI), stocks can be classified into three market cap segments:-

- Large cap: The largest 100 companies by market capitalization are classified as large cap companies.

- Midcap: SEBI categorizes 101st to 250th companies by market capitalization size as midcap companies. There are 150 midcap stocks.

- Small cap: 251st and smaller companies by market capitalization are classified as small cap companies by SEBI.

What is multicap strategy in investing?

Multicap is an equity investment strategy, where your investment is spread across different market capitalization segments e.g. large cap, midcap and small caps. A multicap strategy is essentially a diversification strategy within the equity asset class. In mutual funds, we have a specific equity fund category known as multicap funds which follow the multicap investment strategy.

As per SEBI’s mandate, multicap funds are required to invest at least 25% of their assets in large cap stocks, at least 25% in midcap stocks and at least 25% in small cap stocks. This means that at any point of time, multicap funds will have minimum 50% exposure to small and midcap stocks.

Benefits of multicap strategy

- Within the equity asset class, winners rotate across different market cap segments. In other words, different segments of the market outperform each other in different market cycles (see the chart below). Large cap stocks usually outperform small / midcapsin bear markets. Small / midcaps usually outperform large caps in early to mid stages bull markets. A multicap strategy helps to balance risk and returns across investment cycles.

![Different segments of the market outperform each other in different market cycles Different segments of the market outperform each other in different market cycles]()

Source: National Stock Exchange, Advisorkhoj Research, as on 30th November 2022. Large cap is represented by Nifty 100 TRI, Midcap is represented by Nifty Midcap 150 TRI and Small cap is represented by Nifty Small cap 250 TRI. Disclaimer: Mutual funds are subject to market risks. Past performance may or may not be sustained in the future.

- Small / midcaps provide you exposure to larger number of industry sectors compared to large caps. There are many industry sectors with high demand driven growth potential where large caps do not have any presence e.g. automobile ancillaries, specialty chemicals, textiles, media and entertainment etc. Some of the sectors dominated by midcaps have also high export driven growth potential. Mid and small caps can also benefit from the new China plus 1 strategy of large global corporations, as they try to diversify their manufacturing base and supply chain in wake of the COVID-19 pandemic.

- Multicap strategy provides you exposure to a much larger universe of stocks compared to market cap specific investment strategy. While the large cap segment is restricted to 100 stocks, the mid cap is restricted to 150 stocks. A multicap strategy will provide you exposure to a far bigger universe of stock (500+ stocks) i.e. many more investment opportunities.

- Price discovery is more efficient in large cap stocks due to high institutional ownership and greater research coverage. On the other hand, price discovery is not as efficient in the mid and small cap segments, especially small caps. Fund managers may be able to identify midcap and small cap stocks that are trading at deep discounts to their intrinsic long term valuation and create alphas for investors over sufficiently long investment horizon.

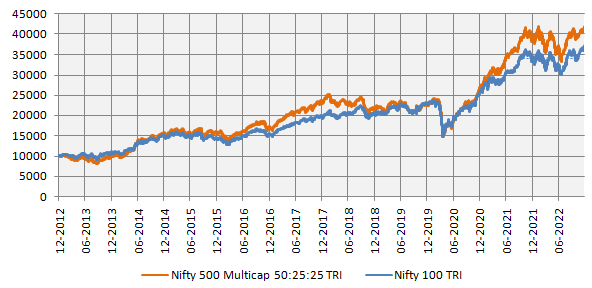

- Historical data provides strong evidence that a multicap strategy has the potential to generate higher alphas compared to a large cap strategy. The chart below shows the growth of Rs 10,000 investment in Nifty 500 Multicap 50:25:25 TRI (multicap benchmark index) versus Nifty 100 TRI (large cap benchmark index). Over the last 10 years, Nifty 500 Multicap 50:25:25 TRI gave 15% CAGR returns, while the large cap Nifty 100 TRI gave 14% CAGR returns.

![Growth of Rs 10,000 investment in Nifty 500 Multicap 50:25:25 TRI versus Nifty 100 TRI Growth of Rs 10,000 investment in Nifty 500 Multicap 50:25:25 TRI versus Nifty 100 TRI]()

Source: National Stock Exchange, Advisorkhoj Research, as on 30th November 2022. Large cap is represented by Nifty 100 TRI and Multicap is represented by Nifty 500 Multicap 50:25:25 TRI. Disclaimer: Mutual funds are subject to market risks. Past performance may or may not be sustained in the future. The above chart is purely for investor education purposes and should not be construed as investment recommendations. Different market cap segments have different risk profiles. You should invest according to your risk appetite and consult with your financial advisor if required.

Who should invest in multicap funds?

- Investors seeking capital appreciation or wealth creation over long investment tenures

- You should have high to very high risk appetites for multicap funds

- You should have minimum 5 year investment tenures for these funds

- You can invest in multicap funds either in lump sum or through SIP

Investors should consult with their mutual fund distributors or financial advisors, if multicap funds are suitable for their long term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY