Maximize your SIP returns in volatile markets

The lockdown imposed by the Government to arrest the spread of COVID-19 pandemic has resulted in significant economic slowdown and equity markets to turn volatile. Though the Government has gradually started re-opening the economy, the economic outlook is uncertain since large parts of the country including the major economic centres are in red zones. As such, equity market is expected to remain volatile in the coming weeks.

History of equity market in India has shown that equity has bounced back strongly after major corrections (see our post, Will history repeat itself in equity). You should simply remain invested and may also consider tactically increasing your asset allocation in equity because valuations are now attractive.

SIPs in deep correction

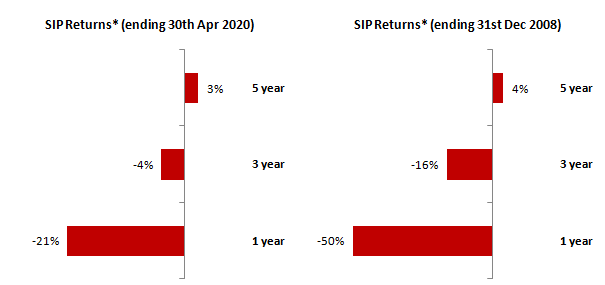

Systematic Investment plans are becoming increasingly popular with retail mutual fund investor, according to AMFI SIP monthly inflows data. SIP returns over last 1 year, 3 year and 5 year periods (ending 30th April 2020) are low (even negative) for many equity mutual fund schemes. This may have come as a shock to many relatively new mutual fund investors. But this is not the first time that SIP returns are negative. This was also observed during the Global Financial Crisis of 2008. The charts below shows the returns of monthly SIP in Nifty 50 TRI over various periods (1 year, 3 year and 5 year) ending 30th April 2020 and 31st December 2008.

Bigger correction in SIP market values during Global Financial Crisis (2008) than COVID-19 (so far)

Source: National Stock Exchange, Advisorkhoj Research, *XIRR

Negative or low SIP returns can be very disappointing especially if you have been investing for fairly long period of time (e.g. 3 years, 5 years etc.). During bear markets you can see the market value of your investments falling even when you continue to invest through SIP. SIP investors can react to deep corrections in different ways.

- Some investors may stop their SIPs and redeem their units in panic.

- Some investors may just stop their SIPs but not redeem at low prices. They continue to hold the units.

- Disciplined investors continue their SIPs irrespective of fall in prices (investment values) and benefit through Rupee Cost Averaging

- Some investor may want to take advantage of fall in prices by increasing their SIP amounts

- Some investors may want to take advantage of price correction by tactically investing in lump sum

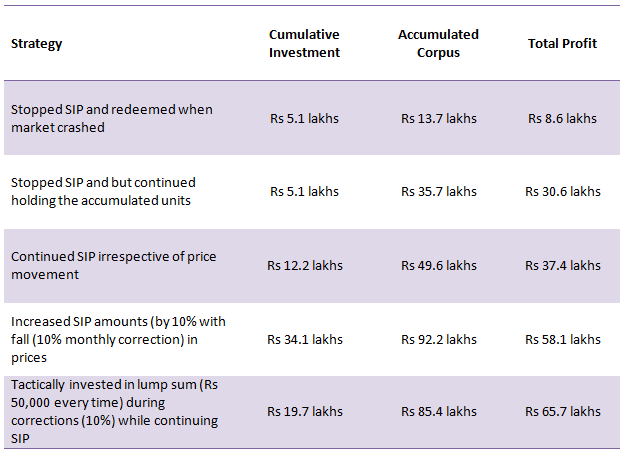

In this post we will see how each of these scenarios played out for Rs 5,000 monthly SIP in Nifty 50 TRI started on 1st January 2000.

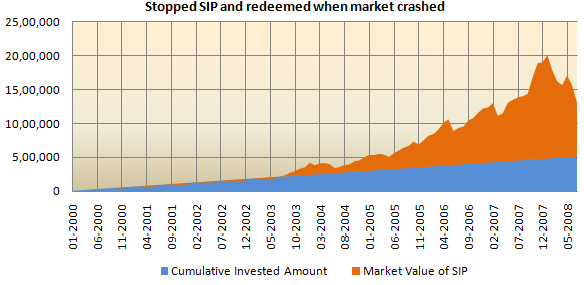

Scenario 1 - Stopped SIP and redeemed when market crashed

In this scenario the investor stopped his SIP and redeemed his units when the market fell by 35% in 2008 during the Global Financial Crisis. The chart below shows how much corpus he accumulated till July when he redeemed his units.

His cumulative investment was Rs 5.1 lakhs and his redemption proceed was Rs 13.1 lakhs.

Source: Advisorkhoj Research

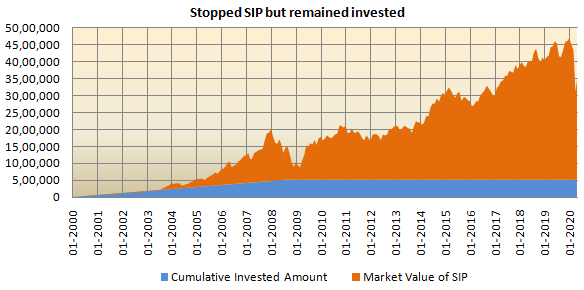

Scenario 2 - Stopped SIP and but continued holding the accumulated units

In this scenario, the investor stopped his SIP when the market fell by 35% in 2008 (July 2008) but continued holding the accumulated units. This was a more prudent strategy than the previous scenario because the investor did not sell at very low prices and the investment value grew as the market recovered. Let us see how much corpus he accumulated till 30th April 2020.

You can see the blue region of the chart flat from 2008, which means that his investment remained the same but his accumulated corpus as on 30th April 2020 was Rs 35.7 lakhs (with a cumulative investment of Rs 5.1 lakhs).

Source: Advisorkhoj Research

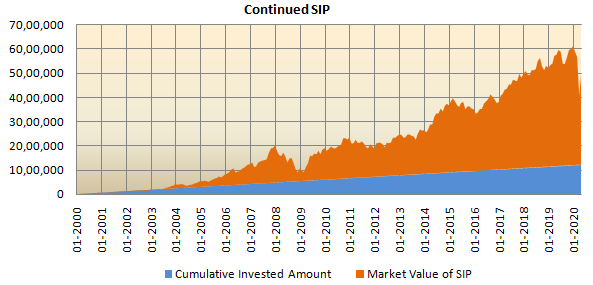

Scenario 3 - Continued SIP irrespective of price movement

In this scenario, the investor continued his SIP irrespective of market movements. There were 3 major corrections of more than 20% after the Global Financial Crisis in 2008 – one in 2011 after US sovereign rating got downgraded, second in 2015 – 16 due to Euro zone debt crisis and China slowdown giving rise to fears of recession and finally the third that we are seeing now due to COVID-19. By continuing his SIPs through the Global Financial Crisis in 2008 and subsequent bear markets, the investor was able to reduce his average cost of purchase. The chart below shows the growth in investment value of the SIP.

With a cumulative investment of Rs 12.2 lakhs, the investor was able to accumulate a corpus of nearly Rs 50 lakhs. He was able to get higher returns and accumulated more wealth than the previous two investment scenarios.

Source: Advisorkhoj Research

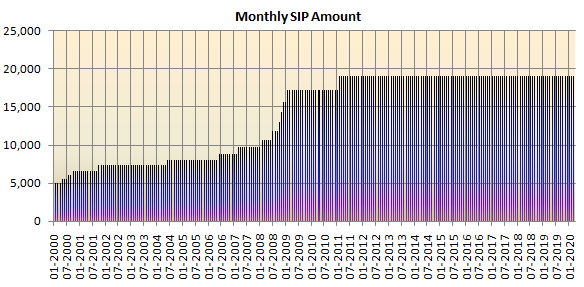

Scenario 4 - Increased SIP amounts with fall in market

In this scenario, the investor increased his monthly SIP amount by 10%, every time Nifty 50 TRI fell 10% on a monthly basis. The chart below shows how the monthly SIP of the investor increased over time. Each monthly SIP increase was permanent i.e. the investor did not reduce the monthly SIP after the correction was over. He started with a monthly SIP of Rs 5,000 in January 2000 and his monthly SIP was little over Rs 20,000 in April 2020.

Source: Advisorkhoj Research

The chart below shows the growth of the investor’s SIP using this strategy.

His cumulative investment was substantial higher than the plain vanilla SIP – cumulative investment of Rs 34.1 lakhs. But his wealth creation was also substantially higher – accumulated corpus as on 30th April 2020 was Rs 92 lakhs.

Source: Advisorkhoj Research

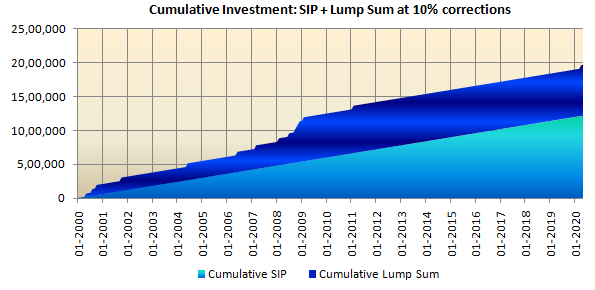

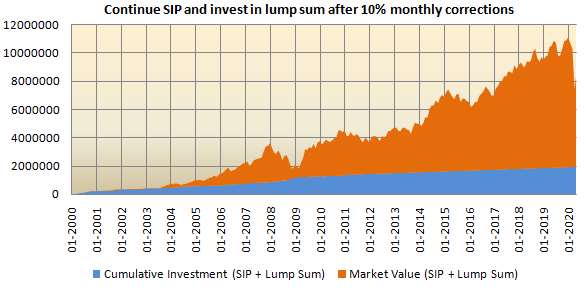

Scenario 5 - Tactically invested in lump sum during corrections while continuing SIP

In this scenario, the investor continued his monthly SIP of Rs 5,000 irrespective of market movements. In addition, he invested Rs 50,000 in lump sum after each 10% monthly correction in Nifty 50 TRI. The chart below shows how much he invested through SIP and lump sum over the investment tenure. In total he invested Rs 19.7 lakhs.

Source: Advisorkhoj Research

The chart below shows how corpus of the investor accumulated using this strategy. He accumulated Rs 85.4 lakhs as on 30th April 2020. This strategy made the maximum profits among all the scenarios.

Source: Advisorkhoj Research

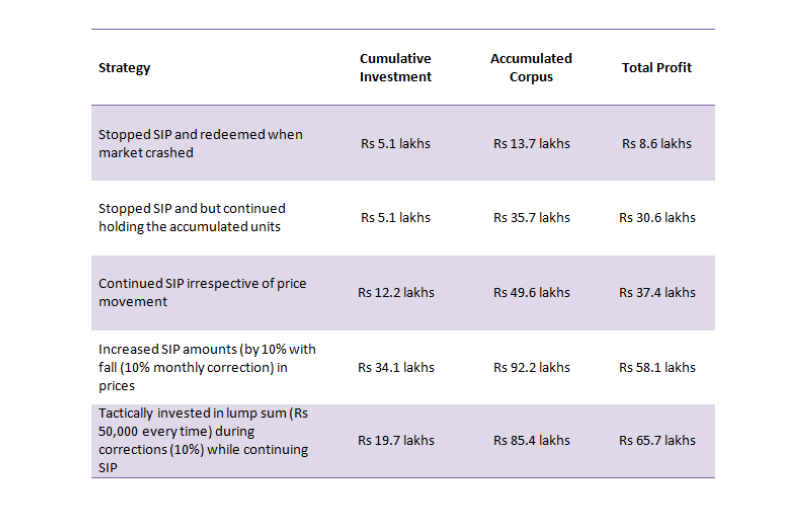

Summary of the scenarios

Conclusion

Investors should not stop their equity mutual fund SIPs in volatile markets. Deep corrections provide ideal opportunities to reduce the average cost of acquisition of your investments through SIP. By increasing your asset allocation to equities in volatile markets either by increasing your SIP amounts or tactically investing in lump sum you give yourself the opportunity to generate potentially more returns as shown in the examples above. You should form your investment strategy based on your investment needs and financial situation in consultation with your financial advisor (if required). Once you have an investment plan in place you should stick to it to achieve success in your financial goals. Stay invested and enjoy the journey of wealth creation.

Issued as an investor education initiative by HSBC Mutual Fund

Click here to see a video on SIP and how they are beneficial to you.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY