What is Volatility and how to deal with it

What is volatility?

Volatility is the statistical measure of fluctuations in price of an asset. In 1953, Nobel Prize winning economist Henry Markowitz introduced the concept of volatility as a measure of investment risk. Volatility is of great significance to traders in the stock market, especially those who trade in derivatives (futures and options). However, volatility and risk have very different connotations for investors. Legendary investor Warren Buffet said, “Volatility is far from synonymous with risk. Risk comes from not knowing what you are doing”.

In this article, we will try to understand what causes volatility, what impact it has on equity market, mistakes to avoid in volatile markets and how you should ride volatility.

You may also like to read: How to deal with volatility

What causes volatility?

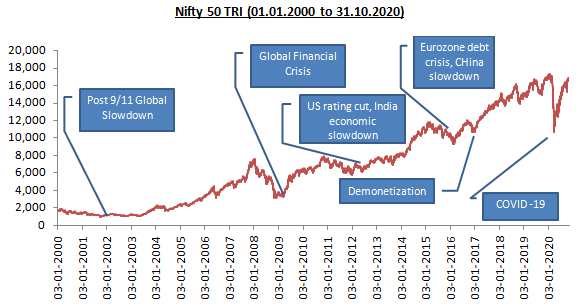

You can see in the chart below that stock market underwent through several deep corrections in the past 20 years. However, it is important to note that Nifty 50 TRI gave 11.6% CAGR returns over the last 20 years. Let us try to understand the causes of volatility.

Source: National Stock Exchange (01.01.2000 to 31.10.2020). Disclaimer: Past performance may or may not be sustained in the future

In the short term volatility is caused by imbalance between buyers and sellers in the stock market. If there are more sellers than buyers in the markets, the stock prices will fall and vice versa. Change in risk sentiments causes this imbalance. Uncertainty about the future outlook is the primary reason behind increase in risk aversion. The most recent example of extreme volatility caused by sudden risk aversion is the market crash in March 2020 caused by the outbreak of COVID-19 pandemic – Nifty fell by 35% (see the above chart). Volatility can be caused by other factors as well.

- Economic Crisis: Stock markets are very sensitive to economic situations. Bigger the crisis, bigger the fall in the market. The market crash in 2008 as a result of the Global Financial Crisis, early 2000s bear market caused by global economic slowdown in the aftermath of 9/11 and the correction of year 2011 are examples of the impact of economic slowdown / recession on stock markets.

- Change in Government policy: Demonetization is an example of volatility in the market caused by uncertainty about the fallout of the Government’s policy on the economy. Market volatility after Government introduced tax surcharge on FPIs in interim Budget of 2019 which was subsequently rolled back is another example.

- Political uncertainty: In India, markets have reacted to political uncertainty. The market fell more than 20% after the Lok Sabha election of 2004. The market was expecting an NDA win, but the UPA Government came to power. However, the market quickly recovered and fortunately we have had stable Governments in all the elections after 2004.

- Global events: With increasing global integration, global events also have an effect on stock market. The correction in FY 2015 – 16 was largely driven by global factors like Eurozone debt crisis (Greece, Portugal etc.), economic slowdown in China etc. The recently concluded US Presidential elections is the another example of the impact of global events on the stock market. India was also impacted by the bout of global volatility in the run up to the US Presidential election.

The pace of recovery depends on the nature of volatility. For example, volatility caused by temporary demand and supply imbalance is usually short-lived and the market recovers fairly quickly. On the other hand, the market takes longer to recover from severe economic downturns or recessions. If you understand the nature of volatility, you will be better prepared to ride it.

Impact of current events on stock market volatility

The Nifty fell nearly 500 points in the two weeks prior to the US Presidential elections. We saw significant intraday volatility during this period. However, the market has clearly welcomed the results of the US elections. Nifty has risen 900 points and is now at its all-time high, since the results showed a clear path to victory for the Democratic presidential candidate. Though the Republicans have filed lawsuits in several states challenging the election results, most market experts expect them to not have any effect on the stock market. Bihar assembly election is another major event on the political calendar, but judging by the market’s response to the exit polls, it may not have a significant impact. As far as COVID is concerned, despite concerns about another wave of infections, the market reacted favourably to the positive news on the vaccine front. Though the mood of the market seems positive, there may be lingering concerns about volatility due to the COVID situation and economic impact thereof.

Should you be worried about volatility?

Let us revisit Warren Buffets quote about volatility and risk not being synonymous. Volatility refers to ups and downs in the market, while risk is the possibility of making a loss when you sell. As you can see in the 20 year price chart of Nifty, the market recovered after each correction and went on to make new highs. Most investors make a loss because they panic in volatile markets and sell. While the book value of your investment will go down in volatile markets, if you wait for the market to recover, you will not make a loss. The longer you remain invested; the lower is your risk of making a loss.

The table below shows the average returns and possibility of making a loss in Nifty for different holding periods over the past 30 years.

Source: Advisorkhoj Research (Period: 30.07.1990 to 08.11.2020). Disclaimer: Past performance may or may not be sustained in the future.

Mistakes to avoid in volatile market

- Do not panic: Volatility can be very stressful emotionally. No one likes to see investments made with their hard earned money go down. But if you panic and sell, you will make a permanent loss. Being patient is of utmost importance.

Suggested reading: How to deal with volatility - Do not try to time the market: Many investors sell in bear markets in the hope of buying back at lower prices when market bottoms. It is very difficult to predict market bottom. Look at the market crash in March 2020. When things were looking very gloomy with COVID-19 and impending lockdown, the market started recovering in April.

- Do not pay listen to rumours: Rumours start flying in bear markets. There will be new rumours about impending doom every other day. In this age of social media, you will receive rumours disguised as “information”. Do not let yourself be deceived by such rumours. It will harm your financial interests.

- Do not try bottom fishing: You may get tips through informal networks about stocks which are at bargain basement price and about to give you multi-bagger returns. Do not fall prey to such rumours because this may be akin to catching a falling knife. Stick to principles of diversification through mutual funds.

How to ride volatility

- Goal based investing: It will help you remain disciplined and not be affected by price movements. For example, if you are investing for your retirement planning and your goal timeline is 20 years, then short to medium term price movements will have no effect on your goals.

Read what is goal based financial planning - Systematic Investment Plan: Investing through the SIP route for your long term goals is one of the best approaches that can help you remain disciplined in your long term financial goals. In fact, SIP will help you take advantage of volatility through Rupee Cost Averaging of acquisition cost of investments.

You may like to read: How to maximize your SIP returns in volatile markets - Asset Allocation: Historical price movements of different asset classes like equity, fixed income and gold show that low or negative correlation among these asset classes (see chart below). Diversification across asset classes can reduce risk and provide stability across different investment cycles. Your asset allocation will depend on your financial goals and risk appetite.

![Historical price movements of different asset classes Historical price movements of different asset classes]()

Source: Advisorkhoj Research. Nifty 50 TRI as the proxy for equity, SBI average quarterly 1 year FD rates as proxy for fixed income and domestic price of 24 carat gold as proxy for gold. 2020 YTD returns as on 31st October 2020. Disclaimer: Past performance may or may not be sustained in the future

You may like to read more about: How asset allocation helps you diversify your investments - Use STP for lump sum investments: Volatile markets provide for tactical investment opportunities in lump sum. However, if you are worried about prices correcting further, you can always use the STP route from a low volatility fund e.g. liquid fund to invest in equity funds.

- Engage with your financial advisor: You need to stay calm and make rational investment decisions during volatile markets. Sometimes this is easier said than done. Your financial advisor can be of great help to navigate you during such times and ensure your best interests. Reading Do you need a financial advisor will make sense if you need one!

- Stick to your investment plan: In any endeavour, having a plan and executing on it in a disciplined manner is the best assurance of success in the long term. Investments are no different. There will be challenges from time to time, but the time tested virtues of patience and discipline will eventually ensure success.

Issued as an investor education initiative by HSBC Mutual Fund

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY