Financial Planning in the new financial year

FY 2022-23 was a difficult year for global financial markets. Russia’s invasion of Ukraine, high inflation and rate hikes by central banks caused major headwinds for stock and bond markets around the world. S&P 500 fell by nearly 9% in FY 2022-23 (source: Bloomberg, as on 31st March 2023). India was a relative outperformer with Sensex ending the year nearly flat on a year on year basis. FY 2022-23 was a difficult year for bond markets also. The 10 year US Treasury Bond yield rose by 116 bps on a year on year basis, while the 10 year G-Sec yield rose by 89 bps.

Current market context

The market seems to have moved past the few negative events. The RBI has taken a pause in its rate hike series and the market is in consolidation mode. However, there are near term risk factors, particularly fears of an economic recession in the United States. You should be aware of the risk factors and always invest according to your risk appetite. From a long term perspective, the outlook for Indian equities continues to be positive as India stand to benefit from the global realignment e.g. China plus one strategy. With the onset of the new financial year, it is a good time to review your financial goals, evaluate progress made against different goals and make plans for the new financial year. If you have not set your financial goals yet, then it is not too late to start goal based financial planning.

Review your financial goals

All investors have financial goals for different stages of life e.g. buying a house, children’s higher education, children’s marriage, retirement etc. If you do not have defined goals, you should work on defining and quantifying your short term, medium term and long term goals. You should always factor inflation in your medium term and long term goals. You should have a financial plan to meet these different life-stage goals; you can take the help of a certified financial planner if required. If you already have a financial plan, you should review the plan at the beginning of the year. For example, if your children have entered their teenage years, you should review whether you are saving and investing enough for their higher education goals. Similarly, if you have other short to medium term financial goals e.g. vacation plan, buying or upgrading your vehicle, buying a house etc, you should make sure that you have a plan for these goals.

A must read what is goal based financial planning

Know your assets and liabilities

Your personal financial inventory is the listing of your financial assets and liabilities. Quite often, investors do not have an idea of the current value of their assets and liabilities; sometimes investors may even forget that they have made some investments. Make a list of all your investments, e.g. mutual funds, fixed deposits, government small savings schemes, life insurance policies (traditional or ULIPs), stocks, bonds etc, on paper or your PC, whatever you are comfortable with. Similarly, make a list of your liabilities e.g. home loan, vehicle loan, credit card loans, personal loans etc. You should know the current values of assets (investments) and liabilities. You can take the help of a financial advisor if you need help in finding out the current value of your investments.

Have a plan to manage your liabilities

Debt is the biggest enemy of financial success. Debt creates pressure on your family’s savings and creates financial security. You should understand that your real net worth is your assets minus your liabilities. If you have liabilities like home loan, vehicle loan etc, you should plan your expenses carefully so that you are able to meet your monthly debt obligations without resorting to additional debt in form of credit card debt or personal loans. In the early to mid stages of your career, the liabilities may be more than the assets, but the difference should reduce over time till you are loan free; if required you should cut down your discretionary expenses.

Review your asset allocation

The basic purpose of asset allocation is the old proverb “Don’t put all your eggs in one basket”. Asset allocation is diversifying your investments over multiple asset classes e.g. equity, fixed income, gold, real estate etc. Asset allocation balances your portfolio risks and returns. All investors should have a target asset allocation based on their risk appetite and financial goals. If you are not sure about your risk appetite, you can use the Rule of 100 to determine your asset allocation. According to this rule, your target equity allocation should be 100 minus your age. Next, you should determine your current asset allocation i.e. what percentage of your portfolio is in equity, fixed income, gold etc. If your current asset allocation is outside a certain tolerance range (say +/- 5%) of your target asset allocation, then you should rebalance your portfolio to bring your current asset allocation within the tolerance range of your target asset allocation. You should factor in exit load and taxation when rebalancing your portfolio.

You may also like to read asset class diversification and why is it necessary when you invest

Know the tax consequences of your investments including the tax changes

Knowing the tax consequences of your investments is important for two reasons. Firstly, you will need to know your tax obligations for filing your income tax returns for the current assessment year (FY 2023-24). Go through all your mutual fund transactions done in FY 2022-23; compute the capital gains (short term or long term) and your tax obligation. If you have received dividends, then the same should be added to your income and taxed according to your income tax rate. Similarly, FD interest whether paid out or accrued, should also be added to your income and taxed accordingly.

Secondly, you should know the tax changes applicable for the current financial year, so that you can make tax efficient investments. In March, the Finance Minister proposed an amendment to the Finance Bill 2023, whereby she proposed that the long term capital gains tax benefit for non-equity schemes be removed. Prior to the aforesaid amendment, long term capital gains (holding period of 36 months or more) in non-equity schemes was taxed at 20% after allowing for indexation benefits. For investments made on or after 1st April 2023, all capital gains (short term or long term) in debt funds will be added to the income of the investor and taxed as per the marginal tax rate (income tax slab) of the investor.

Review and streamline your portfolio

Many a times we invest in some schemes based on the scheme’s or category’s or sector’s short term performance. Over a period of time, we may end up investing in a large number of schemes. The beginning of a new financial year is the time to do a spring cleaning of your portfolio. Review all your mutual fund schemes and try to rationalize your schemes, if required. If some schemes have been underperforming over sufficiently long investment horizons (at least 3 years for equity schemes), consolidate your investments in better performing schemes.

Review your mutual fund SIPs

As your salary and savings increase over time, you should also increase your SIPs. Review your mutual fund SIPs and see if you can increase your SIP investments. Disposable income not invested, often get spent in discretionary or non-essential expenses. The more you invest through SIPs greater can be your wealth creation through the power of compounding over long investment horizons.

Suggested reading should you book short term profits on your SIP

Should you continue to invest in debt funds after the tax change?

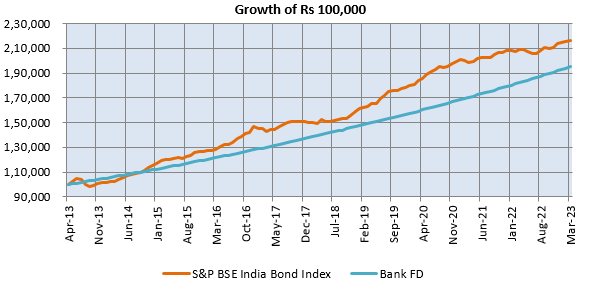

Even though debt funds no longer enjoy tax advantage over traditional fixed income investments like Bank FDs, Government Small Savings Schemes etc, we think debt funds continue to be good investment options for investors. Firstly, debt funds invest in debt and money market instruments with the aim to generate better than risk-free returns. Historical data shows that S&P India Bond Index (composite index of Government and corporate bonds) despite higher volatility has given better returns than traditional fixed income investments over multiple interest rate cycles (see the chart below).

Source: BSE, SBI, Advisorkhoj Research. SBI average 1 year FD interest rates over the investment tenure have been assumed to be a proxy for Bank FDs. Period: 01.04.2013 to 31.03.2023. Disclaimer: Past performance may or may not be sustained in the future.

Secondly, debt funds offer potential capital appreciation in favourable interest scenarios. Finally, unlike Bank FDs, there is no taxation / TDS on debt funds during the investment tenure, in other words, compounding benefits will be higher in debt funds.

Start your tax planning for the year

If you begin your tax planning early, you know how much to save for your 80C tax savings investments early in the year. You can plan your expenses so that you can avail full benefits of 80C tax savings. For salaried people, most companies deduct TDS in the last quarter of the financial year after accounting for all the deductions. If you are unable to avail the tax deductions, there will be a large TDS in the last quarter.

You may also like to read why tax planning with mutual fund ELSS is a good option

Financial Planning Checklist

We will conclude this blog post with our financial planning check-list for FY 2023-24:-

- Have you reviewed your financial goals?

- Do you have a financial plan for your goals?

- Do you have a plan to manage / reduce your outstanding loan?

- Have you done your asset allocation?

- Do you know how much tax you will have to pay?

- Have you reviewed your portfolio’s performance and taken necessary actions?

- Should you increase your SIP investments?

- Have started your tax planning for the current financial year?

Consult with your financial advisor if you need help in managing your investments.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY