What is Financial Independence and how SIPs can help?

On 15th August 2022, we will celebrate the 75th anniversary of India’s Independence. After almost 100 years of unrelenting freedom struggle and sacrifices made by countless patriots, on this day in 1947 India gained her from colonial rule. On the 75th anniversary of India’s independence, we like to bring to investors’ attention the importance of financial independence in their personal finances. Our independence came after a very long period of struggle and sacrifices by several generations; financial independence also requires hard work, planning and maybe some small sacrifices.

What is financial independence?

Financial independence means “not having to work for a living”. Most of us have to work to make a living. We pay for our day to day living expenses (e.g. e.g. food, rent, EMIs, utility bills, children’s school fees, transportation etc) from the income which we get from our job or business. However, a day may come when we are no longer be able to work e.g. retirement. Some people may want to quit their jobs to pursue their passion, which may or may not generate income. How will you pay for your living expenses when you no longer have regular income from your work? If you are financially independent the income from your assets or investments will be able to meet your day to day living expenses.

You may like to read how mutual funds can help you gain financial independence

Is financial independence relevant for all?

Financial independence is relevant to everyone, whether you are in a job or owning a business. Needless to say, you need to be financially independent after retirement because you will have no salary. Even before retirement, circumstances beyond your control can force you to leave your job and be without income for a period of time. If you have sufficient income from your investments, you will able to meet your day to day expenses, without depleting your assets significantly. If you are a business owner, there may be periods where your income from your business is less than your expenses. You will then have to dip into your savings unless you are financially independent.

What will happen if you are not financial independent?

If your income is not sufficient to meet your expenses, then you will have to be dependent on others e.g. children, relatives etc. In the joint family construct, where a lot of expenses were shared, children would take care of the financial needs of their dependent parents. But in nuclear families, where parents and children have separate households, your children may not have sufficient wherewithal to enable you maintain your lifestyle, especially in an inflationary environment. You can pay for your living expenses from your savings, but over a period of time, you may deplete your savings and lose financial independence.

How to achieve financial independence?

You will achieve financial independence if returns from your assets are sufficient to meet all your expenses for the rest of your life. It is important to understand that assets are investments that can generate future cash-flows either in the form of regular income or capital appreciation. Bank fixed deposits, stocks, bonds and mutual funds are assets because they generate returns in form of interest, dividends and potential capital appreciation. You should always factor in inflation, when planning for financial independence because your cost will keep increasing over time. The returns from your investments should be able to keep up with inflation.

You may like to read what is goal based financial planning

Planning for financial independence

- Start saving: You need to save to invest in assets which can generate returns for you. The famous investor, Warren Buffet said, “Do not save what is left after spending, but spend what is left after saving.” You have to prioritize savings by making small sacrifices in your discretionary spending if required.

- Start early, start now: It is important to start saving from an early age. One of most important factors in wealth creation is time. Investments generate returns over time and returns invested generate more returns. This is known as the power of compounding. If you may have missed early investing it could be always wise to start investing now.

- Investing your savings wisely: You need to invest your savings in assets which can generate returns. Different asset classes have different risk / return characteristics. You need to invest in the right asset class according to your age and risk appetite. For younger investors, equity is the most suitable asset class for wealth creation over long investment horizons.

How can mutual funds SIPs help you achieve financial independence?

- Systematic Investment Plan (SIP) is a mutual fund investment facility where an investor can invest can fixed amount in a mutual fund scheme at a regular intervals (weekly, fortnightly, monthly etc). Through SIP, you can invest in mutual funds from your regular savings.

- You can start investing in mutual funds with relatively small amounts with SIPs. With SIPs, you can start investing in mutual funds from a young age to get compounding benefits over long investment tenures.

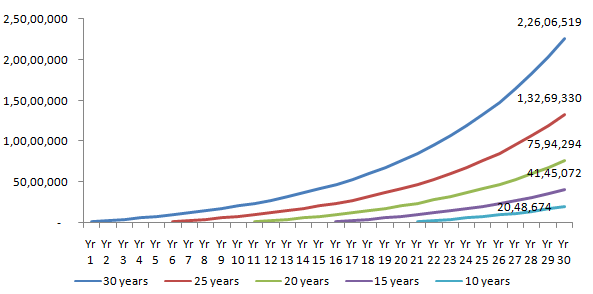

- The chart below shows the wealth creation by Rs 10,000 monthly SIP over different investment tenures (e.g. 30 years, 25 years, 20 years etc) assuming 10% CAGR return on investment. You can see that the power of compounding is higher over long investment tenures.

![Wealth creation by Rs 10,000 monthly SIP over different investment tenures Wealth creation by Rs 10,000 monthly SIP over different investment tenures]()

Disclaimer: The above chart is purely illustrative for investor education purposes and is not an indicator of actual returns on your investments. Mutual funds are subject to market risks. Consult with your financial advisor before investing

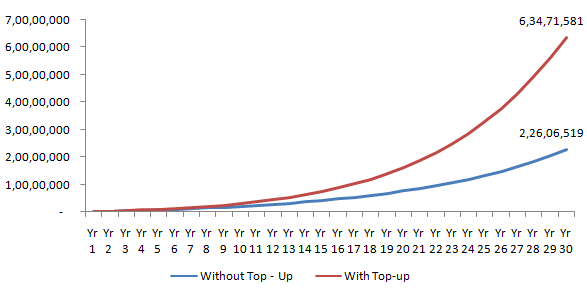

- SIP Top-up is a mutual fund facility using which you can increase your SIP instalments at regular intervals e.g. half yearly, annual etc. You should use SIP top-up facility to increase your investments as your disposable income increases over time. The chart below shows the wealth creation by Rs 10,000 regular monthly SIP and monthly SIP with 10% annual top-up over 30 year investment tenure (assuming CAGR return of 10%). You can see that SIP Top-up can help you achieve financial independence faster and can also create more wealth for you.

![Wealth creation by Rs 10,000 regular monthly SIP and monthly SIP with 10% annual top-up over 30 year investment tenure Wealth creation by Rs 10,000 regular monthly SIP and monthly SIP with 10% annual top-up over 30 year investment tenure]()

Disclaimer: The above chart is purely illustrative for investor education purposes and is not an indicator of actual returns on your investments. Mutual funds are subject to market risks. Consult with your financial advisor before investing

- SIPs can help you remain disciplined in your investments. Investment discipline means that you invest according to your financial plan and not make impulsive decisions based on market movements. It is very important to remain disciplined in your investments if you want to create wealth in the long term and achieve financial independence.

Read more about SIP Top up Why should you do SIP Top up

Conclusion

In this blog post, we have discussed the important topic of achieving financial independence. One important aspect of financial independence is that you should be able to maintain your lifestyle even when you do not have regular income from your work. Over years we get used to a lifestyle and you may find it difficult to change after retirement or when you are not working. You should start investing from a young age to achieve financial independence and also maintain your lifestyle after you retire. Mutual fund SIPs are ideal investment options from your regular savings that can potentially create wealth for you over long investment horizons. You should discuss your life-stage goals with your financial advisor and start investing according to your goals.

Issued as an investor education initiative by HSBC Mutual Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY