Exports as an investment theme

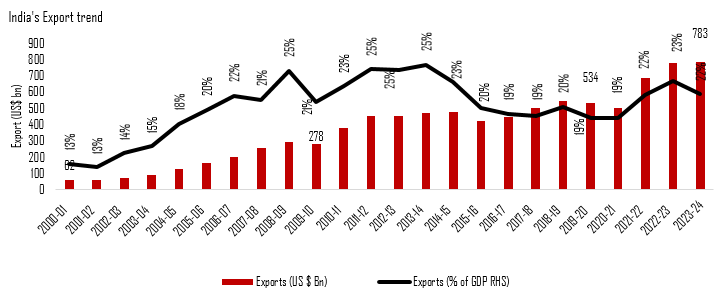

Exports play an important role in a country’s economy. Exports bring valuable foreign exchange which can be used to pay for imports, external debt, stabilize currency and strengthen the economy. India’s exports of goods and services in FY 2023-24 stood at around $783 Billion, growing at a CAGR of 10% over the post COVID era(see the chart below).

Source: World Bank, Latest available data as on 31st August 2024.

Role of exports in India Growth Story

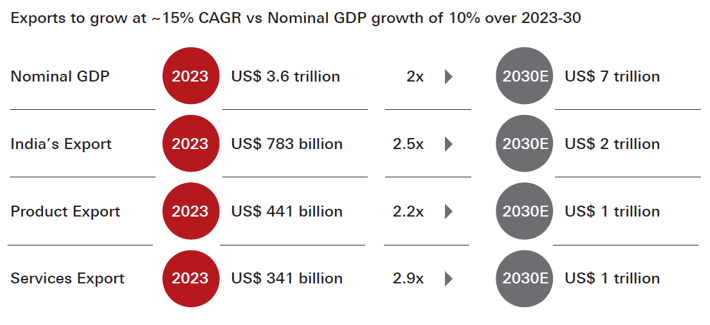

As per IMF’s forecast, India will become the third largest economy of the world by 2028-29. India’s nominal GDP is estimated to grow to $ 7 Trillion by 2030 at a CAGR of nearly 10%. Export is likely to play a major role in India’s GDP growth, by growing at a CAGR of about 15% to $ 2 Trillion. Over the years, services exports have been growing faster than goods exports. Services exports is expected to continue growing at a faster rate, but goods or merchandise exports growth rate is also expected to pick up.

Source: RBI, Ministry of Commerce, Latest available data as on 31stAug 2024

India’s exports mix has evolved over the years to more value-added products and services

India’s exports were largely goods or merchandise oriented till the early 90s. Services exports, primarily IT or IT enabled services grew at a rapid pace from the 90s onwards. Within services, the share of higher value services like professional and management consulting (Global Capability Centres or GCC) and Research and Development has been growing faster. Even within merchandise exports the mix is changing from traditional sectors e.g. Petroleum, Agro products, Textiles, Pharma etc., to sunrise sectors like Electronics, healthcare, Machineries, Auto, Solar energy etc.

Key drivers of exports growth in India

The Government has set an ambitious target of $ 2 Trillion of exports by 2030. The main drivers of exports growth are likely to be:-

- Cost and skills advantage: India has a vast low cost and skilled labour pool. The demographic advantage of India with respect to young population can pay rich dividends in global labour market and therefore export competitiveness.

- Beyond cost arbitrage: India ranks in the Top 3 of the fastest growing services export economy globally and is currently the 6th largest services export economy in the world. India’s rise to a dominant position has been driven mainly by cost arbitrage. However, India’s export mix has been evolving from cost arbitrage solutions to value added solutions though development of GCCs in several verticals like IT, BPOs etc. Even India’s pharmaceuticals exports have evolved from low-cost manufacturing to Research and Development driven solutions.

- Changing geo-political and global supply chain dynamics: Rising protectionism, escalating trade wars, de-risking supply chain disruptions, strategic alliances with countries and cost savings in shipping and logistics will shape global trade dynamics. India may benefit from supply chain realignments e.g. China + 1 strategy, strategic alliances along with infrastructure and capabilities development initiatives of the Government and private sector.

- Government policies: The new Foreign Trade Policy 2023 has set a target of $ 2 Trillion of exports by 2030. The 4 main pillars of the new trade policy are Incentive to Remission (e.g. customs duty waiver on imported goods used for exports), Export promotion through collaboration - Exporters, States, Districts, Indian Missions, Ease of doing business, reduction in transaction cost and e-initiatives and Emerging Areas like E-Commerce, developing districts as export hubs and streamlining SCOMET policy.

The production linked incentive (PLI) scheme introduced by the Government in 2020, is aimed at capacity building, which can help in meeting global demands. The PLI scheme has attracted more than Rs 1 lakh crores of private sector investments. PLI Schemes witness exports surpassing Rs. 3.20 lakh crore, with significant contributions from Large-Scale Electronics Manufacturing, Pharmaceuticals, Food Processing, and Telecom & Networking products.

Finally, infrastructure development is crucial to the Government’s ambition of transforming India into a global manufacturing hub. In the last 3 years, the Government spent Rs 23 lakh crores on infrastructure development in areas of roads, highways, ports, power transmission etc. The planned capex outlay for FY 2025 is Rs 11.11 lakh crores, which is Rs 1.1 lakh crore higher than the previous fiscal year.

Why invest in exports theme?

- Indian exports are expected to grow at a CAGR of about 15% from 2023 - 2030 to meet the Government’s export target for 2030.

- The export target seems reasonable considering the strong existing base of services export, coupled with the Government’s focus on growing merchandise / manufacturing exports.

- Strong earnings growth in export-oriented themes can be expected based on the implied revenue growth / exports growth.

- Exports as an investment theme can bring diversification to your investment portfolio, since India is still largely a domestic consumption-based economy and therefore your portfolio may have domestic consumption bias.

- Consult with your financial advisor or mutual fund distributor if export as an investment theme is suitable for your investment needs.

Source: Union Budget 2024, Ministry of Commerce, RBI, World Bank, HSBC Mutual Fund, Latest available data as on 31st August 2024.

An Investor Education and Awareness Initiative by HSBC Mutual Fund

Visit https://www.assetmanagement.hsbc.co.in/en/mutual-funds/investor-resources/information-library/know-your-customer w.r.t. one-time Know Your Customer (KYC) process, complaints redressal process including SEBI SCORES (https://www.scores.gov.in). Investors should only deal with Registered Mutual Funds, to be verified on SEBI website under Intermediaries/Market Infrastructure Institutions (https://www.sebi.gov.in/intermediaries.html). Investors may refer to the section on Investor Education on the website of HSBC Mutual Fund for the details on all Investor Education and Awareness Initiatives undertaken by HSBC Mutual Fund.

Investors are requested to note that as per SEBI (Mutual Funds) Regulations, 1996 and guidelines issued thereunder, HSBC AMC, its employees and/or empanelled distributors/agents are forbidden from guaranteeing/promising/assuring/predicting any returns or future performances of the schemes of HSBC Mutual Fund. Hence please do not rely upon any such statements/commitments. If you come across any such practices, please register a complaint via email at investor.line@mutualfunds.hsbc.co.in.

Document intended for distribution in Indian jurisdiction only and not for outside India or to NRIs. HSBC MF will not be liable for any breach if accessed by anyone outside India. For more details, Click here / refer website.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

CL 1866

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY