How to build a resilient portfolio

We have just entered the new financial year FY 2021-22. This is a good time for investors to take stock of their investment portfolio and make an investment plan for the year. Many investors are worried about the second COVID wave in India. Though COVID-19 vaccine has been rolled out for the general public in a phased manner since March, we are at very early stages of the vaccination drive and vast sections of our populations have to still get vaccinated. The current situation is alarming in several states. Restrictions have again been re-imposed in various states which are likely to have some impact on economic growth. Keeping these near term factors and experiences from last year in mind, how should you go about your investment planning?

What happened last year?

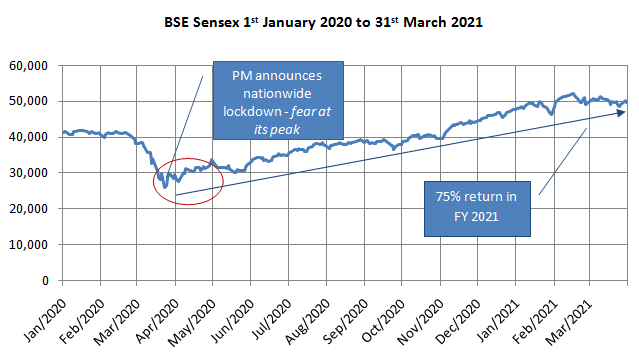

COVID broke out in Wuhan province of China in January 2020 and by early March had spread to several countries. The world was staring at a global pandemic and the stock market crashed with the Sensex falling more than 30% between between 02/03/2020 till 23/03/2020 (source: BSE). The Government imposed a stringent nationwide lockdown in India to slow down the chain of transmission. People were scared about their health, jobs and businesses. The lockdown though necessary had devastating effect on the economy with the GDP contracting by 20% in Q1 of FY 2021. Restrictions were then slowly lifted and economic activities gradually resumed. Confidence returned to the market and stocks started rallying. By Q3 of FY 2021 the Sensex was back at pre March (2020) levels and the Sensex crossed the historic 50,000 levelon 3rd February 2021.

What can we learn from last year?

The biggest fear is the fear of unknown. COVID-19 was a new disease last year. Naturally there was widespread fear among people. Though health and safety was the primary concern, people were also worried about their financial security and investments. March and April 2020 saw large scale panic redemptions (source: AMFI). Equity and equity oriented hybrid funds saw maximum redemption in March and April 2020 (source: AMFI). You can see in the chart below that maximum redemptions took place when the market was at rock-bottom. From May, redemptions went down as the market started recovering.

The lesson we can learn from this chart is that investment decisions made in panic is harmful to our financial interests. Warren Buffett’s famous quote “be fearful when others are greedy and greedy when others are fearful” can be seen in action in the chart below. Investments in BSE Sensex made in April 2020 when fear and uncertainty was at its peak would have potentially earned 75% in FY 2021 (source: Advisorkhoj Research https://bit.ly/2QhkHM3)

Source: Bombay Stock Exchange. Advisorkhoj Research (Period: 01.01.2020 to 31.03.2021). Disclaimer: Past performance may or may not be sustained in the future.

While investing at market bottoms can be rewarding in terms of financial returns, it is difficult to time your investment decisions with market peaks and bottoms. Therefore, it is always prudent to invest systematically at regular intervals at different price levels. By investing systematically you can take advantage of market volatility using Rupee Cost Averaging.

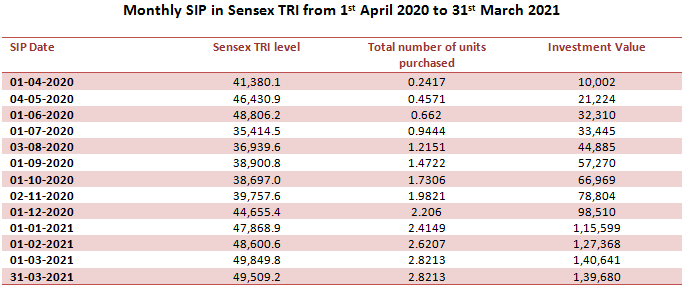

The chart below shows how Rupee Cost Averaging would have worked if you invested in BSE Sensex TRI through monthly SIP of Rs 10,000. The average per unit purchase price of BSE Sensex TRI through monthly SIP, over the last one year, would have Rs 43,108 while the price of BSE Sensex TRI on 31st March 2021 was 49,509. Your investment value as on 31st March 2021 would have been Rs 1,39,680 with a cumulative investment of Rs 1,20,000 demonstrating the benefits of rupee cost averaging in volatile market.

Source: Bombay Stock Exchange. Advisorkhoj Research (Period: 01.04.2020 to 31.03.2021). Disclaimer: Past performance may or may not be sustained in the future.

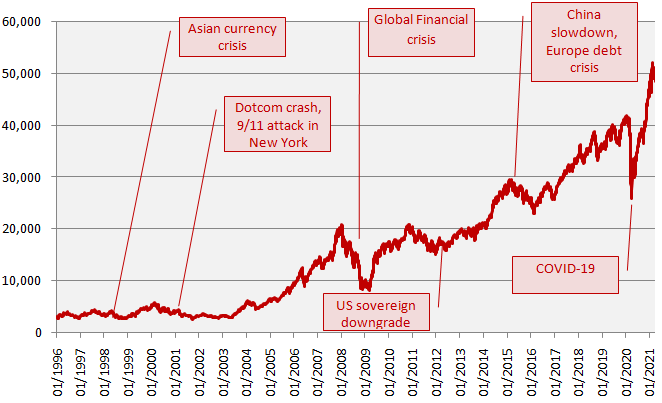

Bear markets are not new – markets move in cycles

For many young investors the COVID-19 crisis may have been their first experience of extreme volatility or bear market, but our market has gone through many crisis and bear markets in the past. The chart below shows the journey of the BSE Sensex over the past 25 years. You can see that the market faced many crises in the past; on an average we had a bear market once in every 4 – 5 years. Yet historical data shows that the market always recovered and made new highs. This is the nature of investment cycles. Historical data shows that in the last 25 years, the Sensex gave 11% CAGR returns.

Source: Bombay Stock Exchange. Advisorkhoj Research (Period: 01.01.1996 to 31.03.2021). Disclaimer: Past performance may or may not be sustained in the future.

Invest according to a plan

We have faced crisis in the past and we may face more in the future too. The COVID-19 crisis is by no means over. We are seeing rising cases of infections, hospitalizations and even unfortunate deaths in many states across the country. We do not know how the situation will evolve and must be prepared for uncertainty. Uncertainty in equity markets is invariably associated with higher than normal volatility. Investors must be prepared for volatility and invest according to a plan, irrespective of market movements.

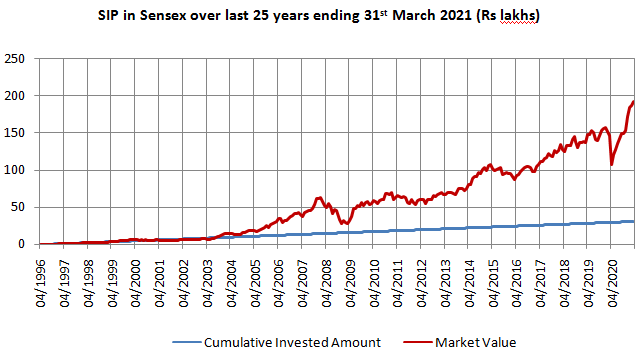

The chart below shows returns of Rs 10,000 monthly Systematic Investment Plan in the BSE Sensex over the last 25 years (1st April 1996 to 31st March 2021).With a cumulative investment of Rs 30 lakhs you could have accumulated a corpus of Rs 1.90 Crores through systematic investing. The annualized returns (XIRR) of monthly SIP in BSE Sensex over the last 25 years would have been over 12.7%. This is higher than Sensex return (11% CAGR over the same period) and clearly demonstrates the benefits of Rupee Cost Averaging.

Source: Bombay Stock Exchange. Advisorkhoj Research (Period: 01.04.1996 to 31.03.2021). Disclaimer: Past performance may or may not be sustained in the future.

Conclusion

Though we begin the new financial year with a lot of uncertainties in the near term, a systematic and disciplined approach to investments will help you get success in your financial goals in the long term. Your investment plan should be based on your financial goals and asset allocation needs. Stick to your plan irrespective of market movements. Never make the mistake of redeeming investments when markets are volatile as it will be a loss making situation. The real benefit of SIP happens when you stay invested patiently in bear markets. Also do consult with your financial advisor if you need help in making your investment plan a resilient one!

Learn how to make a crash proof investment portfolio through SIPs

Issued as an investor education initiative by HSBC Mutual Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY