How to invest in times of high inflation

Inflation is inevitable and everyone is affected by it in one way or another. Prices of goods and your cost of living go up with inflation. Cost of borrowing also goes up as interest rates go up with inflation. Inflation also has impact on your investments. While moderate rate of inflation is generally considered healthy in a growing economy, high inflation rate is not good for the economy, especially for the poorer sections of the population. We have been in an environment of high inflation for the last 6 – 7 months. In this article, we will discuss the impact of high inflation and how you can invest to beat inflation in the long term.

What is inflation?

In very simple terms, inflation is the increase in prices of goods and services. In India the two measures of inflation are, Wholesale Price Index (WPI) and Consumer Price Index (CPI). WPI refers to change in prices of goods in the wholesale market, where goods are sold in bulk. CPI refers to change in prices of goods in the retail market i.e. prices which consumers pay. The basket of goods in calculation of WPI and CPI are different. WPI basket is dominated by manufactured products, while CPI is dominated by food products.

What causes inflation?

- The most common cause of inflation is demand side. In a growing economy, wages and employments increase and along with it, the demand for goods and services. This cause prices to rise and is referred to as demand side inflation.

- When manufacturers increase prices for any reason e.g. rise in cost of production, supply chain constraints etc, it leads to supply side inflation. Supply side inflation is often stubborn and tends to persist till the issues on the supply side are resolved.

- Inflation can also be a by-product of the monetary policy. If the central bank e.g. Reserve Bank of India, US Federal Reserve etc, increase the money supply to stimulate economic growth, it may lead to demand side inflation.

- Fiscal policies can also cause inflation. If the Government increases spending, it may have an inflationary effect (demand side inflation).

What has caused the current high inflation?

The high inflation we are experiencing currently is a global phenomenon. The current situation has been caused by all the factors discussed above, but the main reasons are as follows:-

- The economic crisis caused by the outbreak of COVID-19 pandemic forced Governments and central banks to resort to extraordinary measures in fiscal and monetary policies. These measures were expected to have an inflationary effect. The central banks were expecting the inflation to be transitory, but unfortunately it was not transitory and now the central banks are taking measures to control it.

- COVID-19 pandemic and lockdowns caused a major disruption in supply chain leading to shortages in the supply side and increase in prices of commodities / manufactured products. With resumption in normal economic activities all around the world, we expect the supply chain issues to get resolved though it may take some time.

- OPEC countries and their partners have been cutting back on crude oil production for the last few years, leading to increase in crude oil prices. The Russian invasion of Ukraine and the economic sanctions on Russia has created an extraordinary situation leading to surge in crude prices. Since petroleum and petroleum products are raw materials in many industry sectors, this has led to very high inflation in goods and services.

Impact of high inflation on buying behaviour

As long as inflation is lower than growth in average wages, there is very little or no impact on demand in the economy. However if prices are too high, demand will go down since consumers will not be ready to pay high price. Central bank e.g. RBI will be forced to increase interest rates in inflationary environment. This will make loans more expensive and will have an impact on purchase of real estate, vehicles etc, which are usually through loans. Consumers will postpone their purchase expecting interest rates to come down in the future.

Please read this: What is volatility and how to deal with it?

Impact of high inflation of investments

Let us discuss the impact of high inflation on different asset classes:-

- Equity: As discussed earlier, inflation will result in lowering of demand and this will have an impact on corporate earnings. Companies may also put capex plans on hold due to higher cost of financing (interest rates). As a result, high inflation will have a negative impact on equity. You may also like to read: Inflation and equities

- Fixed income: Price of debt or money market instruments go down with rise in interest rates. Interest rate sensitivity of debt funds increase with duration; longer duration debt funds will be impacted more by inflation and increase in interest rates. Investors may find very short duration funds more attractive since the yields will keep rising with inflation.

- Gold: Gold prices usually rise with inflation. Since gold is an international commodity, its price is linked with our currency. As the India Rupee (INR) depreciates, gold will appreciate (generally high inflation results in currency devaluation).

How does rate hike affect inflation?

The RBI hiked the key interest rate (repo rate) by 40 basis points (bps) on the 4th May 2022, taking the equity market by surprise. However, rate hike is one of the most important tools in the arsenal of RBI to control inflation. Increase in interest rate will reduce money supply in the economy since people and businesses will reduce borrowing to avoid paying high interest. With reduction in money supply, demand will go down and inflation will also go down over a period of time.

How to invest to beat inflation?

We have discussed how inflation affects your investments in the short term. Let us now discuss, how you can build / manage your portfolio to beat inflation in the long term:-

- Focus on asset allocation: Equity, fixed income and gold outperform each other in certain market conditions and vice versa (e.g. equity outperforms gold in bull markets and under-perform in bear markets). Asset allocation will bring stability to your portfolio.

- Equity can beat inflation in the long term: Though equity may underperform in high inflationary environment, it can beat inflation in the long term. Nifty 50 TRI gave 14% CAGR returns in the last 10 years ending 30th April 2022 (source: National Stock Exchange, Advisorkhoj Research as on 29th April 2022). Based on historical data we can say that, post tax CAGR return on equity investment (taking Nifty 50 TRI as a proxy for the asset class) over the last 10 years is significantly higher than the average inflation rate over the same period.

Suggested reading: how to build a resilient portfolio - Adopt a flexible approach to fixed income: Investors can hedge the short term inflation by investing in shorter duration funds that can re-invest in rising yields. When interest rates are increasing, fund managers of shorter duration funds roll over their investments at yields, helping investors to keep up with short-term inflation.

- Rebalance your asset allocation regularly: This is one of the most important aspects of managing your portfolio, yet ignored by many investors. Market movements may cause your asset allocation to diverge from your target asset allocation. Rebalancing your asset allocation (e.g. shifting from equity to fixed income in high markets, shifting from fixed income to equity in low markets) at regular intervals will bring stability to your portfolio and generate risk adjusted returns for you.

You may like to read: How asset allocation help diversify your investments

Remain disciplined in your SIPs to beat inflation

Mutual fund Systematic Investment Plans (SIPs) are excellent investment options for your long term financial goals e.g. children’s higher education, marriage, retirement planning etc, since you can invest for these goals from your regular savings and invest over long tenures benefitting from the power of compounding. In highly inflationary environment, such as the one we are experiencing currently, the market may be extremely volatile. However, your SIPs can be extremely beneficial in such market conditions from the perspective of long investment horizons.

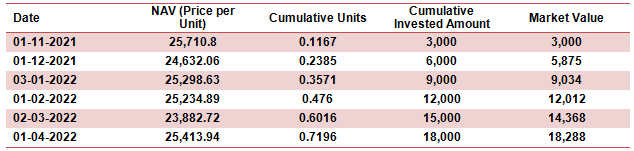

Through SIPs, you can take advantage of market volatility through Rupee Cost Averaging (RCA) of purchase price (NAV) of the units of the mutual fund scheme in which you are investing. RCA in volatile markets can bring down your average cost of acquisition of mutual fund units and create more wealth for you over goal investment horizon. The table below illustrates how RCA works (monthly SIP plan of Rs 10,000) in Nifty 50 TRI over the last 6 months ending 30th April 2022. You can see your unit balance rising faster in more volatile months; this will help you create more wealth over sufficiently long investment horizons.

Source: National Stock Exchange, Advisorkhoj Research. Period: 1/11/2021 to 30/04/2022. Disclaimer: Past performance may or may not be sustained in the future.

Suggested reading: Maximise your SIP returns in volatile markets

Conclusion

In this article we have discussed about the current inflation scenario, causes of inflation and the impact of inflation on investors. There is no denying that inflation will have an adverse impact on investments in the near term, but as an investor, you should take a long term view and remain disciplined in your investments. We have discussed in this article, how mutual fund SIPs not only help you remain disciplined and take advantage of market volatility through Rupee Cost Averaging for wealth creation in the long term.

Issued as an investor education initiative by HSBC Mutual Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY