How asset allocation helps diversify your investments

What is asset allocation?

Asset allocation is a strategy to balance risk and returns by investing in different asset classes. The major asset classes are equity, fixed income or debt and in some cases, also gold. Financial planners suggest that right asset allocation is critical in achieving your financial goals, since it is the most important attribute of portfolio performance, as research suggests.

Why is asset allocation needed?

Investors have multiple financial goals across different life-stages e.g. taking an overseas vacation, making down payment for property, children’s higher education, children’s marriage, retirement planning, estate planning etc. Different types of investments may be needed for different goals. Asset allocation protects your different financial goals from the vagaries of financial markets and can help you to achieve each goal without compromising others.

Let us understand this with the help of an example–

Suppose you have Rs 20 lakhs for investment and you need Rs 10 lakh in 3 years’ time to make the down payment for a property investment.

Scenario 1:- You invest 100% in equity. Assuming you get 15% return in year 1 and then see a 30% crash in year 2, which sees your investment fall in value to Rs 16 lakhs. Since you need minimum Rs 10 lakh for the property investment next year, you cannot take a risk and you will redeem at Rs 10 lakh. You will park the redemption proceeds in your savings bank at 4% interest rate. In year 3 you make the down-payment for your property (Rs 10 lakhs) from your savings bank balance. The balance amount (i.e. interest) in your savings bank after making the down-payment is re-invested back in equity. Let us see how much your investment grows to in 5 years, assuming 15% CAGR returns from year 3 onwards (please see the chart below). You can see that your portfolio value after 5 years would be Rs 9.8 lakhs.

Source: HSBC Asset Management, India (HSBC AMC)

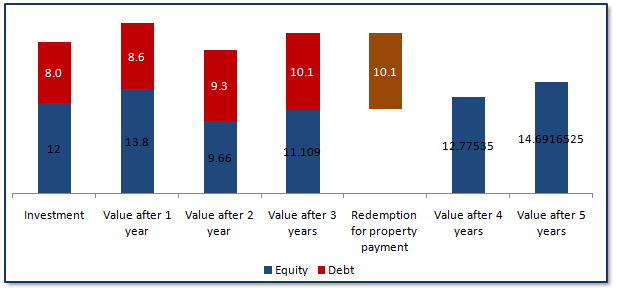

Scenario 2:- Suppose you invested Rs 12 lakhs in equity and Rs 8 lakhs in debt. Let us assume debt gives you gives you 8% annualized return in 3 years. Equity like in scenario 1, gives 15% return in year 1, falls 30% in year 2 and gives 15% CAGR returns from year 3 onwards. Let us see how much your investment grows to in 5 years.

This scenario is better because your investment value at the end of 5 years is almost Rs 5 lakhs higher. Asset allocation can provide downside protection to your portfoliosandliquidity for your short to medium term requirement whilealso keeps you on track for your long term financial goals.

Source: HSBC Asset Management, India (HSBC AMC)

How each asset class helps you diversify?

- Equity is the most volatile asset class, but has the potential to give real returns over a long investment horizon. The primary investment objective of equity or equity oriented funds is capital appreciation. Equity or equity oriented funds are suitable for long term financial goals. You should have investment tenure of at least 5 years for equity funds. You should also have moderately high to high risk appetites for equity or equity or equity oriented funds as equities are volatile too.

Suggested reading: How to deal with volatility - Fixed income or debt has lower volatility compared to equity, but generally underperforms equity in the long term. There are different typesof debt funds havingdifferent risk profiles. The primary investment objective of debt funds is income, though some debt funds can also provide capital appreciation. While debt funds are suitable for short to medium term financial goals, you can also invest in debt funds for generating income over a long investment tenure e.g. retirement income. Debt funds are suitable for investors with low to moderate risk appetites.

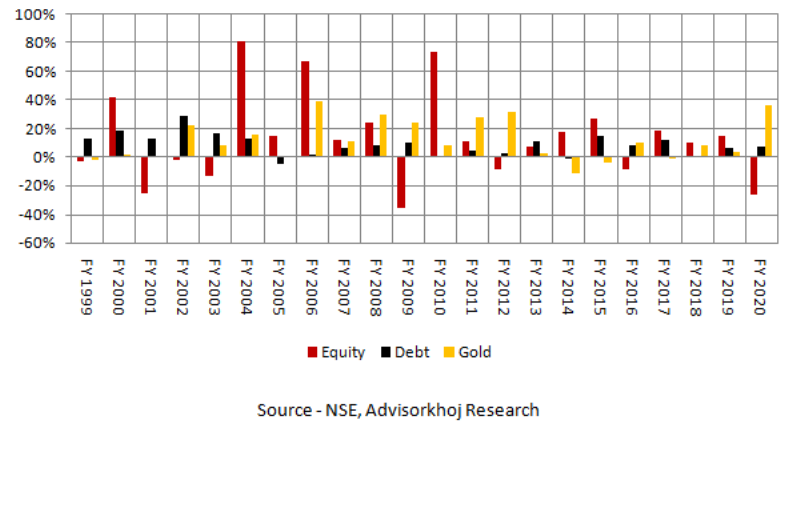

- Gold also is less volatile compared to equity. Another interesting aspect about gold is that it is usually counter-cyclical to equity. Gold underperforms in a bull market when equity prices are rising and outperforms in a bear market e.g. gold underperformed equity in the 2014 – 2018 period but outperformed equity in 2019 – YTD 2020. Gold is an effective hedge against bear markets.

The chart below shows the performance of different asset classes in each financial year from FY 1999 to FY 2020. In this chart we have used Nifty 50 as proxy for equity and Nifty Benchmark 10 year G-Sec Index as proxy for fixed income. You can see that asset classes have low or negative correlation in their price movements. This means that when price of one asset class is falling, price of another asset class may be rising and vice versa.

Therefore, effective risk diversification can be achieved through asset allocation.

Source: National Stock Exchange, Advisorkhoj Research

Factors to consider in Asset Allocation

- Your long term, medium term and short termfinancial goals- though near term goals seem more important than longer term goals, all goals are equally important. Proper asset allocation will ensure that all goals are achieved.

- Your risk capacity– age, disposable income, non-discretionary expenses, assets and liabilities. You should distinguish between your capacity to take risks and your risk tolerance, which is your attitude towards risk. Remember risk and returns are related. You should take the right amount of risk for different financial goals – not more or less.

- Short to medium termliquidity needs- it differs from investor to investor and personal financial situations. You should ensure enough liquidity in your portfolio to meet short term needs and some contingency funds to meet any exigency.

- Risk profileof your existing investments– have you invested only in equity funds or is most of your investments in low yielding bank FDs, are you taking too much risks or too little. Asset rebalancing may be required to bring your asset allocation to the optimal mix required for your different goals.

- Tax planning– different asset classes, investment tenures and nature of income (dividends or capital gains) have different tax treatments. You should understand the tax consequences of your investments in order to make informed decisions.

Conclusion

Asset allocation is one of the most important aspects of investment strategies employed by institutional investors. Unfortunately, large number of retail investors ignore asset allocation and remain over or under invested in certain asset classes which can harm their long term financial interests.

In this blog post, we discussed why asset allocation is important and how different asset classes help you diversify risks in different market conditions. We also discussed 5 important factors that you should always consider when planning your asset allocation. You should consult with your financial advisor and make an asset allocation plan in line with your investment needs. Finally, you should always remain disciplined in your investment and rebalance your asset allocation from time to time to ensure success of your different financial goals.

Additional reading – Infographic on Asset Allocation

Issued as an investor education initiative.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY